Major UK Banks Adjust Overdraft Fees Amid Shifting Financial Landscape

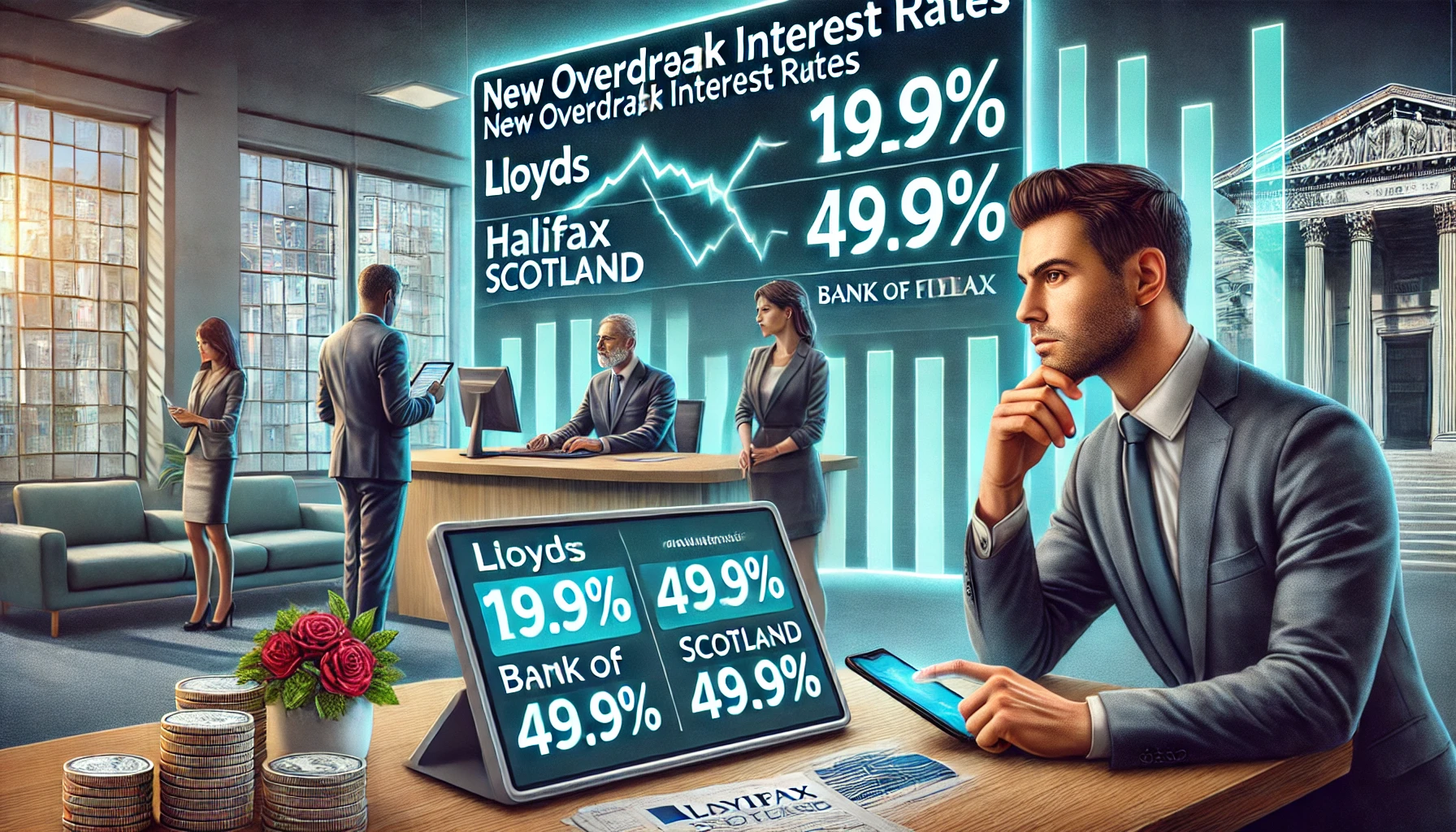

In a significant move that could reshape the UK banking sector, Lloyds Bank, Halifax, and Bank of Scotland have introduced new overdraft fee structures, effective today. The revised interest rates, ranging from 19.9% to 49.9%, will impact millions of customers, with some benefiting from lower rates while others—particularly those on temporary reduced rates—face higher borrowing costs. Investors now face a key question: How will these changes influence consumer behavior, banking profitability, and the broader financial landscape?

Breaking Down the Impact on the Financial Sector

1. Consumer Behavior and Borrowing Trends

The restructuring of overdraft fees will likely drive shifts in consumer financial habits. Higher rates may lead to reduced reliance on overdrafts, while competitive pressures could push consumers toward alternative financial products such as credit cards and personal loans.

- Why it matters: Changes in consumer borrowing habits could affect bank revenue streams, particularly for institutions that rely on overdraft fees as a key source of non-interest income.

- Investor insight: Financial services firms offering credit alternatives, including fintech lenders and digital banks, could see increased demand.

2. Competitive Landscape and Regulatory Considerations

With traditional banks restructuring their overdraft fees, challenger banks and fintech companies may seize the opportunity to attract new customers with lower rates and innovative credit solutions.

- Why it matters: Fintech disruptors like Monzo and Revolut have already introduced alternative overdraft and credit options, intensifying competition in the banking sector.

- Investor insight: Investors should monitor how major banks respond to fintech-driven disruptions and whether regulatory scrutiny increases in response to consumer cost concerns.

3. Stock Market and Banking Sector Performance

Changes in interest rate structures and fee income could influence banking stocks, particularly Lloyds Banking Group (LON: LLOY), which owns Halifax and Bank of Scotland. Investors should assess how these fee adjustments impact overall revenue and customer retention.

- Why it matters: Fee-based income is a critical component of retail banking profitability, and a shift in overdraft revenue could lead to earnings revisions.

- Investor insight: Investors should watch quarterly earnings reports and consumer lending data to gauge the financial impact on major UK banks.

Future Trends to Watch

- Consumer Migration to Fintechs: As traditional banks adjust their fee structures, consumers may explore alternative lending platforms and digital banks.

- Regulatory Scrutiny: The Financial Conduct Authority (FCA) has previously cracked down on unfair lending practices—will these changes prompt further regulatory action?

- Earnings Impact on Major Banks: Investors should track how these changes influence net interest income and overall profitability for traditional banks.

Key Investment Insight

Investors should:

- Monitor consumer lending trends, particularly the growth of alternative credit solutions.

- Assess the impact on traditional banking stocks, such as Lloyds Banking Group, which may experience revenue shifts.

- Track regulatory developments, as changes in lending rules could further reshape the financial services sector.

Final Thoughts

The shift in overdraft fees by Lloyds, Halifax, and Bank of Scotland reflects broader trends in consumer banking and financial regulation. As investors navigate these changes, staying informed on market reactions and emerging opportunities will be essential for making well-informed investment decisions.

For more in-depth analysis and real-time updates on financial markets, stay connected with MoneyNews.Today—your trusted source for investor insights.