The drumbeat of optimism on Wall Street just got louder. As global investors reassess rate-cut expectations and position for 2026, JPMorgan has delivered one of the boldest forecasts yet: the S&P 500 could climb to 7,500 next year, and in an even more bullish scenario, surpass 8,000 if the Federal Reserve continues easing policy. With AI spending accelerating across nearly every major industry, analysts argue that the U.S. equity market is still early in its productivity super-cycle—one that could reshape earnings trajectories through 2026 and beyond.

This projection comes at a critical moment for markets. The S&P 500 has already defied expectations through 2024 and 2025, surging amid resilient corporate earnings, aggressive AI investment, and a macro environment that has continually surprised to the upside. But JPMorgan’s view, published via The Economic Times, suggests this rally may be far from finished—as long as monetary policy cooperates.

AI Spending Is Reshaping the Earnings Curve

According to JPMorgan strategists, the cornerstone of this forecast is a 13–15% expected rise in S&P 500 earnings through 2026. What’s fueling it? A massive, cross-sector surge in AI spending.

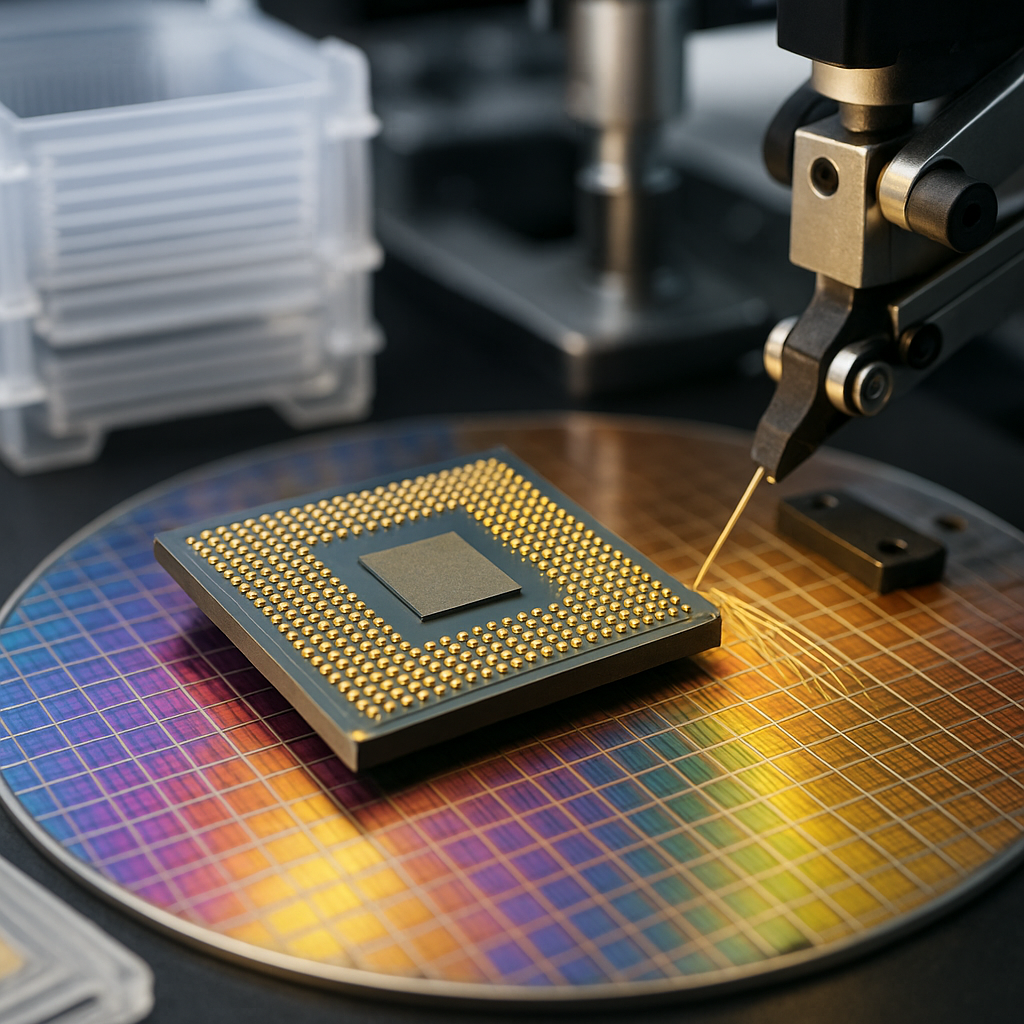

Corporate America continues to pour billions into infrastructure needed to unlock AI productivity gains—data centers, advanced chips, cloud platforms, enterprise automation tools, and model-training systems. Companies like Nvidia, Microsoft, Amazon, and Google are shaping the capex boom, but the ripple effects span everything from industrial automation to financial services.

Major consultancies such as McKinsey and PwC have repeatedly highlighted AI’s potential to add trillions to global GDP over the next decade. The U.S. market, with unmatched tech penetration and capital markets depth, is positioned to capture a disproportionate share of that value. JPMorgan’s thesis builds on this structural macro advantage: AI isn’t a hype cycle—it’s an earnings engine.

This AI-driven expansion is also expected to support higher shareholder payouts, including dividends and buybacks, reinforcing investor confidence during a period of shifting monetary policy.

Why This Matters for Investors

The prospect of the S&P 500 hitting 7,500–8,000 represents a 20–30% upside from current levels. But more importantly, it signals heightened conviction that the U.S. economy remains in a mid-cycle, not late-cycle, environment. Several forces support this:

1. Rate Cuts Could Amplify Equity Performance

JPMorgan’s upside scenario assumes the Federal Reserve continues its path toward lower interest rates. With inflation moderating and labor-market softening, analysts increasingly believe a December rate cut is likely. Strategists from Bloomberg Economics and HSBC have echoed the idea that easing could continue into early 2026.

