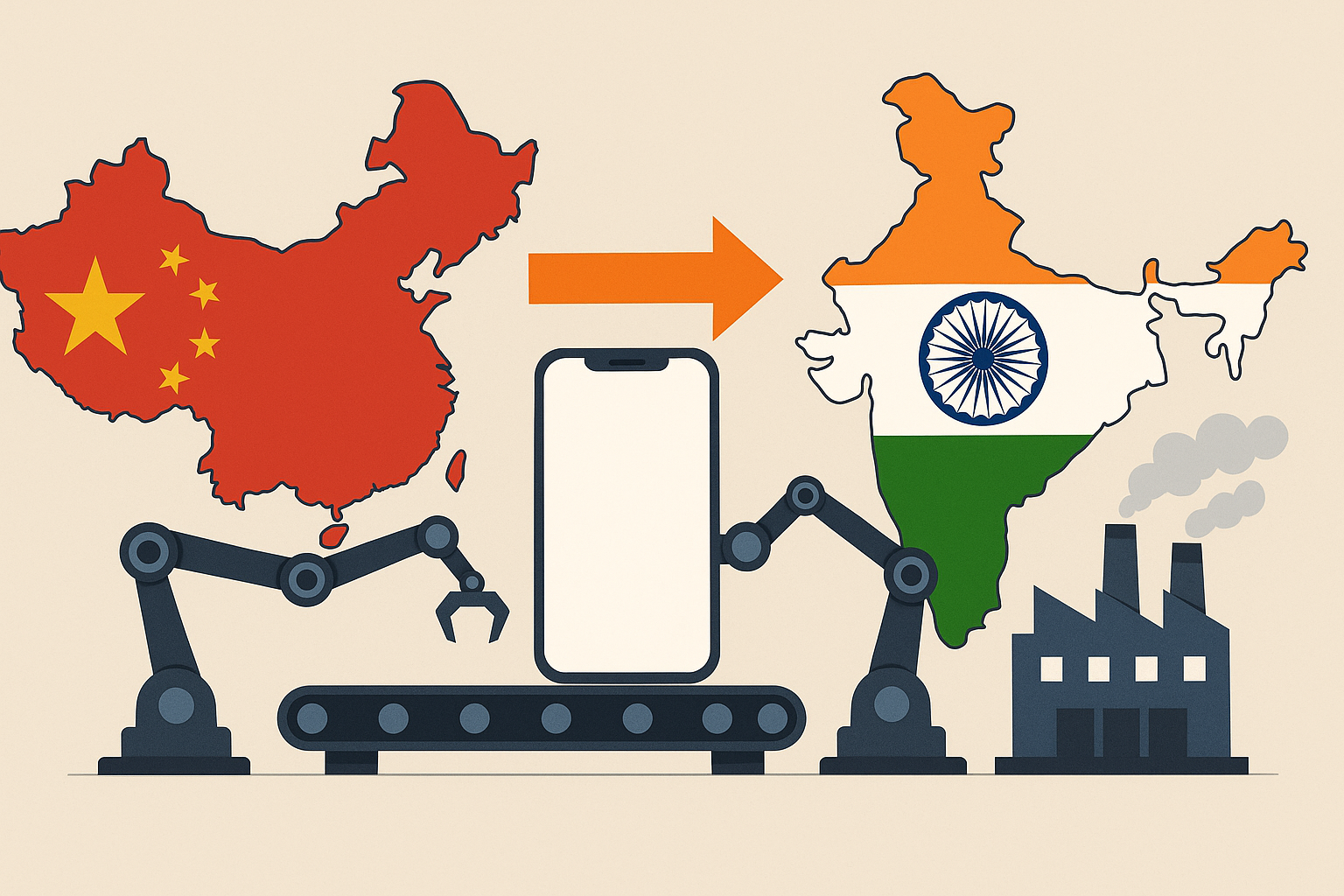

Apple Relocates U.S. iPhone Production to India, Reducing Reliance on China

Apple’s Quiet Pivot Signals Loud Warning to China-Dependent Supply Chains

Apple Inc. (NASDAQ: AAPL), the world’s most valuable tech company, is once again demonstrating its strategic agility—this time by rerouting a critical part of its production pipeline. According to a report by Investopedia, the company is planning to shift assembly of iPhones destined for the U.S. market from China to India in response to rising geopolitical tensions and newly introduced tariffs by the U.S. on Chinese electronics.

