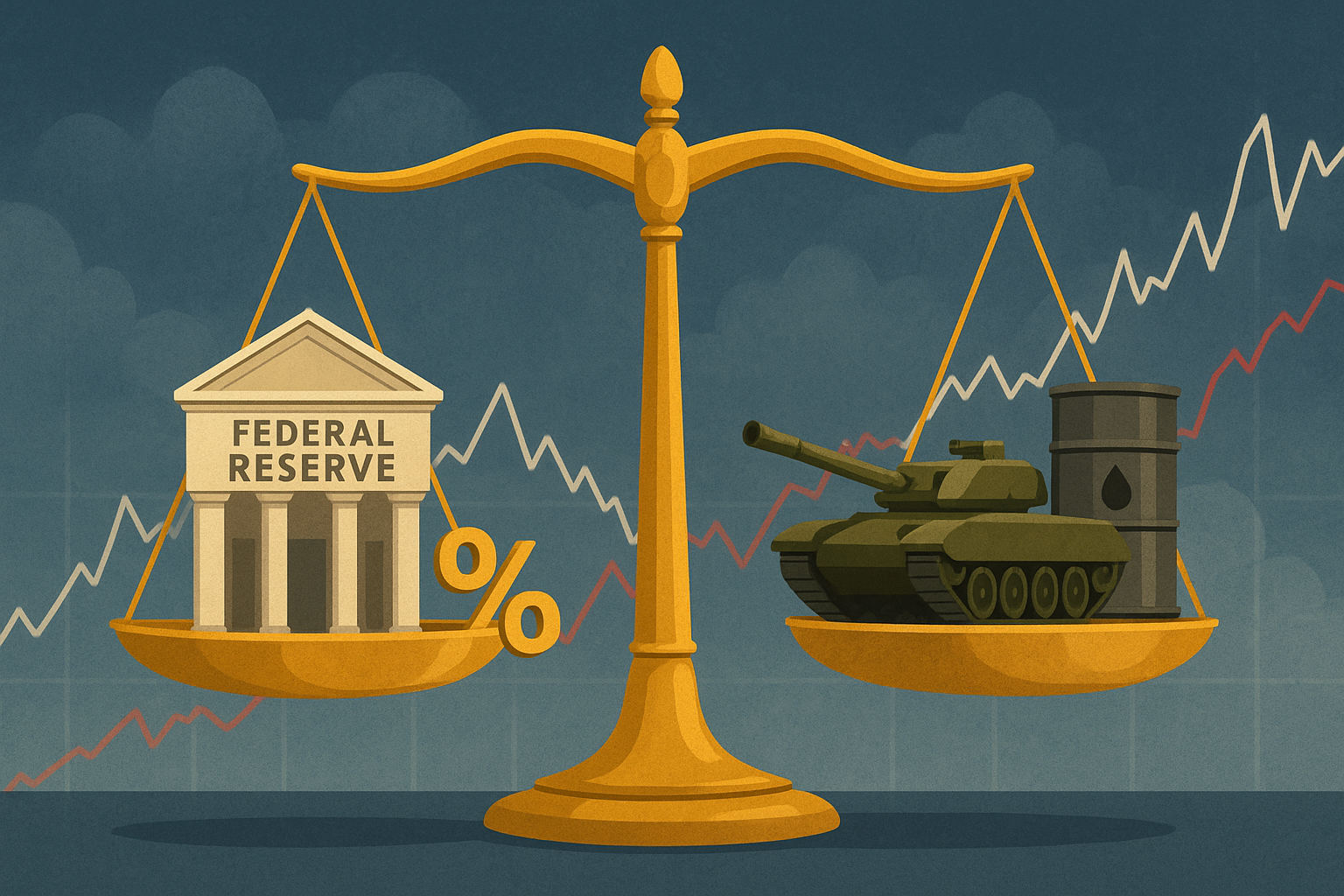

Global markets are entering a pivotal week as investors balance monetary policy expectations with heightened geopolitical currents. Equity indices across Europe and the U.S. traded cautiously Tuesday, with traders unwilling to take bold positions ahead of the Federal Reserve’s annual Jackson Hole symposium. Simultaneously, President Donald Trump’s pledge to maintain U.S. support for Ukraine injected a new dimension into geopolitical risk assessments, leaving defense and energy markets recalibrating their trajectories.

Fed’s Jackson Hole: A Market-Moving Moment

The Jackson Hole symposium has historically been a platform where the Federal Reserve outlines longer-term policy directions. With inflation cooling but still above target and labor markets showing mixed signals, investors are eager for clarity on the Fed’s rate trajectory. According to Bloomberg, futures markets are pricing in a 40% probability of a rate cut by November, but the tone of Fed Chair Jerome Powell’s speech could sharply alter those odds.

A dovish tilt could galvanize equities and risk assets, potentially driving renewed flows into growth sectors such as technology and emerging markets. Conversely, any indication of “higher-for-longer” rates may reinforce recent strength in the U.S. dollar and Treasury yields, exerting pressure on equities and commodities.

Ukraine and Geopolitical Tail Risks

Geopolitics remains a wildcard for investors. Trump’s reaffirmation of military and economic support for Ukraine was framed as a stabilizing move, particularly for NATO allies. However, defense stocks like Lockheed Martin and Northrop Grumman slipped modestly following the announcement, as markets weighed the likelihood of reduced incremental spending in the short term.

At the same time, energy markets are watching developments closely. Crude oil, which had been buoyed by supply risks tied to the conflict, edged lower on expectations of diplomatic stabilization. Analysts at Goldman Sachs caution that “even incremental progress toward de-escalation can shift energy market risk premiums, though volatility remains embedded in the system.”

Why This Matters for Investors

The intersection of Fed policy and geopolitical developments presents a two-pronged challenge for portfolio positioning:

- Monetary Policy Risk: Jackson Hole could either reinforce market resilience or trigger a correction if Powell signals tighter-for-longer policy. Rate-sensitive assets such as growth equities and emerging markets remain particularly vulnerable.

- Sector Rotation Risk: Defense, energy, and commodities could see repricing as U.S. policy toward Ukraine evolves. Reduced immediate defense outlays could weigh on military contractors, while energy traders recalibrate supply risk expectations.

Future Trends to Watch

- Bond Market Reaction – A dovish signal could compress Treasury yields, lifting equities, while hawkish commentary may push the 10-year yield back above 4.5%.

- Currency Markets – The dollar’s reaction will be critical. A weaker dollar could reignite flows into gold, crypto, and emerging market currencies.

- Defense & Energy Divergence – Investors should monitor whether defense stocks rebound after the initial dip and whether energy price volatility reemerges if conflict dynamics shift again.

Key Investment Insight

For investors, the week ahead requires agility. Short-term opportunities may lie in U.S. Treasuries if the Fed leans dovish, while energy equities could present value if risk premiums fall too quickly on optimism over Ukraine. Longer term, the defense sector remains strategically vital—temporary pullbacks may offer attractive entry points.

Staying nimble and diversified across monetary-sensitive assets and geopolitically exposed sectors will be key to managing volatility as Jackson Hole and Ukraine headlines unfold.

Stay with MoneyNews.Today for continuous updates on the Fed, global markets, and geopolitical risk—helping you position ahead of the curve.