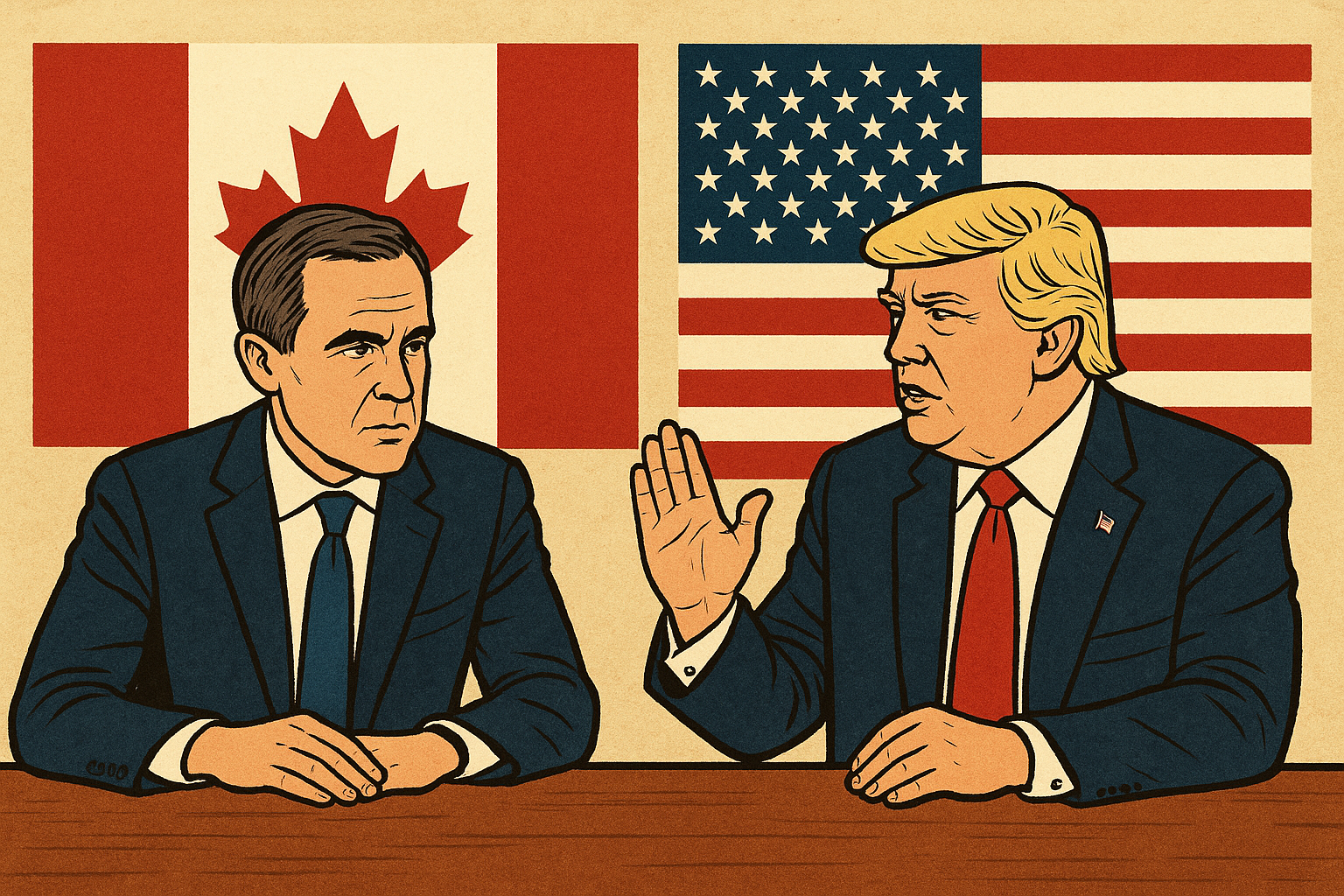

Canadian Prime Minister Mark Carney visited the White House for his second meeting with President Donald Trump in five months, focusing on tariffs affecting Canadian steel, autos, and aluminum exports, according to Reuters and AP News. The meeting comes amid mounting pressure on both sides to resolve bilateral trade grievances ahead of the upcoming USMCA review, highlighting the ongoing tension in North American trade relations.

For investors, these developments are particularly relevant as cross-border supply chains, commodity flows, and sector performance can be significantly affected by tariffs, retaliatory measures, or negotiated relief.

Why This Matters for Investors

The U.S. remains Canada’s largest trading partner, and tariffs on steel, autos, and aluminum can materially impact Canadian industrial and manufacturing sectors:

- Automotive Industry: Tariffs could affect major manufacturers like Magna International (TSX: MG) and auto parts suppliers, influencing earnings and stock performance.

- Metals and Mining: Steel and aluminum producers are sensitive to export restrictions; volatility in these sectors may ripple into broader commodity markets.

- Currency Fluctuations: Trade uncertainty often drives shifts in the Canadian dollar, impacting multinational companies and export competitiveness.

Analysts from BMO Capital Markets highlight that investor focus should remain on tariff resolution timelines and potential USMCA amendments, as outcomes will likely dictate near-term market sentiment.

Core Analysis: Political Risk Meets Market Impact

Carney’s visit underscores how political negotiations are intertwined with economic performance. Investors should note:

- Strategic Negotiation Window: With the USMCA review approaching, both Canada and the U.S. face pressure to demonstrate progress, which could lead to short-term market swings.

- Sector-Specific Exposure: Heavy reliance on cross-border exports means that metals, automotive, and industrial companies may see heightened volatility depending on trade outcomes.

- Investor Sentiment: Markets react not only to actual policy changes but also to rhetoric and signaling from high-profile meetings like this.

According to Reuters, Carney pressed the Trump administration for tariff relief on key exports, emphasizing economic stability and North American competitiveness. Market strategists note that even tentative agreements or talks can influence TSX performance, corporate earnings projections, and risk appetite for equities tied to trade-sensitive industries.

Future Trends to Watch

- USMCA Review Outcomes: Investors should monitor negotiations closely; tariff reversals or adjustments could boost earnings for Canadian exporters.

- Commodity Price Sensitivity: Metals prices may respond to shifts in export flows, affecting both equities and ETFs focused on the sector.

- Currency Risk Management: A stronger U.S. dollar relative to the Canadian dollar could amplify trade impacts, influencing portfolio allocation strategies.

- Broader North American Trade Policy: Any precedents set during this negotiation may influence Mexico and other partners, shaping long-term investment opportunities across the continent.

Key Investment Insight

The ongoing Canada-U.S. trade dialogue highlights a policy-driven risk environment that can have tangible effects on investor portfolios. Strategic points for investors include:

- Assessing Sector Exposure: Focus on metals, automotive, and industrial stocks with high U.S. export dependency.

- Diversifying Geographically: Mitigate trade-specific risks by allocating across sectors or markets less sensitive to U.S.-Canada relations.

- Tracking Regulatory Signals: Regulatory announcements, interim trade agreements, or tariff adjustments can trigger market moves — staying informed is critical.

Investors who navigate policy risk with a keen eye on timing and sector impact are positioned to capitalize on opportunities while minimizing downside exposure.

Trade negotiations between Canada and the U.S. are more than political theater; they directly shape market dynamics, corporate earnings, and investor confidence across North America. Monitoring developments and understanding sector-specific sensitivities will be crucial for informed decision-making.

Stay connected with MoneyNews.Today for timely updates and expert insights on trade policy, market trends, and investment opportunities.