Syntholene Energy Corp. (TSX.V: ESAF.V)(FSE: 3DD0)

Energy is getting more expensive and more political.

Global oil and gas discoveries are declining. Legacy fields are depleting faster than expected. The world is entering an era in which fuel and power are no longer taken for granted.

As governments scramble to secure reliable energy and critical materials:

- Western nations are actively decoupling from Russian, Iranian, and Middle Eastern supply chains

- Domestic energy security has become a strategic priority, not a political slogan

- Oil and gas costs are rising as replacement supply fails to keep pace with depletion

- Critical materials are now treated as national security assets

This shift is creating one of the most powerful capital reallocations of the next decade, favoring assets that support energy independence, reliability, and sovereignty.

For investors, this isn’t a climate story. It’s a story of scarcity and security.

But progress is too slow.

The United Nations estimates that a staggering $4.3 trillion per year must be spent to transition to clean, economically viable energy solutions by 2030. The US, EU, China, and dozens of other countries are unleashing billions in subsidies, mandates, and regulations.

Industries are being forced to decarbonize…

And consumers are demanding cleaner, greener, non-extractive energy solutions.

And yet…

Despite the boom in renewables and EVs, the hardest sectors to decarbonize remain stuck:

- Aviation

- Shipping

- Long-haul freight

- Cement and steel production

Why? It’s simple.

EVs can’t replace diesel. Batteries can’t fly planes. Hydrogen isn’t ready.

We need liquid fuels, and we need them now. But not the old kind.

We need clean, carbon-neutral fuels that work with today’s infrastructure but don’t contribute to tomorrow’s disasters.

Until now, that solution didn’t exist at scale.

The truth is, the next wave of global energy wealth won’t come from oil rigs or lithium mines…

It’s going to come from the air.

That’s right: air itself, and specifically the carbon molecules inside it.

While legacy players are busy trying to reinvent 20th-century energy systems, one trailblazing American startup is quietly building something revolutionary:

A closed-loop synthetic fuel system that could replace fossil fuels… while making carbon emissions disappear.

And the best part? This isn’t a company from the future.

It’s listed and trading at a sub-$50M CAD valuation, and it already has a technology that could upend the $1.4 trillion energy transition market.

Right now, this visionary small-cap holds groundbreaking intellectual property, Fortune 500 partnerships, and a first-mover advantage in carbon-negative fuels, the keys to unlock this bonanza…and the potential to generate unprecedented fortunes for its investors.

Syntholene Energy: The Synthetic Fuel Pioneer That’s About To Unleash An Energy Revolution

What if there were a liquid fuel that:

- Required no drilling, no pipelines, no fracking

- Worked in every jet engine already in the sky

- Was carbon-neutral or even carbon-negative?

- And could be made using steam from the Earth itself?

That’s the trillion-dollar question.

Welcome to Syntholene Energy Corp. (TSX.V: ESAF.V)(FSE: 3DD0)

Syntholene is not just another carbon capture company or “green” energy play.

It’s a cutting-edge synthetic fuel company targeting the most urgent, underserved, high-value energy market on the planet: aviation.

It’s a synthetic energy platform, an end-to-end system that pulls CO₂ from the air and turns it into clean, burnable fuel.

Here’s how it works and why it’s about to matter a lot:

✅ High-Temperature Electrolysis

Harnesses both geothermal electricity and geothermal heat to split water into ultra-low-cost hydrogen — the #1 cost bottleneck in synthetic fuel.

✅ CO₂ Utilization

Captures carbon (either from the air or industrial processes) to combine with hydrogen and synthesize jet fuel from thin air — literally.

✅ Fuel Synthesis

Produces drop-in compatible jet fuel (eSAF) — ultra-clean, carbon-balanced, and ready to use in existing engines with no modifications.

✅ Geothermal-Powered Production

The world’s first geothermal-powered eSAF demo facility is being built in Iceland — the ideal location due to cheap, clean, stable energy and political support.

✅ Modular, Scalable, Ready to Grow

This isn’t a lab fantasy. Assembly is already underway in Chicago, site work has begun in Iceland, and the team is targeting first production by 2026.

