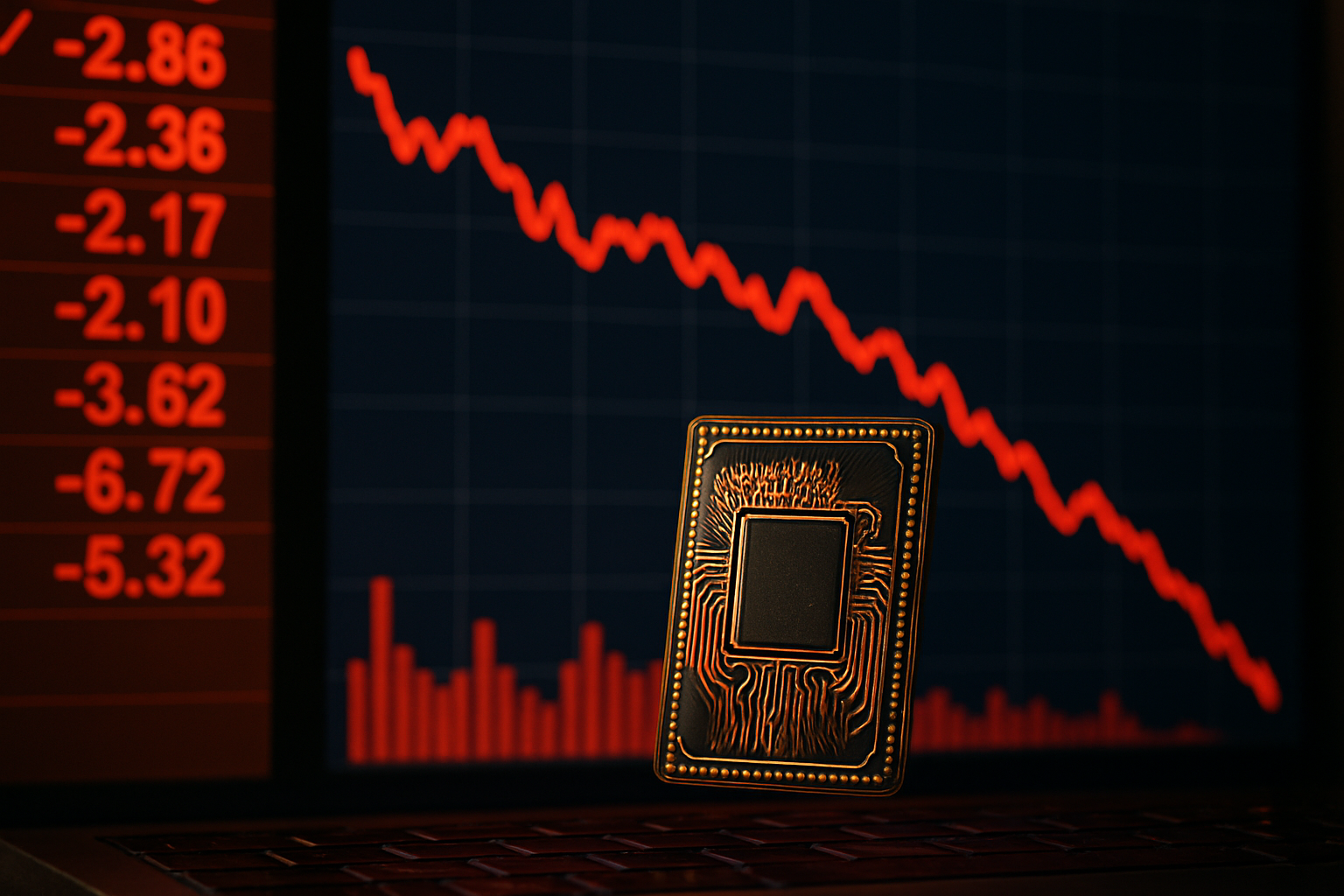

New AI Chip Restrictions on China Trigger Broad Sell-Off, Fueling Investor Caution Across Indices

Global stock markets have turned sharply lower this week following the U.S. government’s announcement of stricter export controls on advanced AI chips to China, sending ripples through the technology sector and rattling investor sentiment worldwide. The Nasdaq 100, which is heavily weighted toward tech giants, fell over 2.1% in early trading on Monday, with Nvidia, AMD, and other semiconductor stocks posting steep losses.

The policy shift, spearheaded by the U.S. Commerce Department, prohibits the sale of high-performance chips—specifically those used in AI and supercomputing—to Chinese entities without a license. As tensions between the world’s two largest economies escalate, markets are responding with increased caution, especially in sectors with high exposure to international trade.

Why This Matters for Investors

This development arrives at a critical juncture for global equity markets already grappling with inflation pressures, central bank uncertainty, and sluggish earnings growth in key sectors. The announcement has introduced a new layer of geopolitical risk—this time with direct implications for tech revenues, supply chains, and global trade policies.

According to the Associated Press, the policy is likely to hit not only major chipmakers like Nvidia and AMD but also broader tech infrastructure companies reliant on high-end computing resources. Nvidia, which had previously forecast $5.5 billion in potential losses from China-related restrictions, saw its stock dip by 5.9% in the aftermath.

Markets in Asia and Europe mirrored the slide, with the Hang Seng Tech Index dropping over 3%, and the Stoxx 600 Technology Index shedding 1.7%, underscoring the global nature of the risk.

Key Drivers Behind the Sell-Off

1. Tech Dependence on Chinese Demand

China represents a substantial market for advanced computing hardware. Many U.S. tech firms generate 15–25% of their revenues from Chinese clients. Stricter export limits could severely curtail earnings in the near term.

2. Increased Market Volatility

With geopolitical developments now directly impacting specific sectors, investors are repricing risk, leading to increased volatility and sectoral rotation out of tech and into more defensive assets like gold, utilities, and cash equivalents.

3. Heightened Trade Tensions

This move signals a further deterioration in U.S.-China relations, casting doubt over future trade cooperation. Markets fear retaliatory measures, including restrictions on rare earth exports, technology imports, or other economic levers.

Future Trends to Watch

- Supply Chain Restructuring: Investors should monitor how tech companies adapt their supply chains and revenue models to reduce reliance on sensitive international markets.

- Policy-Driven Market Swings: With global politics increasingly influencing corporate earnings, expect more headline-driven market corrections.

- Growth in Domestic AI Markets: Restrictions may accelerate investment in AI self-sufficiency in both the U.S. and China, boosting smaller domestic suppliers and innovation ecosystems.

Key Investment Insight

For investors, the key takeaway is diversification. Concentration in megacap tech stocks, especially those with global exposure, could amplify portfolio risk in this evolving geopolitical environment. Consider the following strategies:

- Broaden Exposure: Incorporate non-tech sectors such as healthcare, defense, and commodities to hedge against tech-specific volatility.

- Look for Undervalued Plays: Mid-cap tech stocks or regional chipmakers less reliant on China could become attractive in a sector-wide pullback.

- Monitor Government Policy: Stay informed on international trade developments. Markets may react sharply to new policy signals from Washington or Beijing.

Stay Ahead with MoneyNews.Today

With markets increasingly reactive to global policy shifts, timely insights are more critical than ever. MoneyNews.Today keeps you informed with daily updates, expert analysis, and actionable investment intelligence to help you navigate today’s complex financial landscape.