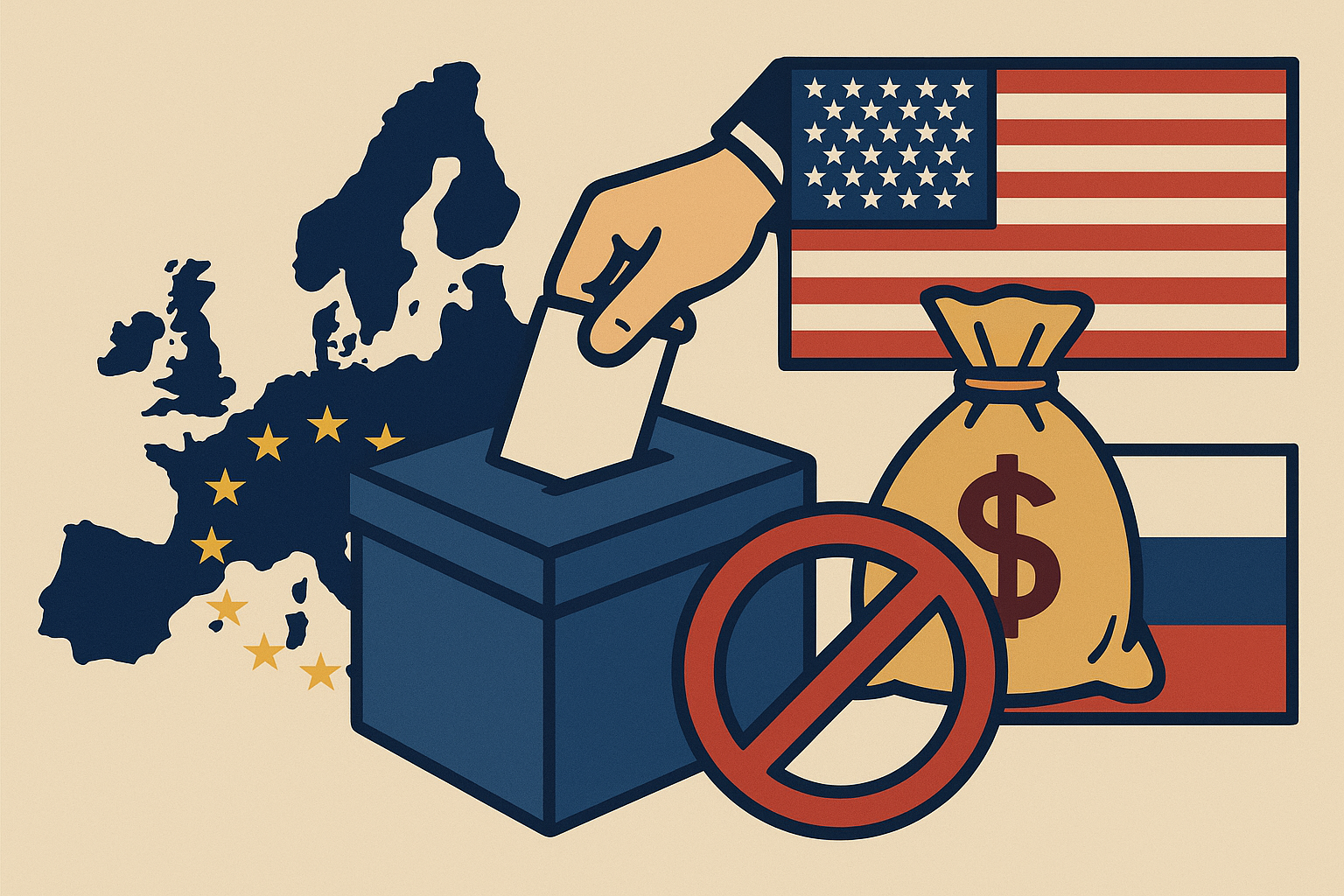

Europe is ramping up pressure on the U.S. to toughen sanctions against Russia ahead of the looming Trump–Putin summit in Alaska. European leaders are especially focused on leveraging frozen Russian sovereign assets to bolster Ukraine’s reconstruction—and are openly rejecting any territorial concessions as a potential peace inducement.

Why This Matters to Investors

This geopolitical alignment marks a pivotal moment in global financial flows and security dynamics. Energy markets, defense contractors, and infrastructure sectors are all poised for heightened volatility or opportunity. As Europe pushes to tap frozen assets—estimated in the hundreds of billions of dollars—investors face a dynamic policy environment with tangible impact on sanctions-driven asset reallocation and spending.

Strategic Breakdown

European Playbook: Frozen Assets as Leverage

Over $200–300 billion in Russian central bank assets remain frozen across Europe and U.S. jurisdictions. The EU is exploring legal structures to invest—or borrow against—these funds to generate yield for Ukraine’s support, while avoiding full-state-level confiscation

Unified European Front—and Rising Frustration

High-level European voices, including Germany’s Friedrich Merz and Foreign Minister David Lammy, are urging Washington to intensify sanctions and reject peace negotiations that ignore Ukraine’s sovereignty. President Zelenskiy has garnered EU and NATO backing to ensure any summit involves Kyiv directly.

Geopolitical Risk Meets Investor Strategy

Heightened sanctions may trigger energy price swings—especially in oil and gas—as new restrictions tighten supply or change trade flows. Defense and security spending may rise across Europe, while infrastructure and energy transition sectors could benefit from reconstruction funding derived from frozen assets. But risks remain: legal challenges in using sovereign frozen funds, potential retaliatory sanctions from Moscow, and diplomatic stalemates could undermine expected investor gains.

Key Investment Insight

- Energy Sector Traders: Watch oil and gas benchmarks closely. New sanctions or secondary restrictions on buyers of Russian energy could tighten supply and drive volatility.

- Defense & Security Suppliers: Europe’s emerging push to rearm—backed by new funds and urgency—positions defense contractors well for near-term upside.

- Infrastructure & Clean Energy Funds: Reconstruction efforts may channel funds into rebuilding Ukraine’s energy grid, broadband, and green energy installations.

- Legal & Compliance Advisors: The evolving frameworks for asset allocation present demand for services around sanctions compliance, sovereign asset structuring, and international law.

Europe’s escalating strategy signals a decisive shift: using frozen assets not just as political posturing, but real-world financing for Ukraine’s future. Investors should closely monitor policy developments, summit outcomes, and sanctions clarity to identify both risks and opportunities emerging from this high-stakes diplomacy.

Stay tuned to MoneyNews.Today for continued coverage—your trusted source for investor-focused geopolitical and market intelligence.