This is the holy grail of climate tech… and Syntholene is first to market.

Because the reality is simple: the aviation industry is desperate.

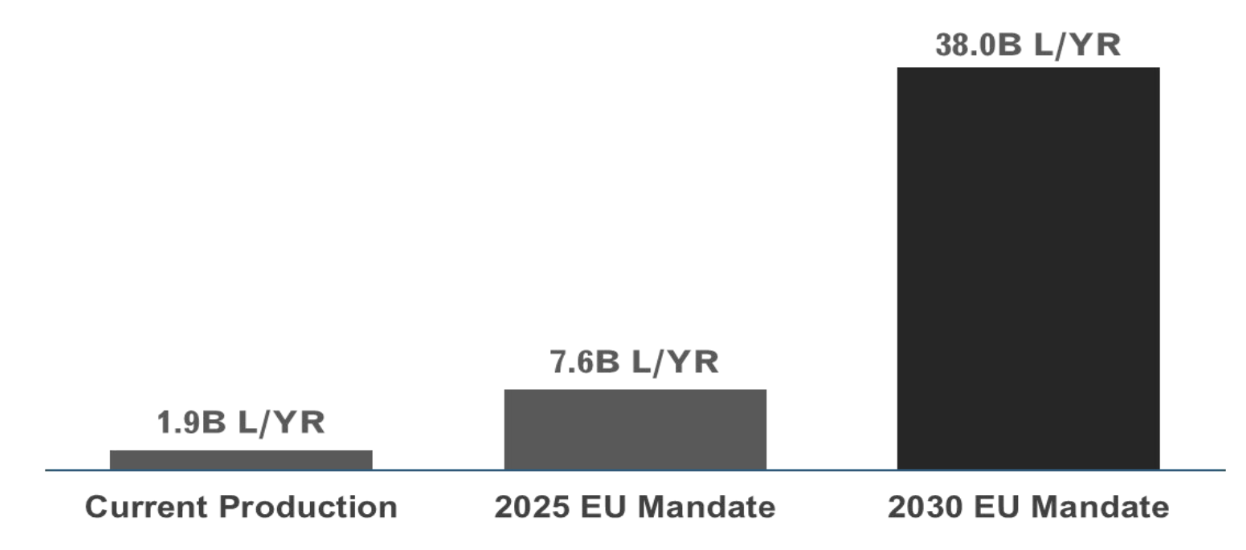

EU mandates are now forcing airlines to use sustainable aviation fuel – with a massive 5x production increment required between 2025 and 2030:

The problem? Most SAF is made from biofuels, which are scarce, dirty, expensive, and capped by feedstock limits.

Syntholene’s eSAF has none of those problems.

It’s purer than fossil jet fuel.

And it’s carbon-neutral from day one.

And thanks to their patented thermal integration, it’s targeting production costs up to a staggering 70% lower than other synthetic fuels…

No wonder insiders say this could be the company that finally cracks aviation’s decarbonization crisis.

Backed by Geothermal Power, World-Class Engineers, and a 70% Cost Advantage: Syntholene Prepares for Takeoff

Syntholene is moving fast.

They’ve already accumulated a portfolio of first-mover advantages that will cement their leadership of the booming SAF niche, including:

🔷 A thermal-hybrid production process validated at Idaho National Lab

🔷 A 20MW geothermal energy secured — powering the world’s first synthetic aviation fuel facility in Iceland, the world leader in geothermal energy.

🔷 A Demo plant already in motion — with key assembly underway in Chicago and site work live in Iceland

🔷 Commercial validation from Icelandair, outlining interest in 250 million liters of eSAF over 10 years, reinforcing real airline demand ahead of EU mandates

🔷 A Modular system design — enabling global deployment in energy-rich, carbon-hungry regions across the world, meaning unprecedented scalability.

Syntholene Secures Foundational U.S. Patent, Locking in Its Cost Advantage

If commercial demand validates why Syntholene matters, intellectual property explains why competitors will struggle to catch up.

On January 27, 2026, Syntholene announced the issuance of its first U.S. patent, granted by the United States Patent and Trademark Office.

