Solaris Resources (TSX:SLS) (NYSEAmerican:SLSR) has announced assay results from its ongoing 2024 drilling program at the Warintza Project in southeastern Ecuador. The results reveal high-grade mineralization near the surface, improving previously modeled grades and expanding the potential of the resource in several key areas of the site.

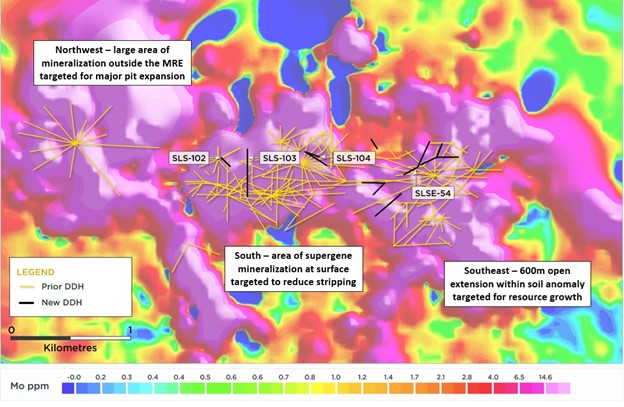

The company, which has drilled over 53,000 meters by the end of the third quarter of 2024, is aiming to exceed its 60,000-meter target for the year. The latest drill holes, SLS-103, SLSE-54, SLS-102, and SLSE-52, add significant mineralization in areas that had not been extensively drilled. Holes SLS-103 and SLSE-54, located in the northwest and northeast sectors, respectively, have intersected new high-grade mineralization at surface, with much of the mineralization falling outside the current Mineral Resource Estimate (MRE). This marks an important step in expanding the known resource, as these results indicate higher grades than previously modeled in these regions.

Key intercepts include 87 meters of 1.23% CuEq, 93 meters of 1.01% CuEq, and 84 meters of 1.00% CuEq. These findings bolster the company’s ongoing efforts to improve the quality of the resource, particularly in sparsely drilled zones within the northwest, north, and northeast areas of the project.

In addition to the resource expansion efforts, Solaris is conducting exploration drilling in an area featuring a large soil anomaly on the opposite side of a granodiorite formation, which shapes the northwestern pit wall. Assays from this exploration are expected in the coming weeks.

With high productivity on-site due to infrastructure investments, Solaris remains on track to exceed its 2024 drilling plan. Current efforts include drilling focused on expanding open extensions of the resource, infill drilling to upgrade existing resources, and further geotechnical and condemnation drilling.

Highlights from the results include:

Northwest, North and Northeast Sectors:

SLS-102 (drilled northwest): 93m of 1.01% CuEq² within 156m of 0.74% CuEq² from surface

SLS-103 (drilled north): 87m of 1.23% CuEq² within 528m of 0.59% CuEq² from surface

SLS-104 (drilled southeast): 84m of 1.00% CuEq² within 485m of 0.77% CuEq² from surface

SLSE-54 (drilled southwest): 258m of 0.52% CuEq² within 399m of 0.41% CuEq² from surface

Table 1 – Mineral Resource Extension, Infill and Condemnation Results

Hole ID

Date

Reported

From

(m)

To

(m)

Interval

(m)

Cu

(%)

Mo

(%)

Au

(g/t)

CuEq²

(%)

Comments

SLS-104

Oct 7, 2024

0

485

485

0.56

0.03

0.06

0.77

Northern sector – infill

Including

45

129

84

0.82

0.02

0.07

1.00

Including

45

255

210

0.69

0.03

0.07

0.90

Including

45

485

440

0.61

0.03

0.06

0.82

SLS-103

0

528

528

0.26

0.05

0.04

0.59

Northwest sector – infill and extensional

Including

21

108

87

1.00

0.03

0.11

1.23

Including

21

483

462

0.29

0.06

0.05

0.64

Including

240

345

105

0.28

0.08

0.02

0.72

SLS-102

0

156

156

0.46

0.04

0.08

0.74

Northwest sector – infill

Including

57

150

93

0.73

0.04

0.09

1.01

SLS-101

0

307

307

0.06

0.01

0.02

0.14

Northwest sector – condemnation

SLSE-60

0

290

290

0.16

0.01

0.03

0.23

Northeast sector – infill

Including

93

290

197

0.21

0.01

0.04

0.30

Including

141

290

149

0.24

0.01

0.05

0.35

Including

207

290

83

0.28

0.02

0.03

0.43

SLSE-58

0

453

453

0.03

0.00

0.01

0.04

Northeast sector – condemnation

SLSE-57

0

660

660

0.22

0.01

0.05

0.30

Southeast sector – extensional

Including

552

660

108

0.49

0.02

0.06

0.61

SLSE-56

0

381

381

0.09

0.00

0.03

0.11

Northeast sector – condemnation

SLSE-55

0

473

473

0.12

0.00

0.02

0.16

Northeast sector – condemnation

SLSE-54

0

399

399

0.29

0.01

0.04

0.41

Northeast sector – infill and extensional

Including

0

258

258

0.37

0.02

0.05

0.52

Including

81

231

150

0.43

0.02

0.05

0.60

SLSE-53

0

455

455

0.04

0.00

0.02

0.07

Northeast sector – condemnation

SLSE-52

0

138

138

0.15

0.01

0.03

0.23

Southeast sector – condemnation

SLSE-51

0

257

257

0.15

0.01

0.03

0.20

Southeast sector – condemnation

Notes to Table 1: True widths are interpreted to be very close to drilled widths due to the bulk-porphyry style mineralized zones at Warintza.

Table 2 – Collar Locations

Hole ID

Easting

Northing

Elevation

(m)

Depth

(m)

Azimuth (degrees)

Dip (degrees)

SLS-104

800383

9648303

1411

485

110

-70

SLS-103

799760

9648031

1575

528

360

-56

SLS-102

799568

9648147

1403

253

315

-60

SLS-101

799760

9648031

1575

307

180

-45

SLSE-60

801800

9648235

1102

290

243

-54

SLSE-58

801806

9648243

1098

454

90

-58

SLSE-57

801150

9647610

1396

660

45

-60

SLSE-56

801163

9648335

1309

382

326

-71

SLSE-55

801597

9648134

1155

473

25

-50

SLSE-54

801596

9648136

1154

481

240

-70

SLSE-53

801802

9648239

1100

455

23

-68

SLSE-52

801248

9647968

1252

354

270

-46

SLSE-51

801246

9647967

1252

257

225

-45

Notes to Table 2: The coordinates are in WGS84 17S Datum.

Endnotes

Refer to the technical report entitled “Mineral Resource Estimate Update – NI 43-101 Technical Report, Warintza Project, Ecuador” with an effective date of July 1, 2024 and available on SEDAR+ under the Company’s profile at www.sedarplus.ca and on the Company’s website.

Copper-equivalence grade calculation for reporting assumes metal prices of US$4.00/lb Cu, US$20.00/lb Mo, and US$1,850/oz Au, and recoveries of 90% Cu, 85% Mo, and 70% Au based on preliminary metallurgical testwork. CuEq formula: CuEq (%) = Cu (%) + 5.604 × Mo (%) + 0.623 × Au (g/t).

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

I specialize in the mining industry, focusing on top global mining stocks. My reporting covers the latest industry news, company/project developments, and profiles of key players. Beyond my professional pursuits, I have a keen interest in global business and a love for travel.

Comments are closed.