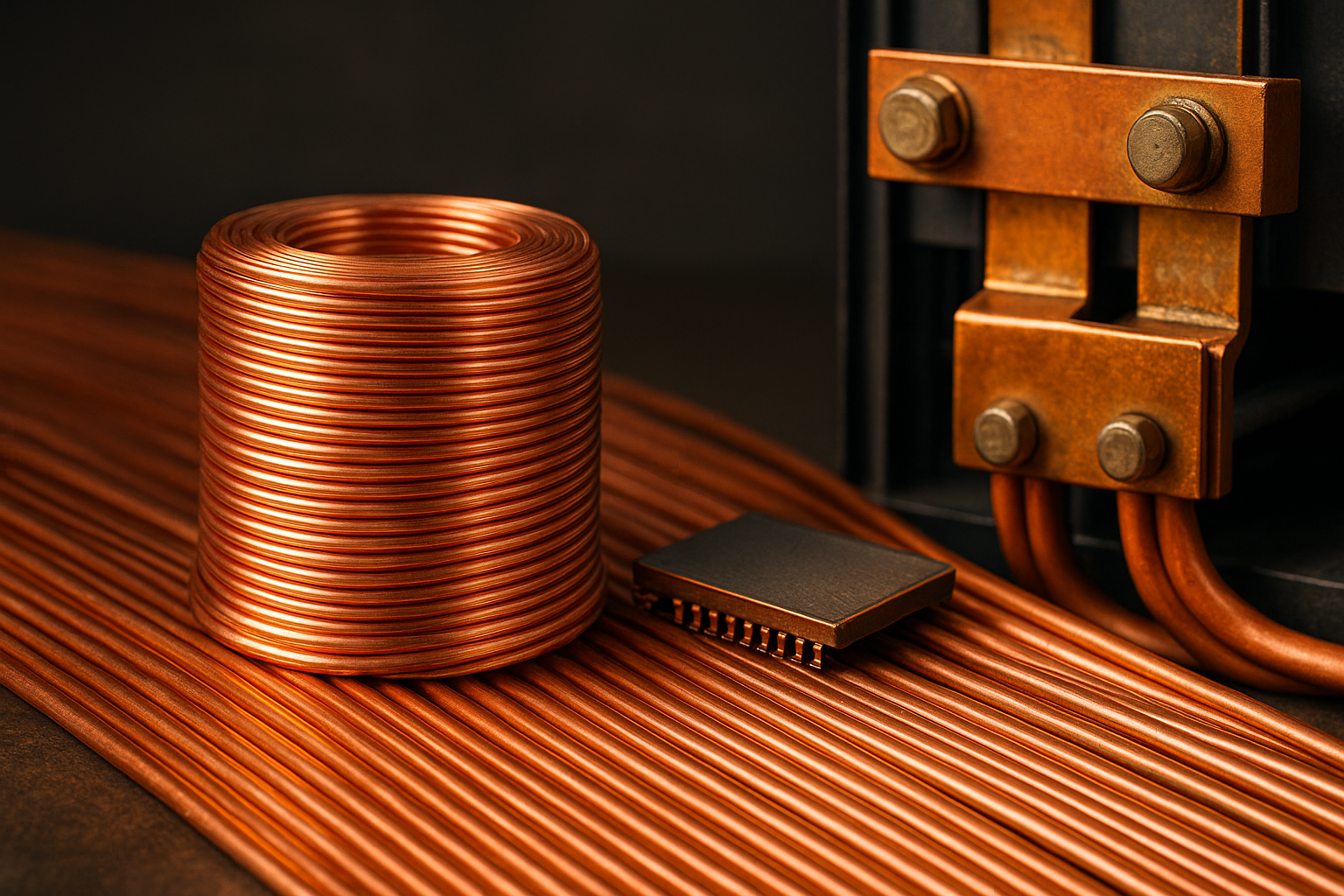

Copper — long known as the backbone of industrial growth — is rapidly emerging as one of the most strategically important metals of the AI era. While investors have been fixated on semiconductors, rare earths, and battery metals, a quieter but more consequential squeeze is building in global copper markets. According to detailed reporting from The Financial Times, accelerating demand from AI data-centres, electrification, grid upgrades, and green-energy infrastructure is colliding with increasingly constrained supply from ageing mines and declining ore grades.

What makes this trend significant is not the short-term price spikes, but the emerging likelihood of a structural global deficit — a supply imbalance that could define commodity markets for the next decade.