Patent No. US 12,441,674 B2 protects a core component of Syntholene’s fuel synthesis platform: the Compact Cascade Oligomerizer.

This isn’t incremental IP.

It’s foundational reactor architecture.

Why this patent matters:

- It replaces multiple discrete reactors with a single, integrated unitary vessel

- It enables higher fuel yields, greater purity, and lower energy loss

- It intensifies heat integration by placing exothermic and endothermic reactions in physical proximity

- It directly underpins Syntholene’s claim of up to 70% lower production costs

In simple terms:

This patent protects the economic engine of the business.

CEO Dan Sutton called it a major de-risking milestone, while Chief Engineer John Kutsch emphasized that the USPTO validated Syntholene’s unique process-intensification approach — something legacy fuel systems simply cannot replicate without starting from scratch.

For investors, this shifts Syntholene from:

“promising technology”

to:

“protected industrial platform”

And with additional patent filings underway across Europe and Asia, the company is actively building a global IP moat ahead of commercial deployment.

But there is more.

The company is already planning to generate revenue as early as 2026, in addition to exploring the massive global licensing potential, particularly in jurisdictions with carbon-credit or decarbonization mandates.

This series of catalysts could soon put ESA in the crosshairs of investors… and of the world’s trillion-dollar energy behemoths.

The build is already underway. The timing is perfect. The runway is clear…

What’s needed now?

Someone who can execute.

And the Syntholene team’s unparalleled track record is the company’s trump card to win the global synthetic fuel race…

Commercial Validation Arrives: Icelandair Signals Demand for 250 Million Liters of eSAF

Up until recently, skeptics could argue that synthetic aviation fuel demand was “theoretical.”

That argument just collapsed.

In January 2026, Syntholene announced it had secured a non-binding Expression of Interest (EOI) from Icelandair, Iceland’s flagship airline and a major transatlantic hub carrier.

The agreement outlines Icelandair’s interest in purchasing:

- 20,000 tonnes (~25 million liters) of synthetic sustainable aviation fuel (eSAF) per year

- For a 10-year period

- Totaling ~250 million liters of eSAF

This commitment is conditional on scaled production and competitive pricing — exactly the two variables Syntholene is designed to solve.

Icelandair CEO Bogi Nils Bogason put it plainly:

“The transition to sustainable aviation fuel will only happen if production is scaled up and competitive pricing ensured.”

That statement alone validates Syntholene’s entire strategy.

Why this matters to investors:

- This is real airline demand, not a press-release partnership

- Icelandair operates in one of the most mandate-driven SAF regions in the world

- The airline sits at the crossroads of Europe and North America, making it a logical anchor customer for future expansion

Even more important?

This EOI lands right as EU eSAF mandates and subsidies collide to create one of the most attractive fuel markets on Earth.

Meet the Syntholene Team: A Heavyweight Lineup Built to Win the eFuel Race

The biggest clean fuel breakthrough of the decade means nothing if it’s not executed with industrial precision.

That’s why Syntholene’s elite management team may be the single most important reason why ESAF stock could become a market rocket.

Because this isn’t a group of first-time founders with a whiteboard and a dream.

This is a proven battalion of engineers, financiers, energy veterans, and industrial project builders—the kind of team you’d expect from a multi-billion-dollar public company.

Let’s break it down:

Dan Sutton, CEO

A visionary operator with 15 years of experience building high-complexity industrial infrastructure. Sutton previously scaled Tantalus Labs to $50M+ revenue and recruited executives from KPMG, Imperial Brands, Walmart, and Accenture. Now, he’s bringing that same executional intensity to Syntholene’s revolutionary production platform.

Canon Bryan, Co-Founder

The architect behind multiple billion-dollar companies in the energy and critical materials space. Canon co-founded Uranium Energy Corp (NYSE: UEC), now the largest incumbent uranium company on the NYSE, and Terrestrial Energy, a Gen IV nuclear SMR company now listing at $1.3B.

