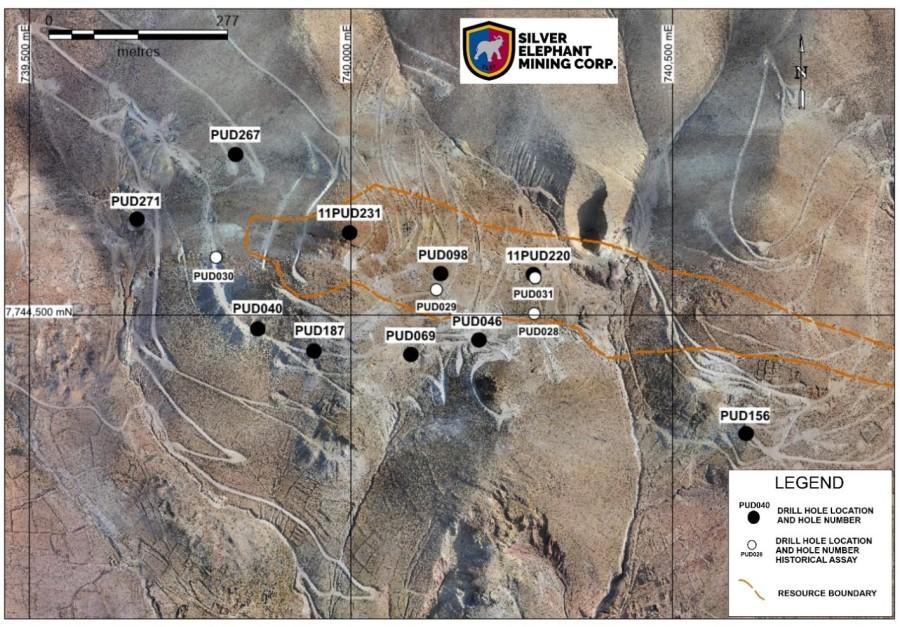

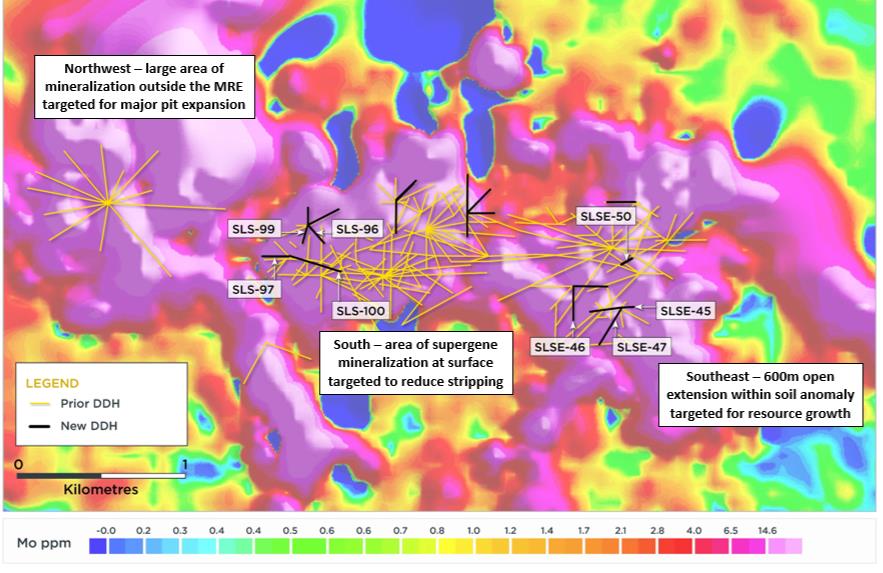

Silver Elephant Mining (TSX:ELEF) has announced the discovery of gallium and indium at its Pulacayo-Paca silver-lead-zinc project in Bolivia’s Potosi department. The company reported assay results showing gallium levels up to 34 g/t and indium levels up to 266 g/t over a 750-meter strike length.

The assays were conducted on 199 core samples from 12 diamond drill holes at the site. These samples were selected based on their proximity to previous drill holes that had shown promising results for gallium and indium. Earlier testing on those holes had revealed 99 meters containing 27.8 g/t gallium and 9.7 g/t indium.

According to Silver Elephant, the gallium and indium occurrences appear to correlate with zinc mineralization at the site. The company stated it will continue evaluating the potential of these elements, noting they could add significant value to any concentrate produced from future mining operations.

The Pulacayo-Paca project, Silver Elephant’s flagship operation, began production in October 2023. While primarily focused on silver, lead and zinc, these new findings suggest the possibility of additional valuable minerals at the site.

Bill Pincus, an independent consultant acting as a qualified person under NI 43-101 guidelines, supervised the technical aspects of this announcement. The company employed standard Quality Assurance/Quality Control protocols during the drilling campaigns, including the use of standards and blanks comprising 3-5% of analyzed material.

This announcement comes amid growing interest in gallium and indium, which are used in various high-tech applications including semiconductors and flat-panel displays. The discovery of these elements at an existing silver mine could potentially enhance the project’s economic viability.

It should be noted that while these initial results are promising, further testing and evaluation will be necessary to determine the full extent and economic potential of the gallium and indium mineralization at the Pulacayo-Paca project.

