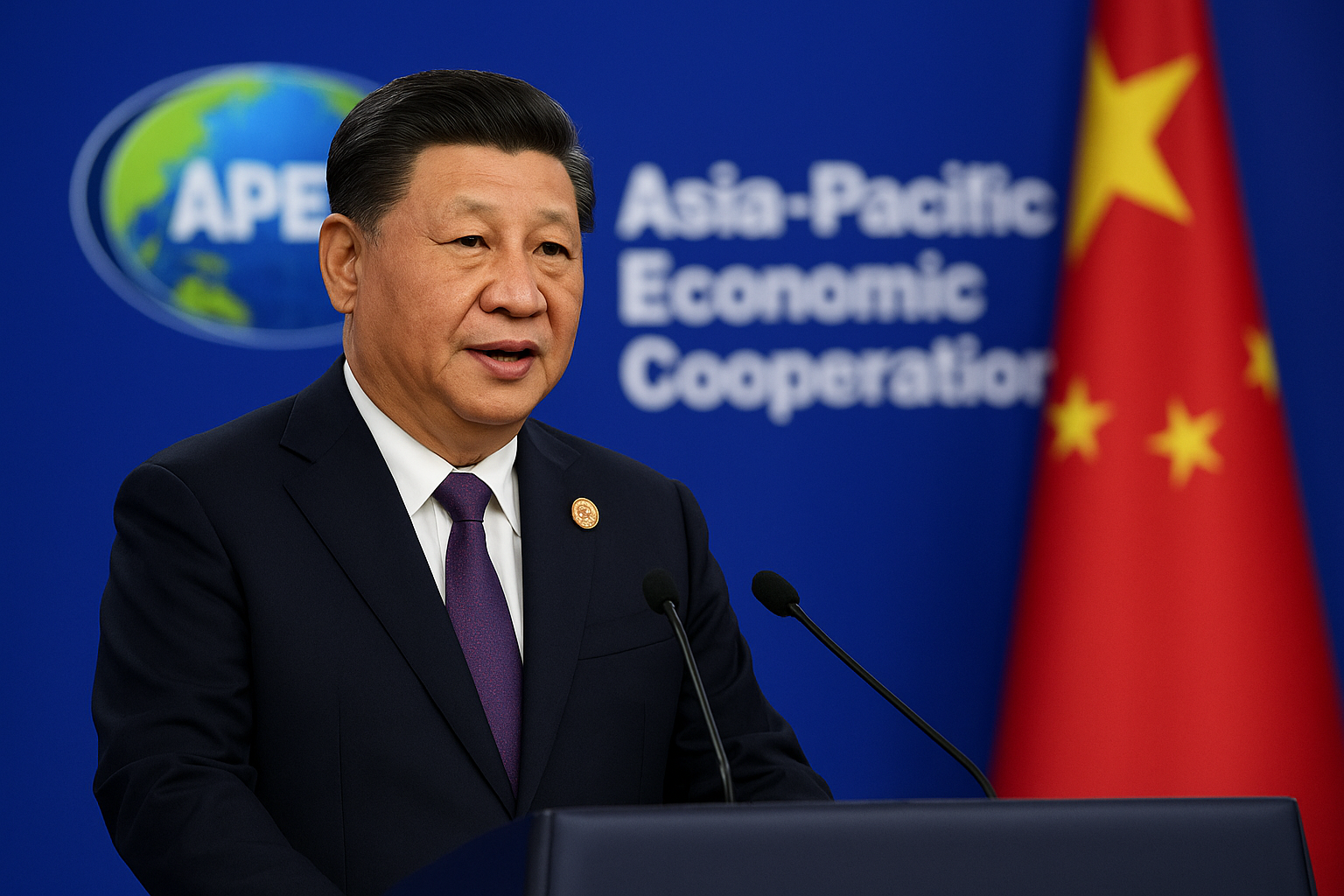

At a pivotal moment for global trade and investment, Chinese President Xi Jinping has assumed a central role at the Asia-Pacific Economic Cooperation (APEC) summit in South Korea. Following the partial disengagement of the United States under President Donald Trump, Beijing is stepping in to lead a new wave of multilateral cooperation. For investors, this shift signals deep structural realignments in global supply chains, trade policies, and access to critical resources like rare earth elements.

