%Bitcoin (CRYPTO: $BTC) and %Ethereum (CRYPTO: $ETH) exchange-traded funds (ETFs) experienced $439 million U.S. in outflows on Sept. 22 as options traders turn more bearish and defensive.

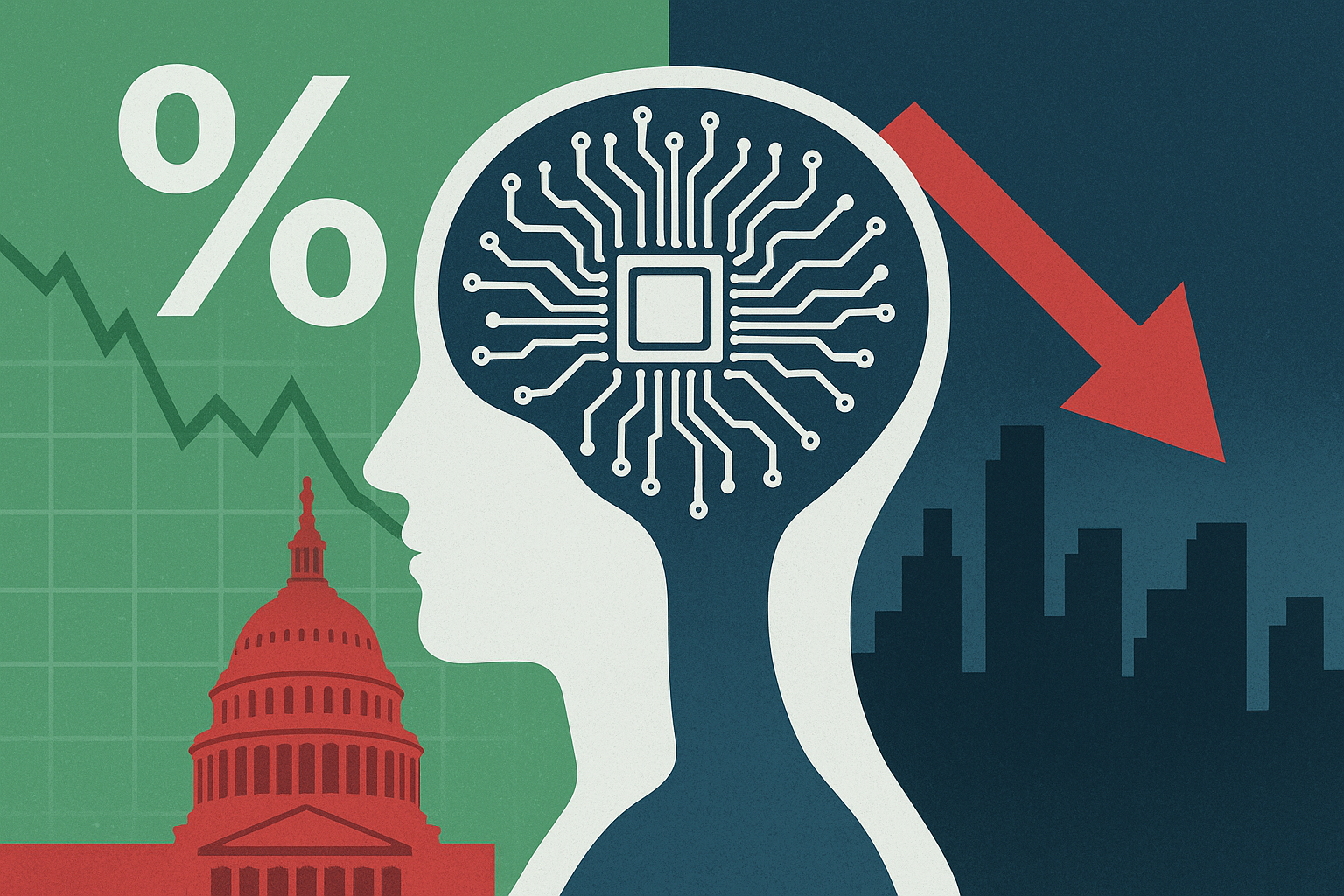

Concerns that U.S. Federal Reserve interest rate cuts will spark a rise in inflation has investors and options traders bracing for more downside risk and moving out of cryptocurrencies.

Bitcoin ETFs saw $363.1 million U.S. in outflows to start the trading week, while Ethereum funds recorded $76 million U.S. in redemptions on the day, according to market data.

The selling is a reversal from the heavy buying of Bitcoin and Ethereum ETFs ahead of the U.S. Federal Reserve’s interest rate cut on Sept. 17.

Last week, Bitcoin and Ethereum ETFs attracted $977 million U.S. and $772 million U.S. of capital respectively, according to reports.

However, now traders and markets are awaiting the latest inflation data out of the U.S. for indications on the direction of consumer prices.

Analysts say that if the inflation data due out on Sept. 26 is cooler than expected, we could quickly see flows into BTC and ETH funds turn positive again.

Despite the current volatility, many analysts say the long-term outlook for digital assets remains bullish, pointing to supportive regulations and a rise in cryptocurrency treasury strategies among companies.

Bitcoin, the largest crypto by market cap, is currently trading just under $113,000 U.S., having risen 20% this year.