HOLE ID

FROM m

TO m

WIDTH m

Ag g/t

Pb %

Zn %

Ga g/t

In g/t

PUD156

247.3

248

0.7

934

5.67

6.16

4.56

266.00

11PUD231

30

31

1

1

0.53

0.01

7.58

12.25

11PUD231

42

43

1

1

0.65

0.02

10.05

14.55

11PUD231

48

49

1

2

1.56

0.02

34.80

42.40

11PUD231

101

102

1

108

1.91

8.71

5.56

38.40

11PUD231

111

112

1

345

5.83

10.85

8.83

74.80

11PUD231

119

120

1

145

2.20

1.23

10.20

29.00

PUD069

254

255

1

40

1.10

5.44

4.61

11.15

PUD069

278

279

1

44

0.17

6.65

2.42

20.30

PUD069

290

291

1

98

0.91

1.20

2.57

17.75

PUD069

296

297

1

620

0.44

8.79

3.04

16.40

PUD069

310

311

1

169

0.24

7.73

7.08

219.00

11PUD220

84

85

1

74

2.67

2.95

2.61

14.50

PUD046

227

228

1

54

1.02

4.35

3.90

10.30

PUD046

233

234

1

93

1.62

3.82

7.29

21.60

PUD046

261

262

1

106

1.47

1.81

1.84

20.80

PUD046

267

268

1

314

1.71

2.44

2.53

20.00

PUD046

273

274

1

62

0.96

4.91

4.61

37.50

PUD046

279

280

1

56

0.51

5.48

5.45

32.70

PUD046

285

286

1

199

1.99

6.70

3.77

29.50

PUD046

291

292

1

786

10.95

3.59

5.74

51.00

PUD046

296

297

1

>100

0.83

>10000

2.05

12.40

PUD098

63

64.15

1.15

77

1.74

3.89

2.93

12.60

PUD098

154

155

1

44

0.71

5.84

5.18

43.40

PUD098

159

160

1

1.29

0.15

0.66

4.64

14.00

PUD098

184

185

1

41

0.94

5.43

2.52

12.90

PUD098

190

191

1

650

10.90

12.95

6.84

83.90

PUD187

316

317

1

15

0.06

1.63

3.27

13.25

PUD267

33.5

35

1.5

40

1.22

1.21

3.78

15.90

HOLE ID

FROM m

TO m

WIDTH m

TRUE WIDTH m

Ag g/t

Pb %

Zn %

PUD 156

241

278

37

22.78

74.65

0.33

0.82

including…

246.6

253

6.4

3.94

217.49

0.99

1.36

11PUD 231

21

23

2

0.94

199.5

9.35

0.06

11PUD 231

40

47

7

3.29

92

2.53

0.07

including…

45

46

1

0.47

407

6.72

0.07

101

106

5

2.35

54.4

1.07

3.32

109

114

5

2.35

96.4

1.77

4.7

117

120

3

1.41

79

1.37

4.45

PUD 069

276

306

30

22.98

413.9

3.59

1.2

11PUD 220

35.2

56

20.8

9.76

79.3

0.9

0.62

65

68

3

1.41

44.7

0.75

0.6

80

89

9

4.22

119.7

2.6

2.64

PUD 040

237

241

4

2.29

7.25

1.1

3.49

PUD 046

225

309

84

70.44

106.29

0.86

2.26

including…

284

303

19

15.93

258.47

1.8

2.85

PUD 187

315

317

2

1.53

13.5

0.08

1.74

324

326

2

1.53

7

0.01

1.14

PUD 267

31.5

67

35.5

25.10

54.3

4.31

0.92

including…

48

58

10

7.07

146.7

9.79

1.97

PUD 267

117

123

6

4.24

47.8

1.11

0.25

including…

121

122

1

0.71

238

3.61

0.86

127.5

131

3.5

2.47

1.3

1.45

0.25

139.5

142

2.5

1.77

2.4

1.68

0.2

PUD 271

123

126

3

2.12

1

0.005

0.012

PUD 098

178

215

37

29.93

48.8

1.06

2.9

Including…

189

193

14

11.33

304.4

5.15

10.69

PND 108

15

65

50

48.30

135

1.42

0.4

including…

33

57

24

23.18

200

2.12

0.6

and…

33

43

10

9.66

257

1.49

0.41

94

96

2

1.93

160

0.52

0.94

PND 110

9

182

173

122.33

95

1.4

1.63

incl…

9

98

89

62.93

279

1.17

1.28

and…

9

28

19

13.43

718

0.74

0.05

and…

9

12

3

2.12

145

0.9

0.07

and…

16

28

12

8.49

1085

0.71

0.04

and…

44

180

138

97.58

87

2.01

1.59

and…

44

46.5

2.5

1.77

111

1.09

0.61

and…

44

98

54

38.18

98

1.52

2.03

and…

52

54

2

1.41

115

1.33

1.61

and…

60

82

22

15.56

328

1.43

1.98

and…

61

65

4

2.83

1248

2.88

1.93

and…

86

94

8

5.66

270

2.74

2.83

and…

97

98

1

0.71

155

3.03

3.26

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

I specialize in the mining industry, focusing on top global mining stocks. My reporting covers the latest industry news, company/project developments, and profiles of key players. With a degree in finance and economics from the University of Toronto, I’ve contributed to a wide range of industry publications. Beyond my professional pursuits, I have a keen interest in global business and a love for travel.

Comments are closed.