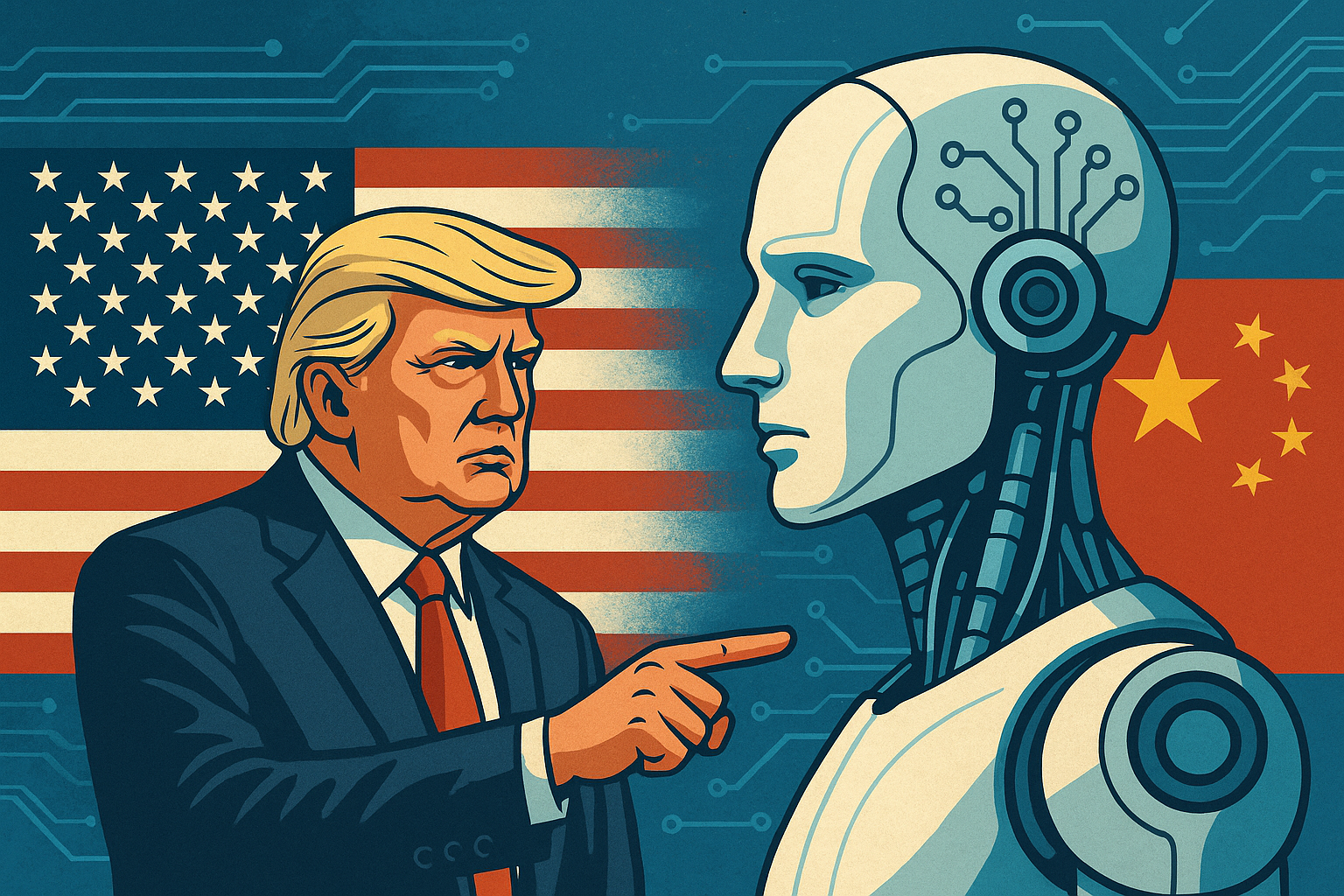

In a geopolitical climate increasingly defined by tech rivalry, the White House has released a sweeping new artificial intelligence strategy aimed at catapulting U.S. dominance in the AI arms race against China. On the same day, global enterprise software firm IFS announced a 30% surge in its annual recurring revenue (ARR), fueled by rapid industrial AI adoption—two parallel developments that have investors rethinking their exposure to this accelerating sector.