Lower rates reduce the discount rate used in equity valuations, directly boosting forward price-to-earnings multiples—a powerful catalyst for index-level moves.

2. Corporate Capex Is Expanding, Not Contracting

Instead of slowing, companies are doubling down on investment in next-gen technologies. The AI build-out is now influencing sectors beyond tech: healthcare, automotive, energy, industrials, and logistics are all integrating AI-powered efficiencies to streamline operations and improve margins.

3. U.S. Equities Still Command a Global Premium

Even as Europe and parts of Asia struggle with structural and cyclical challenges, U.S. markets continue to attract inflows. Strong governance, deep liquidity, and resilient corporate earnings help solidify America’s position as the world’s most attractive equity destination.

Future Trends to Watch

AI Infrastructure Bottlenecks

The supply chain for advanced chips, high-density servers, and power-hungry data centers remains stretched. Delays or regulatory constraints could become headwinds.

Inflation and Fed Messaging

A surprise rebound in inflation—or more hawkish Fed commentary—could halt equity momentum quickly. Investors need to monitor CPI, PCE, and labor-market data closely.

Earnings Revisions

Consensus forecasts remain optimistic, but any notable downward revisions could challenge index valuations. The next two earnings seasons will be critical in confirming whether AI-driven productivity gains are materializing as expected.

Sector Rotation

Investors should watch whether outperformance rotates from mega-cap tech toward cloud, semiconductors, software-as-a-service (SaaS), industrial technology, and cybersecurity—all positioned for structural AI tailwinds.

Key Investment Insight

For investors, JPMorgan’s bullish outlook reinforces the case for staying invested in U.S. equities, particularly sectors with strong AI leverage. Broad-based exposure through index ETFs may benefit from the secular upward trend, while sector-specific allocations—cloud computing, enterprise software, semiconductor manufacturers, and AI hardware—offer targeted upside.

However, vigilance is key. A sudden shift in inflation metrics or a more aggressive stance from the Fed could derail the rally. Maintaining a balanced allocation, incorporating risk-managed strategies, and tracking macro data regularly will be essential for navigating the months ahead.

As the market evolves through this pivotal period, staying informed is your biggest edge. Follow MoneyNews.Today for timely, data-driven coverage of the trends shaping the next chapter of global investing.