John Kutsch, Chief Engineer

A systems engineer with 30+ years of experience delivering large-scale industrial infrastructure. Kutsch helped develop IMSR reactors and was a key figure in Caldera’s mine-to-metal process innovation. Now, he’s applying that know-how to fuel synthesis tech that could transform aviation forever.

Jack Williams, Head Engineer

A Cambridge-credentialed chemical engineer and energy systems expert. Williams designed the world’s first MRI-compatible Fischer-Tropsch reactor and produced the synthetic kerosene used by KLM’s historic first SAF passenger flight.

Jens Thordarson, Europe Lead

Former COO of Icelandair Group and Honorary Consul of Ireland in Iceland, Thordarson brings unmatched access to government, aviation, and carbon policy channels in Europe—a critical region where SAF mandates are driving demand through the roof.

And if that wasn’t enough firepower…

Syntholene is backed by Inventa Capital, the elite venture platform that delivered major exits and public listings across the energy and mining world:

- Michael Konnert, Founder of Vizsla Silver ($2.76B Valuation) and CobaltOne

- Simon Cmrlec, former COO of Ausenco Engineering

- Craig Parry, founder of NexGen, IsoEnergy, and EMR Capital

- Mahesh Liyanage, CFO of Vizsla Silver and Heliostar Metals

This is not your average energy startup.

This is a war-tested energy team with deep-pocketed backers and the playbook to build multibillion-dollar energy companies from scratch.

And all this horsepower is being deployed into one of the hottest, most heavily incentivized sectors in the world—synthetic aviation fuel.

With a $1.3 trillion+ market, mandated demand, and limited supply, the opportunity is no longer theoretical.

It’s here. It’s now. And Syntholene is perfectly positioned to ride it all the way to the top.

Because in 2026, every energy major, airline, and sovereign fund is hunting for the winning fuel tech platform – and this dash to strategic M&A could put Syntholene right in the crosshairs….

Prime Target: How Syntholene’s Bargain Valuation Could Land It In the Crosshairs of a Energy Tech M&A Frenzy

Syntholene isn’t just a first mover.

It’s a prime acquisition target sitting on a proprietary fuel tech stack that could transform the economics of aviation and heavy industry.

The strategic value is obvious:

- A proven synthetic fuel platform with 70% lower production costs than any known competitor

- Drop-in compatibility with global aviation and shipping infrastructure

- IP-protected integration of high-temperature electrolysis + geothermal heat

- Commercial traction in a sector where governments are mandating adoption and subsidizing demand

And it’s happening in a market where M&A activity is catching fire.

Volumes have risen sharply in 2025, with energy, utilities, and resources M&A totaling a stunning $142 billion from November 2024 to November 2025.

In Europe alone, the renewable energy M&A environment in 2025 saw 47 announced clean‑energy deals in October alone, spanning battery storage, biofuels, hydrogen, and other clean fuel verticals

This isn’t theoretical. It’s unfolding right now.

Here’s just a snapshot of recent energy-tech M&A deals:

- In December 2025, Inox Clean Energy Ltd. completed the acquisition of Vibrant Energy, with a portfolio of 1.3 GW of renewable energy projects out of which is 800 MW is operational.

- In October 2025, UK power company Drax acquired a 260 MW / 2‑hour battery energy storage system (BESS) portfolio from Apatura for £157 million.

- Also in October 2025, Tyczka Hydrogen acquired MPREIS Hydrogen GmbH and its Völs production facility in Austria, expanding its hydrogen production and distribution capabilities in Europe

The trend is clear:

Big oil, big airlines, and big nations are acquiring their future fuel supply — before competitors do.