With markets already pricing in AI’s potential across sectors, these dual announcements have injected new energy into the narrative. The U.S. federal government’s strategic pivot to loosen AI regulations marks a major shift in policy posture, one designed to stimulate innovation, encourage capital flow, and outpace China in one of the 21st century’s defining technological arenas.

A Shift in Washington: Deregulating to Compete

President Trump’s new AI blueprint, unveiled on July 23, 2025, outlines a deregulatory framework designed to reduce bureaucratic red tape while incentivizing private-sector R&D. Key elements include fast-tracked federal AI pilot programs, expanded tax credits for enterprise AI deployment, and limited liability protections for AI developers under specific conditions.

According to BNN Bloomberg and Yahoo Finance, the administration’s approach is a direct response to China’s state-led AI strategy, which has seen massive public investments in generative models, autonomous logistics, and military AI. Trump’s plan is expected to refocus U.S. efforts around industrial and defense applications, especially in sectors where AI can boost productivity and national competitiveness.

“The regulatory shift creates a tailwind for domestic tech giants like Palantir, NVIDIA, and Microsoft—firms already deeply embedded in enterprise and federal AI contracts,” noted David Levine, a senior tech analyst at Horizon Capital, speaking to MoneyNews.Today.

IFS Surges with Industrial AI Demand

Complementing the White House’s pro-AI stance, global enterprise software leader IFS reported a 30% increase in annual recurring revenue for the first half of 2025, driven largely by its expansion in agentic and industrial AI tools. As reported by PR Newswire, the company’s success signals robust demand in asset-intensive sectors such as aerospace, manufacturing, and utilities.

IFS CEO Mark Moffat stated, “This is not speculative AI—it’s operationalized AI driving real-world decisions and measurable ROI across critical industries.”

IFS’s H1 performance positions it as a bellwether for enterprise-level AI adoption. Its growth reflects a broader industrial trend where automation, predictive maintenance, and supply chain optimization are being redefined by AI technologies—areas where SaaS providers with domain expertise are finding a clear edge.

Why This Matters for Investors

The convergence of political will and industrial execution around AI should not be underestimated. The U.S. government’s deregulation strategy lowers cost and legal friction for AI developers, potentially fast-tracking innovation pipelines and time-to-market. This policy environment benefits not only Big Tech but also mid-cap players operating in niche AI verticals.

Meanwhile, IFS’s results underscore how AI is moving from hype to hard returns. With AI capabilities now embedded across enterprise resource planning (ERP), field service, and asset management platforms, firms that lead in industrial AI stand to gain share in a market poised to exceed $300 billion globally by 2027 (according to a McKinsey report).

Future Trends to Watch

- Defense-Tech Convergence: Expect renewed investor interest in companies sitting at the intersection of AI and national security, especially those aligned with DoD procurement.

- Mid-Cap Enterprise AI: Companies like IFS, UiPath, and ServiceNow could be poised for further upside as enterprises adopt scalable AI modules.

- China-U.S. Retaliation Risks: Investors should monitor Chinese tech policy responses. A potential tech export restriction or retaliatory regulation could introduce volatility in semiconductor and AI-adjacent equities.

- ETF Rotation: Funds like BOTZ, ROBO, and ARKQ may benefit as capital shifts toward industrial automation and AI execution layers.

Key Investment Insight

The U.S. administration’s deregulation push and the strong H1 showing from IFS suggest that AI is transitioning from theoretical opportunity to tangible enterprise value. Investors should consider rebalancing their portfolios to include enterprise AI firms—especially those with proven ARR growth, industrial partnerships, or government exposure. Watch for updates from the Department of Commerce and quarterly earnings from AI-heavy mid-caps to validate this thesis.

Stay ahead of the curve with MoneyNews.Today—your trusted source for real-time insights across technology, policy, and market strategy.