A Renewed Risk-On Wave Lifts Digital Assets

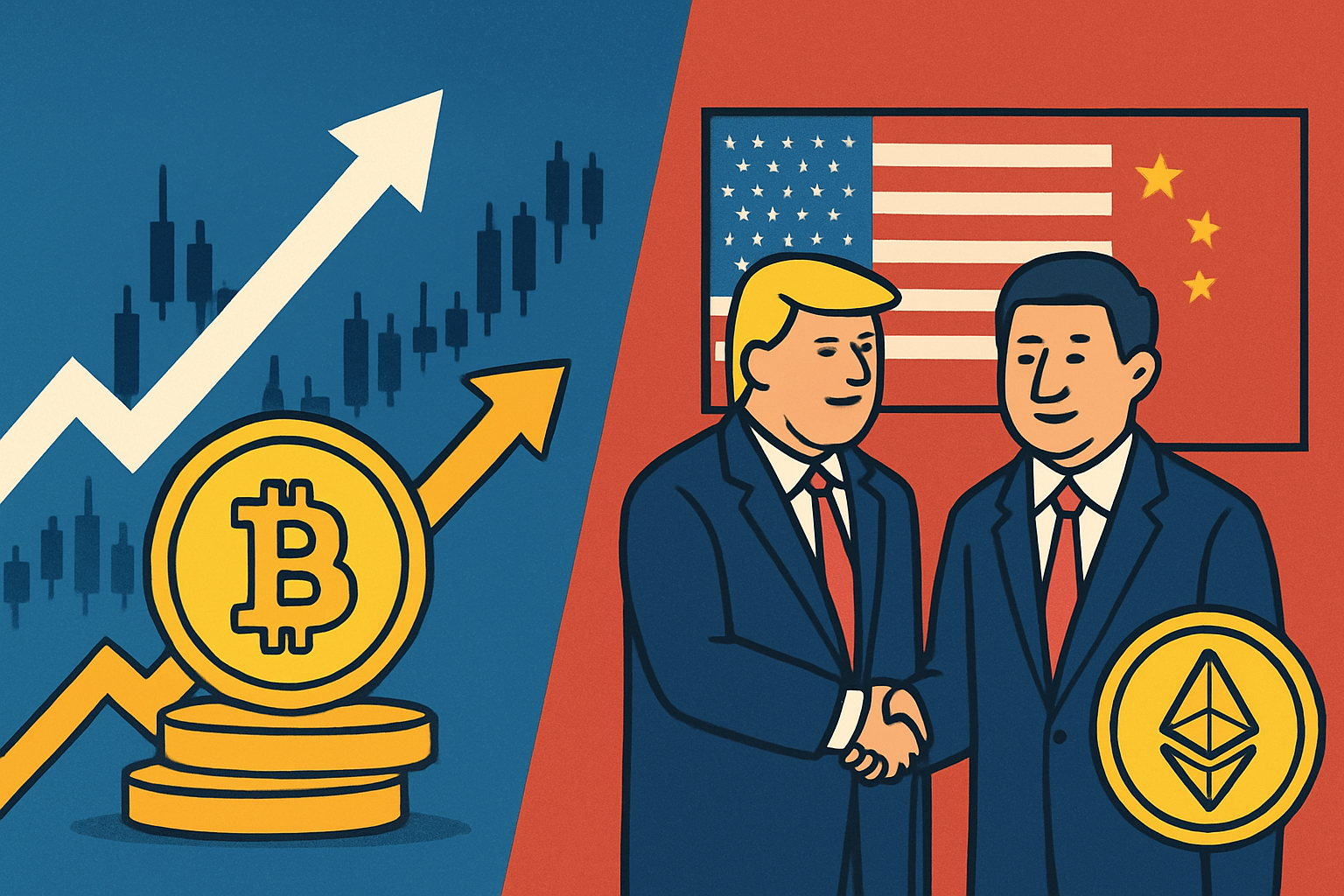

Crypto markets surged sharply on Monday as investor sentiment turned risk-on following reports of a planned meeting between former U.S. President Donald Trump and China’s President Xi Jinping at the upcoming APEC summit. Bitcoin rebounded toward the US$110,000–111,000 range, marking one of its strongest daily performances this quarter. The rally extended across major altcoins — including Ethereum, Solana, and Avalanche — pushing the total crypto market capitalization above US$4.6 trillion, according to CoinMarketCap data.