This move isn’t just a logistical adjustment—it marks a critical inflection point in global supply chain realignment and presents key implications for investors in the technology, manufacturing, and emerging markets sectors.

Why This Matters for Investors

This isn’t Apple’s first foray into Indian manufacturing, but the significance of the latest shift cannot be overstated. Apple’s pivot to India reflects a broader de-risking strategy from overexposure to China. Amid escalating trade friction, Apple is accelerating its diversification agenda, which began modestly in 2020 but is now gaining strategic urgency.

Apple suppliers such as Foxconn and Pegatron, already operating in India, are expected to play a central role in this transition. According to a 2025 IDC supply chain briefing, over 12% of iPhone production is already being carried out in India—a number expected to double within two years under the new U.S.-bound model.

For investors, this realignment could signal new capital flows into India’s manufacturing ecosystem. It also raises red flags for China-heavy manufacturing portfolios, which may face mounting regulatory and geopolitical risk premiums.

Data-Backed Insights: Tariffs, Production Shifts, and Market Movements

- Tariff Impact: In early April 2025, the U.S. Trade Representative (USTR) announced a new round of import tariffs on Chinese-made electronics, including a 15% duty on smartphones, set to take effect in Q3. The aim: to reduce reliance on Chinese goods in critical technology sectors.

- Cost Dynamics: According to Morgan Stanley’s April 2025 Asian Tech Report, manufacturing an iPhone in India may be up to 12% more expensive in the short term than in China due to nascent infrastructure and higher logistics costs. However, Apple is willing to absorb short-term costs to hedge against long-term geopolitical volatility.

- Market Reaction: Apple shares rose 1.8% intraday following the news, suggesting investor approval of the de-risking strategy. Indian electronics suppliers like Dixon Technologies (NSE: DIXON) and Bharat FIH have also seen upticks, hinting at broader market enthusiasm for India’s growing tech manufacturing role.

Future Trends to Watch

- Supply Chain Decoupling: Apple’s move could set a precedent for other tech giants like Microsoft, Google, and Samsung. Look for increased capital expenditure in India and Southeast Asia, particularly in Vietnam, Malaysia, and Thailand.

- India’s Rise in Tech Manufacturing: The Indian government’s Production Linked Incentive (PLI) scheme is already attracting hardware giants. Expect a surge in FDI in India’s electronics sector, with smartphone and semiconductor segments leading the charge.

- ESG and Risk Management: With investors increasingly considering ESG and geopolitical risk in valuation models, companies that diversify their manufacturing footprint stand to earn premiums in risk-adjusted performance metrics.

Key Investment Insight

Apple’s strategic shift is more than a logistics move—it’s a macro signal. The transition underscores how geopolitical risk, trade policy, and supply chain resilience are now essential variables in tech investing. Investors should closely monitor U.S.-listed companies with deep China exposure and consider rebalancing toward firms capitalizing on India’s manufacturing ascent.

Watchlist Suggestions:

- Apple Inc. (AAPL) – Positive long-term manufacturing hedge.

- Foxconn Technology Co. (TPE: 2317) – Key beneficiary of Indian expansion.

- Dixon Technologies (NSE: DIXON) – India-based EMS firm positioned for growth.

- TSMC (NYSE: TSM) – Strategic partner likely to follow diversification trends.

From a Single Move to a Global Shift

Apple’s decision is a microcosm of a broader, secular transformation in global supply chains. As the tech world recalibrates, investors should be alert to emerging winners in non-China manufacturing hubs and reassess risk across portfolios deeply embedded in old supply chain models.

Stay ahead of the curve with MoneyNews.Today—your go-to source for intelligent, actionable investor news. Subscribe now for daily briefings that keep you in the know.