A new wave of geopolitical tension is brewing in Myanmar’s Shan State, where the United Wa State Army (UWSA), a militia supported by China, has secured control of vital rare earth mining operations. This move has far-reaching implications for the global supply chain of these critical materials, which are essential for the production of electric vehicles (EVs), renewable energy technologies, and high-tech electronics. With China already holding a dominant position in the global rare earths market, this development raises significant concerns for investors in industries that rely on these materials.

Why This Matters for Investors:

Rare earth metals are crucial to the modern economy, serving as a backbone for industries that power the green energy transition, such as EV manufacturing, wind turbines, and solar power. As nations seek to reduce their reliance on fossil fuels and move toward sustainable energy, the demand for these materials is expected to soar. In particular, the electric vehicle sector has become one of the largest consumers of rare earth elements, with automakers increasingly sourcing materials like lithium, cobalt, and neodymium for their batteries and motors.

With the UWSA’s new control over rare earth mining operations in Myanmar, the supply of these critical materials is at risk of being heavily influenced by political and military developments. This has raised red flags for investors who rely on a stable and secure supply of rare earths. The implications are twofold: investors must assess both the potential risks to supply chains and the opportunities that may arise from diversifying into alternative sources of rare earths.

Geopolitical Implications:

The United Wa State Army’s involvement in Myanmar’s rare earth mining industry underscores the rising geopolitical risks tied to the rare earth supply chain. While China has long been the dominant player in rare earth production, Myanmar has also become a key contributor to the global supply, particularly with its rich deposits of rare earth elements. China’s influence over the UWSA has allowed Beijing to secure mining rights in Myanmar, effectively consolidating its grip over the global supply chain.

Given the importance of rare earths in emerging technologies, this consolidation of power has significant strategic value for China. For global investors, this raises several concerns:

- Supply Chain Vulnerabilities: Any disruption in the supply of rare earths from Myanmar could lead to shortages, driving up prices and creating instability in industries that depend on these materials. Companies involved in the production of EVs and renewable energy technologies are particularly vulnerable to such disruptions.

- Market Concentration: China’s increased control over Myanmar’s rare earth resources may exacerbate the existing concentration in the global market. As more nations seek to secure access to these materials, the political dynamics surrounding rare earth mining will play an increasingly significant role in market pricing and availability.

