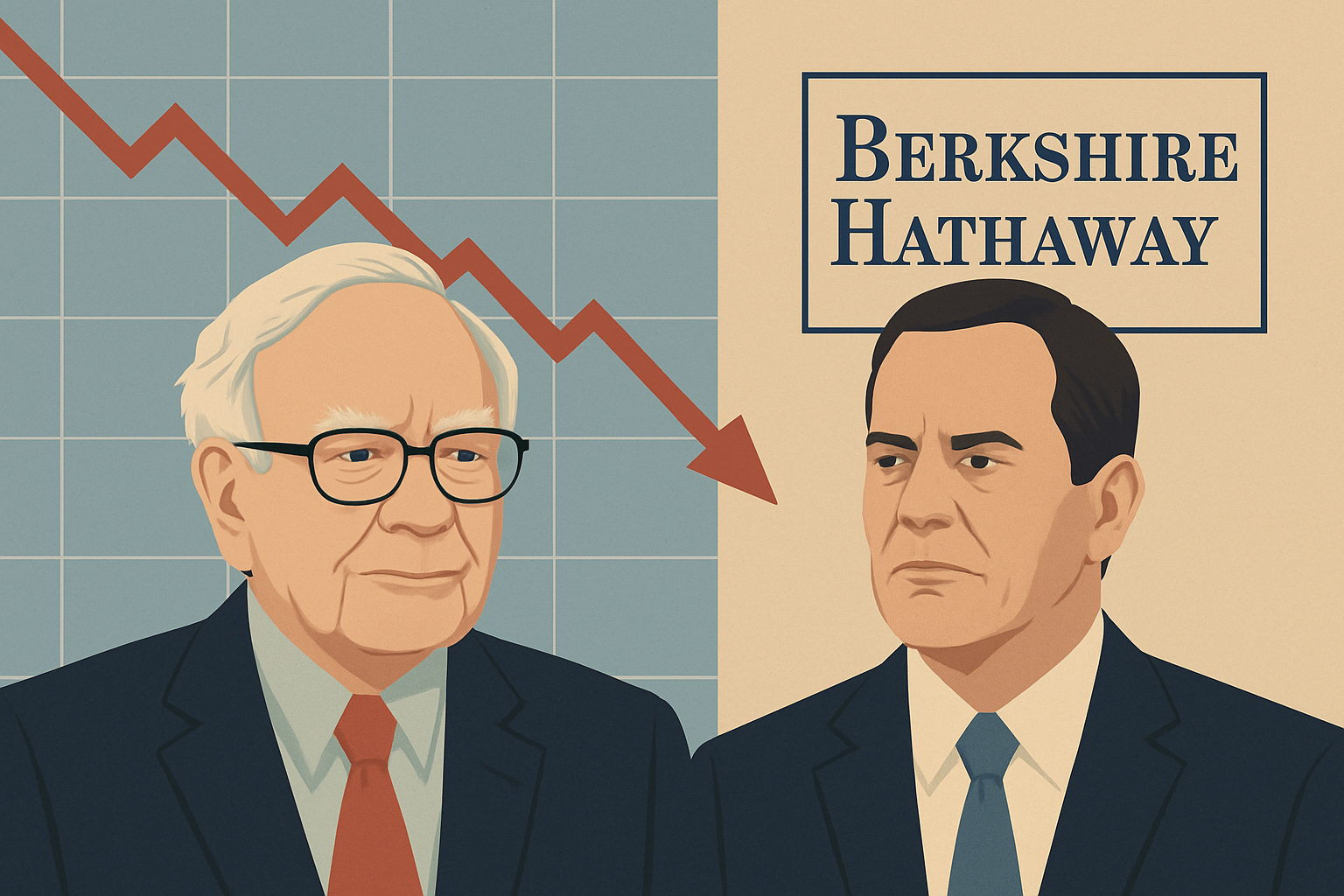

As Warren Buffett officially steps back from the spotlight, Wall Street is recalibrating its long-standing love affair with Berkshire Hathaway. Since the succession announcement, Berkshire’s share price has declined by approximately 14%, according to Financial Times, eroding what many analysts long dubbed the “Buffett premium” — the intangible valuation investors awarded the company for being steered by the Oracle of Omaha himself.

This transition, years in the making, comes at a delicate time for markets already navigating interest rate uncertainty, shifting macro narratives, and mounting investor sensitivity to leadership risk. With Greg Abel assuming operational leadership, questions are now swirling over whether Berkshire’s valuation can withstand the emotional and strategic shift away from Buffett’s legendary influence.

Legacy Meets Leadership Risk

For decades, Berkshire Hathaway (NYSE: BRK.A / BRK.B) was viewed not just as a holding company, but as a living extension of Buffett’s disciplined value investing philosophy. His letters were gospel. His moves shifted markets. His brand offered stability in an increasingly algorithm-driven world.

But that narrative is shifting fast.

Greg Abel, previously vice chairman for non-insurance businesses, is widely respected for his operational rigor. However, unlike Buffett, Abel lacks a cult of personality — and Wall Street is reacting accordingly. “Markets are efficient at pricing future cash flows, but not always at pricing emotional confidence,” said David Kass, a finance professor at the University of Maryland. “The decline in Berkshire’s share price may be the market pricing in uncertainty over the intangible value of Buffett himself.”

Why This Matters for Investors

The fading Buffett premium isn’t just a story about Berkshire — it’s a broader referendum on founder-led companies, intangible value premiums, and succession planning risks across corporate America.

Alphabet, Tesla, and Meta have all faced valuation turbulence during leadership transitions or even speculative succession news. Institutional investors, especially long-only asset managers and pension funds, often overweight companies with charismatic or proven founders. When those figures exit, even temporarily, historical data shows a modest average drawdown of 8–12% in the three months following — according to a 2024 Goldman Sachs leadership risk report.

For Berkshire specifically, the company’s massive cash pile (over $189 billion as of Q2 2025) and steady income from operating businesses still provide a cushion. But the question remains: Will investors now start to apply a “conglomerate discount” rather than a premium?

Future Trends to Watch

- Investor Communication Strategy: Abel’s public presence has been minimal. Analysts will likely scrutinize his tone, transparency, and strategic direction during the next shareholder letter or annual meeting.

- Capital Allocation Clarity: Buffett’s long-standing aversion to dividends and preference for stock buybacks may be revisited under Abel. Any deviation could signal a philosophical shift — or invite activist investor scrutiny.

- Reevaluation of Holdings: With Berkshire’s core holdings (Apple, Coca-Cola, Bank of America) facing their own market headwinds, some investors may begin reevaluating the portfolio through a fresh lens.

- Generational Investor Sentiment: Younger retail investors, drawn by Buffett’s mythos via books, documentaries, and Buffett-style YouTube channels, may not resonate with the new leadership. This shift could reduce retail demand for BRK shares over time.

Key Investment Insight

Investors holding Berkshire Hathaway should monitor not just financial metrics, but sentiment metrics. Track:

- Insider activity under Abel’s leadership

- Market reaction to any major portfolio reshuffles

- Shareholder meetings or quarterly commentary for tone and transparency

For portfolio managers, the Berkshire case underscores the importance of stress-testing legacy-tied names for succession impact and potential de-rating risk. It may also serve as a cue to reevaluate exposure to other founder-led firms where leadership risk is high but underappreciated.

Stay ahead of the headlines with MoneyNews.Today — your trusted source for daily market intelligence, sharp analysis, and investor-ready insights that cut through the noise.