Now compare that with Syntholene’s sub CAD $50M market cap…

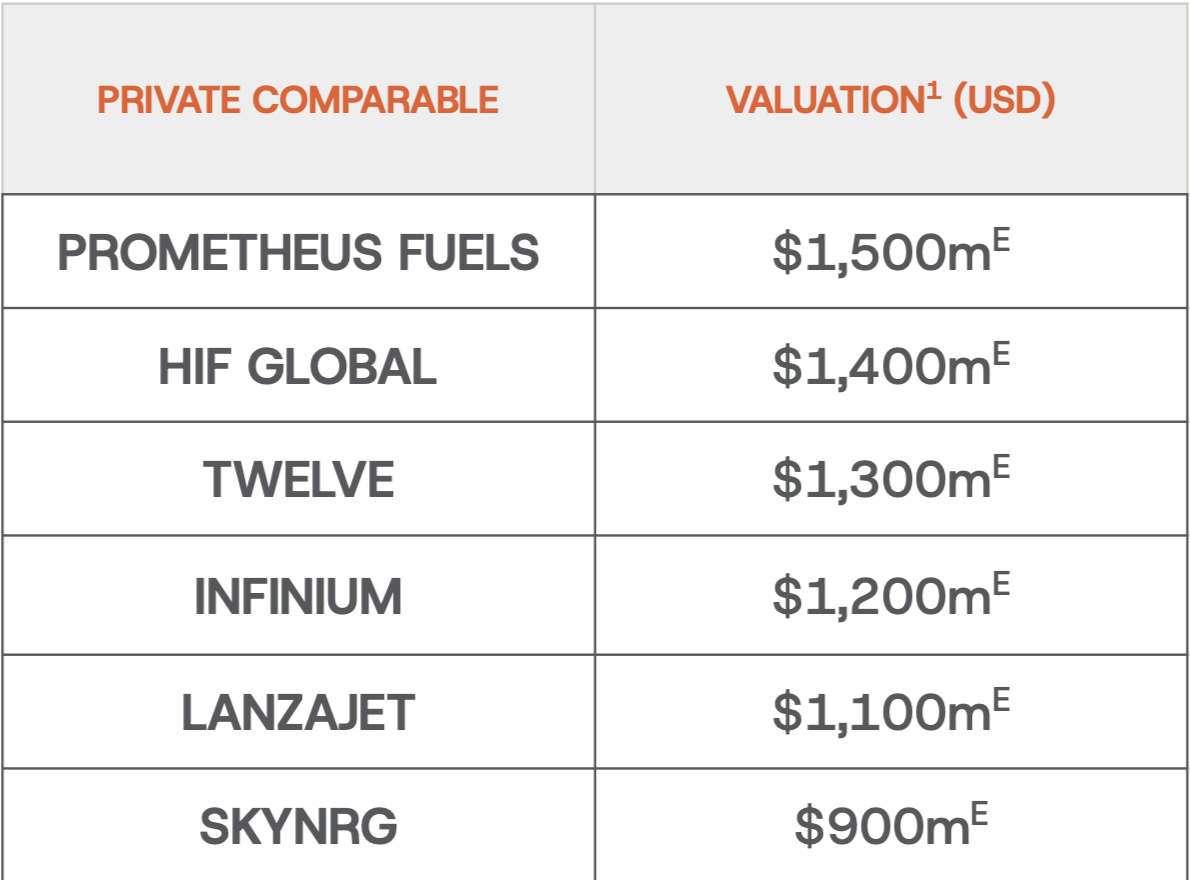

While peer companies in the synthetic fuel space remain private and valued between $900M–$1.5B, Syntholene is already public and trading at less than 2% of that range.

This is what the top institutional investors call a “valuation vacuum.”

And get this: it won’t last.

Because the moment a buyer runs the math on:

- The production cost advantage

- The IP stack

- The low-cost modular deployment

- And the strategic value of being first to market with a publicly tradable ticker…

…Syntholene becomes an obvious potential acquisition target.

This is the calm before the M&A storm. And ESAF is still under the radar — for now.

But when news hits, even a small partnership, demo facility announcement, or airline LOI, the re-rate will be immediate.

Because in a $3 trillion fuel transition, a $50M synthetic fuel pioneer doesn’t go unnoticed for long…

Syntholene: The eFuel Powerhouse of 2026

All the stars are aligning for Syntholene to become a market leader:

A massive multi‑trillion‑dollar global opportunity

The global renewable fuel market was already valued at ~$1 trillion in 2024/2025 — and is projected to surge to $2–$3+ trillion by 2030–2035, driven by climate mandates, aviation decarbonization, shipping regulations, and government subsidies worldwide.