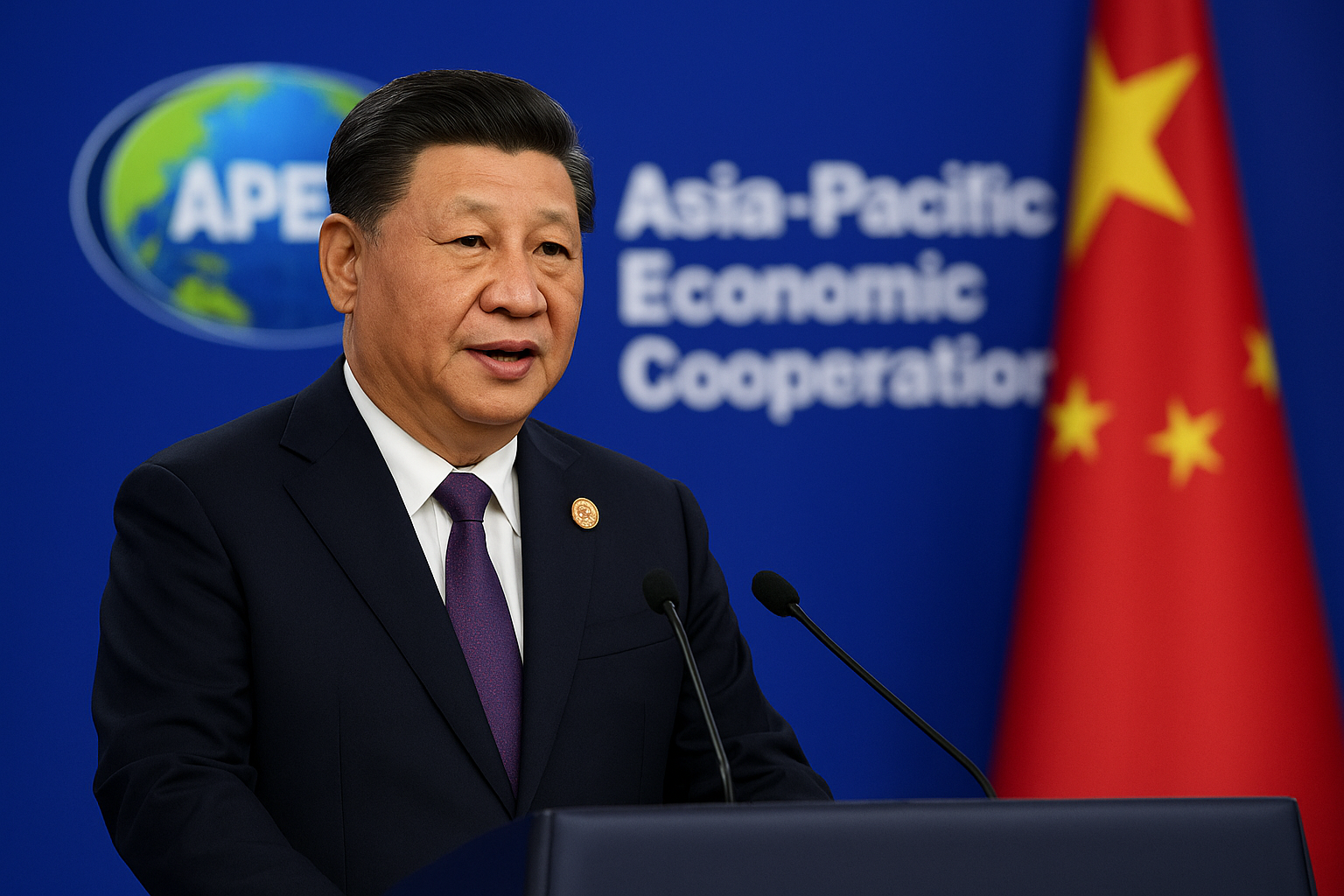

The Role of China in the Global Rare Earth Market:

China’s long-standing dominance in the rare earth market is no secret. The country produces around 60% of the world’s rare earths, a position that has enabled it to exert significant influence over global pricing and distribution. The latest development in Myanmar solidifies China’s near-monopoly in this sector, potentially allowing the country to control a significant portion of the world’s rare earth supplies.

While this may be seen as a strategic advantage for China, it also poses challenges for global companies and governments trying to reduce their reliance on Chinese resources. Several nations, including the United States, Japan, and the European Union, have been actively seeking to diversify their rare earth supply chains. However, Myanmar’s growing significance in the market complicates these efforts.

Investment Risks and Opportunities:

As rare earths continue to gain in importance, investors must carefully consider their exposure to companies in industries reliant on these materials. The recent geopolitical shift in Myanmar introduces new uncertainties, but it also presents opportunities for those looking to hedge against potential supply disruptions.

Opportunities to Watch:

- Diversification of Supply Sources: Companies that can secure rare earth supplies from outside China and Myanmar may offer attractive investment opportunities. Nations like Australia, Canada, and Brazil are becoming increasingly important players in the rare earth market, and companies operating in these regions could benefit from rising demand.

- Rare Earth Recycling: As demand for rare earths grows, so too does the need for sustainable practices. Investors should consider companies that focus on the recycling and reuse of rare earth materials. These companies could benefit from rising environmental concerns and regulatory changes aimed at reducing mining activities.

- EV and Renewable Energy Stocks: Companies involved in the production of electric vehicles, batteries, and renewable energy infrastructure will remain at the forefront of rare earth demand. Investing in these sectors may provide opportunities for growth as the world transitions to greener technologies.

Key Takeaways for Investors:

The latest developments in Myanmar underscore the volatility of global rare earth supply chains and the geopolitical risks that accompany them. Investors should be cautious when relying on suppliers from high-risk regions and consider diversifying their portfolios to include companies with more secure and diversified supply chains. In addition, rare earth recycling and investments in alternative supply sources are areas that could present strong opportunities in the long term.

With China-backed militias securing control of Myanmar’s rare earth mines, the future of the global supply chain for these essential materials has entered a new phase of uncertainty. As investors navigate these turbulent waters, staying informed on geopolitical developments and diversifying into alternative supply sources will be key to mitigating risks and capturing growth opportunities. For more updates on critical sectors like metals and mining, make sure to stay tuned to MoneyNews.Today for your daily dose of actionable investment insights.