As global semiconductor supply chains remain under intense pressure, Canada has taken a decisive step to strengthen its domestic chip manufacturing capabilities. The Canadian government recently announced a significant investment of up to C$210 million in semiconductor packaging and commercialization, as part of a broader C$662 million project centered at IBM Canada’s Bromont facility and the C2MI microelectronics research centre in Quebec.

Why This Matters for Investors

The semiconductor industry is foundational to modern technology — powering everything from smartphones and data centers to AI and advanced computing. Canada’s renewed focus on building out packaging and R&D capabilities within its borders is a strategic move to carve out a more competitive position in a sector currently dominated by major players like Taiwan, South Korea, and the U.S.

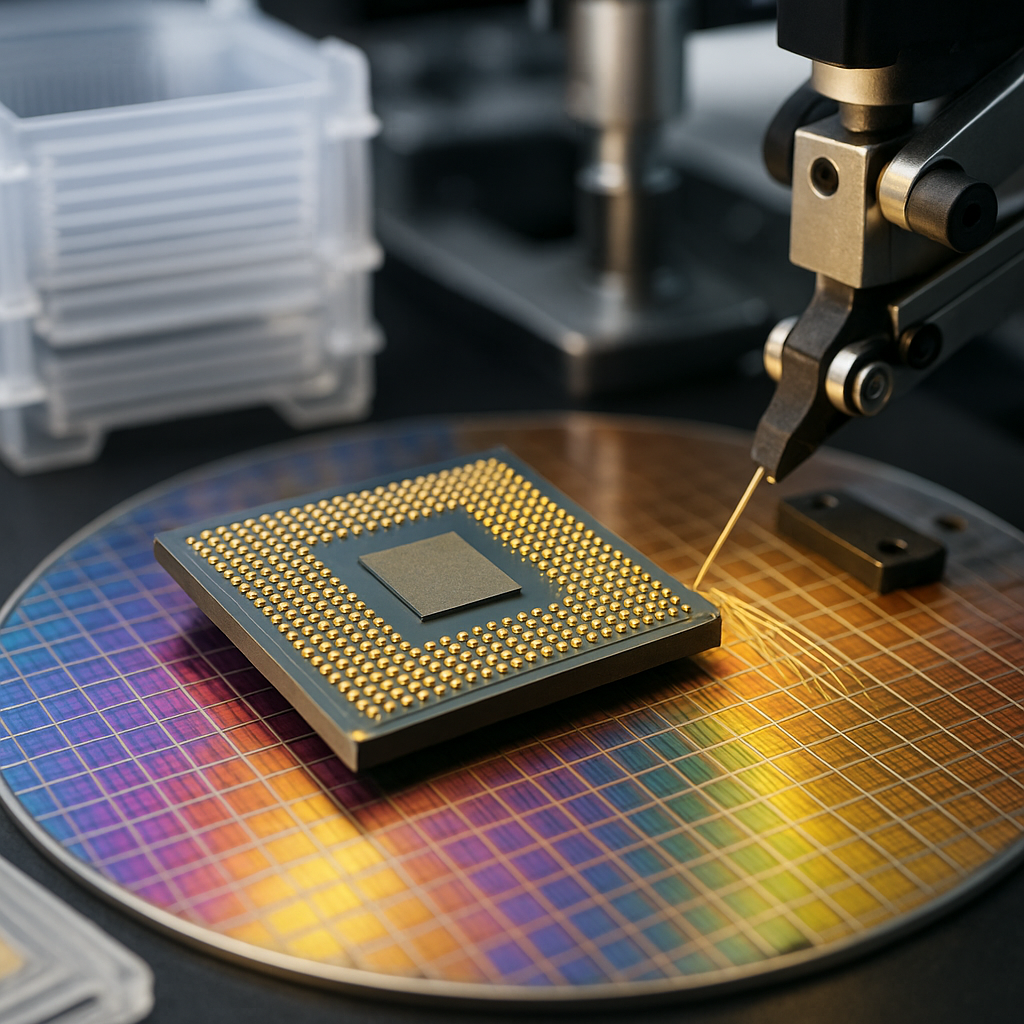

This investment is particularly important because packaging — the final stage of semiconductor manufacturing — plays a critical role in chip performance, power efficiency, and integration into end products. Expanding domestic expertise here strengthens the entire Canadian semiconductor ecosystem.

From an investment perspective, this signals the start of a potential long-term growth cycle for Canadian semiconductor-linked companies, not only for the major firms like IBM Canada but also for the broader supply chain. This includes manufacturers of packaging materials, semiconductor equipment suppliers, and specialized service providers supporting chip fabrication and assembly.

Canada’s Strategic Push in Semiconductor Manufacturing

This project forms part of the Canadian Semiconductor Strategy, aimed at reducing dependency on foreign chip manufacturing by nurturing homegrown capabilities. The CAD 210 million government commitment is matched by partners IBM Canada and C2MI, bringing total project funding to CAD 662 million. This kind of public-private collaboration is essential in a capital-intensive industry like semiconductors.

The Bromont facility is focused on advanced packaging and testing, while the C2MI centre provides cutting-edge microelectronics research and prototyping. Together, they aim to deliver innovations in next-generation chip packaging for AI processors, high-performance computing, and quantum computing components.

According to government statements, this initiative is expected to:

- Increase production capacity and scale for Canadian chip packaging.

- Accelerate commercialization of new semiconductor technologies.

- Enhance Canada’s role in the global semiconductor value chain.

What Investors Should Watch

Over the next 6 to 12 months, investors should monitor several key indicators to assess the project’s momentum and its impact on the market:

- Production Capacity Expansion: Announcements from IBM Canada and C2MI regarding new wafer packaging lines, increased throughput, and technological milestones.

- Commercialization Milestones: Updates on export-ready semiconductor products emerging from the facility that could attract international partnerships or licensing deals.

- Supply Chain Ripple Effects: Growth opportunities for Canadian suppliers in semiconductor materials, advanced packaging solutions, and related infrastructure companies servicing chip manufacturers.

- Government and Industry Collaboration: Additional funding rounds, policy initiatives, or incentives aimed at bolstering the semiconductor ecosystem domestically.

Broader Implications for the Semiconductor Sector

This Canadian initiative reflects a larger global trend: governments worldwide are recognizing the strategic importance of semiconductor sovereignty amid geopolitical tensions and supply disruptions. The U.S., Europe, South Korea, and Japan are all funneling resources into semiconductor manufacturing, with a special emphasis on advanced packaging and R&D.

For investors, this translates into sector bifurcation — those companies with exposure to next-generation packaging technology and local manufacturing incentives could outperform peers reliant on traditional offshore supply chains.

Key Investment Insight

Canadian investors with exposure to semiconductor supply chain equities should consider positioning for a potential multi-year growth cycle driven by increased domestic production, innovation, and government support. This includes:

- Large technology firms expanding packaging and R&D.

- Mid-cap and small-cap suppliers providing essential materials and equipment.

- Infrastructure and logistics firms servicing new manufacturing hubs.

Diversification within the semiconductor ecosystem, including both hardware manufacturing and upstream service providers, may mitigate risks related to the sector’s capital intensity and geopolitical uncertainties.

Stay tuned to MoneyNews.Today for ongoing updates and deep dives into this evolving sector. Our commitment is to deliver timely, data-driven insights that help investors navigate emerging growth opportunities in technology and beyond.