A one‑of‑a‑kind synthetic fuel platform — with no true public comparables

Syntholene is building high‑grade, low‑cost, carbon‑negative synthetic fuels with a proprietary technology stack that integrates advanced thermal coupling, hydrogen production, and Fischer‑Tropsch synthesis — a combination that private competitors valued between $900M and $1.5B USD are still racing to achieve.

A first‑in‑class management and engineering team that has already built billion‑dollar energy companies

From Canon Bryan (founder of Uranium Energy Corp and co‑founder of Terrestrial Energy, listing on NASDAQ at $1.3B valuation) to Jack Williams (engineer of the world’s first MRI‑compatible Fischer‑Tropsch reactor and the synthetic fuel used in the first passenger SAF flight with KLM), Syntholene’s leadership is exactly the kind that institutions back when they smell a breakout.

A clear monetization engine — selling real fuel into massive real markets

This is not a licensing experiment or a lab‑scale science project.

Syntholene is building and selling synthetic fuel directly into aviation, shipping, and industrial energy markets — the hardest and most valuable sectors to decarbonize on Earth.

An unprecedented valuation disconnect.

While private synthetic‑fuel peers command $900M–$1.5B valuations, Syntholene currently trades at a sub ~CAD $50M market cap.

This is one of those rare textbook setups — the kind that shows up just before a major market move.

Syntholene offers the kind of opportunity that institutions crave:

First-mover in a large addressable market.

And the simple truth?

This disconnect will not last.

Syntholene only began trading on the TSX Venture Exchange on December 12, 2025. The market is only just beginning to notice.

As execution milestones are met, partnerships signed, and fuel sales commence, Syntholene could no longer be a sub‑$50M story — let alone a sub‑$20M one.

With global energy markets worth tens of trillions of dollars, even a microscopic shift of capital toward Syntholene’s model could have a huge impact on the company’s market position.

But let’s be honest:

This is not a one‑day or one‑week trade.

This is the kind of stock that compounds over months… years… and full market cycles — delivering what every serious investor hunts for:

A ground‑floor position in a category‑defining energy company.

As an investor, you now face a simple question:

Do you want exposure to one of the most potentially explosive clean‑energy opportunities of the Decade, or do you want to read about it later? Be sure to keep Syntholene at the top of your radar if you want to ride the eFuel boom.

Disclaimer:

This article is a paid advertisement. SmallCap Communications Inc. and its owners, managers, employees, and assignees (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of Syntholene Energy Corp. (“SEC”) and its securities, SEC has provided the Publisher with a budget of approximately three hundred thousand CAD to cover the costs associated with the creation and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purports to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor.

Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results.

This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by SEC) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP

The Publisher does not own any shares of SEC and has no information concerning share ownership by others of SEC. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website, and this has the potential to hurt share prices. Frequently, companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations.

Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements.

These forward-looking statements include, among other things, statements relating to:

(a) revenue generating potential with respect to SEC’s industry;

(b) market opportunity;

(c) SEC’s business plans and strategies;

(d) services that SEC intends to offer;

(e) SEC’s milestone projections and targets;

(f) SEC’s expectations regarding receipt of approval for regulatory applications;

(g) SEC’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and

(h) SEC’s expectations regarding its ability to deliver shareholder value.

Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about:

(a) the ability to raise any necessary additional capital on reasonable terms to execute SEC’s business plan;

(b) that general business and economic conditions will not change in a material adverse manner;

(c) SEC’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis;

(d) SEC’s ability to enter into contractual arrangements;

(e) the accuracy of budgeted costs and expenditures;

(f) SEC’s ability to attract and retain skilled personnel;

(g) political and regulatory stability;

(h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms;

(i) changes in applicable legislation;

(j) stability in financial and capital markets;

Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of SEC to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation:

(a) SEC’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations;

(b) the volatility of global capital markets;

(c) political instability and changes to the regulations governing SEC’s business operations

(d) SEC may be unable to implement its growth strategy; and

(e) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of SEC or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of SEC or such entities and are not necessarily indicative of future performance of SEC or such entities.