AI Data-Centres and Electrification Are Driving a New Copper Supercycle

Data-centres powering advanced AI workloads are now among the fastest-growing consumers of copper. Servers, cooling systems, energy transmission lines, substations, and next-generation GPU clusters all rely heavily on the metal. Analysts at Goldman Sachs estimate that AI data-centre copper consumption could grow by more than 40% by 2030, making copper an “unavoidable bottleneck” in digital infrastructure.

This surge in demand is layered onto already rising consumption from:

- Electric vehicles, which use 2–4 times more copper per unit than conventional cars

- Grid modernization, as countries expand transmission networks to handle renewable energy

- Solar and wind installations, both of which require large copper volumes for wiring, inverters, and grid tie-ins

Combined, these forces are pushing copper into a role similar to oil during the industrial age — a foundational resource for modern economic systems.

Supply Constraints Are Deepening, With New Mines Failing to Keep Pace

While demand surges, supply growth is slowing at the worst possible moment. Global copper ore quality continues to weaken, forcing miners to process more rock for the same yield. Many of the world’s largest copper mines — including those in Chile and Peru — are decades old and facing operational challenges, water scarcity, and environmental constraints.

Rystad Energy, S&P Global, and McKinsey have all issued warnings of an emerging structural deficit:

- S&P Global forecasts a 10+ million-tonne supply shortfall by 2030 if investment doesn’t accelerate.

- McKinsey projects a 20% gap between expected demand and current supply pipelines.

- The Financial Times highlights the acute shortage of new discoveries, despite rising exploration spending.

Compounding the issue, permitting timelines for new mines have lengthened dramatically. Major projects in the U.S., Canada, Chile, and Panama remain stalled due to environmental, regulatory, or political opposition — delaying production for years, sometimes decades.

This mismatch between fast-growing demand and slow-moving supply could set the stage for one of the most significant commodity bull cycles of the decade.

Why This Matters for Investors

1. Copper Producers Could Enter a Multi-Year Upside Cycle

Producers with high-grade assets, large reserve bases, and stable jurisdictions are positioned to benefit disproportionately. If supply shortages continue, pricing power could strengthen for companies able to deliver consistent volume.

Mining giants like Freeport-McMoRan, Southern Copper, BHP, and Glencore — as well as mid-tier players with expansion-ready projects — may become increasingly attractive holdings.

2. EVs, Renewable Energy, and Data-Centre Operators Face Rising Costs

Copper is embedded across the cost structure of electrification and AI infrastructure. Sustained shortages could pressure margins for:

- EV manufacturers

- Battery producers

- Solar and wind developers

- Data-centre builders and cloud providers

For investors with portfolio exposure to these sectors, rising input costs must be factored into long-term valuation models.

3. Political and Regulatory Risks Are Now Central to Copper Investing

Many high-potential copper deposits sit in geographies where social license, environmental approvals, or geopolitical tensions can delay developments. Jurisdictions like Chile, Peru, the DRC, and Panama are high-opportunity but high-risk.

Meanwhile, new mining-friendly policies in Canada, Australia, and the U.S. could shift future production maps.

Understanding the regulatory climate is now essential to assessing copper investment risk.

Future Trends to Watch

1. Long-Life, High-Grade Deposits Will Command Premium Valuation

As ore grades continue to decline globally, assets with high copper concentration will be increasingly scarce — and more valuable.

2. M&A Wave in the Mining Sector

Major mining firms are likely to pursue acquisitions of emerging or mid-tier players with undeveloped resources. Several analysts already expect a multi-year M&A cycle.

3. New Technologies in Exploration and Processing

AI-driven geological mapping, autonomous mining systems, and water-efficient processing could help unlock future supply — but implementation timelines remain uncertain.

Key Investment Insight

Investors seeking long-term exposure to the AI, electrification, and green-infrastructure boom should strongly consider selectively overweighting copper. The case for a structural deficit is supported by credible data across industry reports and global research institutions. Well-managed copper miners with high-grade assets, strong balance sheets, and operations in politically stable jurisdictions may offer significant upside potential in the years ahead.

For risk-managed portfolios, the coming copper shortage is not just a mining story — it is a foundational macro trend shaping the future of AI, energy, and global industrial growth.

Stay informed with MoneyNews.Today as we continue tracking commodity markets, supply-chain dynamics, and the long-term investment shifts redefining global economic strategy.