China Steps Into the Trade Leadership Vacuum

According to Reuters and China’s official english.www.gov.cn, Xi used the APEC platform to call for “open and inclusive development” across Asia-Pacific economies — a clear message that China intends to fill the gap left by Washington’s reduced involvement in multilateral trade frameworks. The forum, which includes 21 member economies representing nearly 60% of global GDP, comes at a time when supply chains are still recovering from pandemic-era disruptions and rising geopolitical tensions.

Beijing’s strategy focuses on deepening ties with emerging markets in Southeast Asia and Latin America through trade and infrastructure partnerships, while simultaneously strengthening its hold over high-value manufacturing and critical minerals processing. Analysts from the Peterson Institute for International Economics note that China’s Belt and Road infrastructure investments, combined with its advanced manufacturing policies, are increasingly aligned with APEC’s goals of “sustainable and resilient” economic growth.

Why This Matters for Investors

The geopolitical rebalancing underway could reshape global investment strategies for years to come. The U.S. withdrawal from major multilateral initiatives — including the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) — has created a vacuum that China is now actively filling. This transition is not merely diplomatic; it’s structural, impacting trade routes, logistics hubs, and industrial clusters.

For investors, this means that exposure to supply-chain-sensitive industries such as semiconductors, automotive manufacturing, and rare earth mining will need reevaluation. China’s dominant role in processing rare earths — accounting for more than 70% of global refining capacity — gives it significant leverage in industries critical to the green energy and defense sectors.

Moreover, emerging markets integrated into China’s trade network may benefit from increased capital inflows, logistics investment, and export opportunities. Vietnam, Indonesia, and Mexico have already seen surging foreign direct investment as global manufacturers seek diversification away from China while still staying close to Asian supply networks.

Supply Chains and Rare Earths in Focus

China’s renewed leadership in APEC discussions also places supply-chain sovereignty at the forefront of policy priorities. The South Korean summit highlighted commitments to strengthening regional trade routes and developing alternative sourcing strategies for critical minerals — particularly as Western nations continue to impose export restrictions on semiconductor technologies and advanced manufacturing tools.

For instance, Xi’s comments on “technological self-reliance” suggest that China will double down on AI chips, robotics, and clean energy tech manufacturing — areas heavily reliant on rare earth elements. This reinforces the strategic importance of upstream mining companies and processing facilities worldwide.

According to Investing.com, demand for rare earths is projected to grow 40% by 2030, driven by the energy transition and EV boom. This creates a dual opportunity: while Western mining firms could benefit from diversification efforts, China’s continued dominance in refining could pressure global prices and supply security.

Future Trends to Watch

- Trade Fragmentation vs. Realignment: Investors should monitor whether APEC’s trade momentum translates into real supply-chain diversification or merely a deeper China-centric model.

- Tariff and Regulation Risks: Policy shifts between China and the U.S. could continue to impact cross-border trade in semiconductors, renewable tech, and advanced manufacturing.

- Emerging Market Beneficiaries: Nations integrated into China’s trade corridors (Vietnam, Thailand, Indonesia, Mexico) stand to attract substantial FDI inflows.

- Rare Earth and Commodity Plays: The race to secure access to critical minerals offers upside potential for mining and processing firms aligned with Western or diversified supply chains.

Key Investment Insight

Geopolitical shifts often trigger revaluations of entire sectors. As China assumes a more prominent trade leadership role, investors should reassess geopolitical exposure and diversify portfolios across regions and industries benefiting from new trade alignments. Pay particular attention to firms in logistics, rare earths, and industrial automation positioned to thrive under a multipolar trade environment.

For those with China exposure, risk management through hedging and scenario modeling is essential, as policy volatility and potential sanctions could reshape valuations swiftly.

Stay tuned with MoneyNews.Today for daily investor updates and actionable insights across global markets — helping you stay ahead of political shifts shaping the investment landscape.