The market response reflects a broader shift in macro mood. After months of geopolitical uncertainty and regulatory drag, the prospect of renewed U.S.–China dialogue sparked optimism that global trade and technology cooperation may find common ground — potentially easing pressure on risk assets.

Why This Matters for Investors

The planned Trump–Xi meeting represents more than a political handshake; it signals the potential rebalancing of global risk appetite. In recent months, investors have grappled with volatility stemming from rising U.S. bond yields, hawkish Federal Reserve commentary, and escalating technology trade restrictions between Washington and Beijing.

A reduction in geopolitical tension could benefit risk-on assets like equities and crypto — particularly those aligned with emerging digital infrastructure. Analysts at Bloomberg Intelligence note that Bitcoin has increasingly mirrored “a macro hedge asset with leverage to liquidity cycles,” meaning improved cross-border capital confidence could accelerate institutional crypto flows.

Meanwhile, the CME Bitcoin futures open interest hit a new post-halving high, underscoring growing participation from hedge funds and asset managers betting on renewed crypto upside amid stable policy signals.

The Macro Context: A Perfect Storm for Repricing Risk

The crypto rebound also coincides with a global repricing of risk across multiple asset classes. The MSCI World Index rose 1.3%, while tech-heavy NASDAQ futures climbed 0.9% amid easing Treasury yields. Gold, often seen as a defensive play, slipped 0.7% as investors rotated back into growth-oriented trades.

In digital assets, sentiment was amplified by strong on-chain data. Glassnode reported that Bitcoin’s long-term holder supply recently hit a record 15.9 million BTC, indicating deep investor conviction despite ongoing market swings. Meanwhile, network transaction volumes for Ethereum surpassed US$20 billion in 24 hours — a level last seen during the 2021 bull cycle.

Adding to the momentum, the U.S. SEC reportedly accelerated internal discussions on pending Bitcoin and Ethereum ETF proposals, according to sources cited by The Wall Street Journal. The possibility of near-term ETF approvals is fueling institutional optimism, potentially unlocking billions in new liquidity channels.

Future Trends to Watch

1. Institutional Rotation:

BlackRock, Fidelity, and ARK Invest have all expanded crypto research coverage this quarter. A thaw in geopolitical risk could further normalize crypto allocations within diversified portfolios.

2. Stablecoin and FX Convergence:

Cross-border settlement volumes using stablecoins like USDC and USDT have surged 38% month-over-month, per The Block Research. Any improvement in U.S.–China relations could accelerate adoption of digital currency rails for trade settlement.

3. AI–Crypto Integration:

Emerging reports from Deloitte and Chainlink Labs point to a new convergence between AI computation and decentralized data verification. As capital returns to growth sectors, “AI-linked crypto infrastructure” tokens could lead the next wave of inflows.

Key Investment Insight

While short-term volatility remains high, the macro setup now favors strategic accumulation across quality crypto assets. Bitcoin’s resilience above US$100 k suggests that institutional demand continues to underpin the market, even as speculative altcoins remain vulnerable to rapid reversals.

For sophisticated investors, the key opportunity lies in identifying crypto projects with tangible real-world integration — in payments, tokenization, and AI-linked infrastructure — rather than pure meme speculation.

However, the risks are clear: renewed geopolitical tension, regulatory crackdowns, or unexpected macro tightening could easily erase current gains. Maintaining disciplined exposure and risk management is essential.

Bottom Line

The thaw in U.S.–China relations has reignited optimism across global markets — and crypto stands among the biggest early beneficiaries. Whether this marks the beginning of a sustained breakout or a temporary relief rally will depend largely on policy follow-through and liquidity trends heading into year-end.

For now, digital assets are back in the spotlight — and investors are watching closely.

Stay tuned with MoneyNews.Today for daily investor updates and market-driven insights shaping the next phase of global capital flows.