January 2025 has been a monumental month for EMP Metals Corp. (CSE: EMPS) (OTCQB: EMPPF), as the company unveiled a series of developments that underscore its growing prominence in the lithium exploration sector. With the demand for lithium soaring amid the global energy transition, these advancements position EMP Metals as a key player in the race to supply critical resources for electric vehicles (EVs) and renewable energy storage.

Below, we delve into the highlights of the company’s announcements and what they mean for investors.

Horizontal Flow Testing Program Achieves Breakthrough Results

On January 16, 2025, EMP Metals reported the successful completion of a horizontal flow testing program at one of its flagship projects. This testing yielded an average lithium concentration of 241 milligrams per liter (mg/L), coupled with exceptional flow rates of 418 cubic meters per day. These metrics not only confirm the viability of the company’s resource base but also indicate the potential for commercial scalability.

The horizontal flow testing program represents a critical milestone for EMP Metals. The combination of high lithium concentrations and strong flow rates is pivotal in determining the economic feasibility of lithium production. According to the company’s technical team, these results compare favorably with some of the top lithium brine projects globally.

From an investor’s perspective, the success of this program demonstrates the technical expertise of EMP Metals and its ability to de-risk its projects. The data provides a strong foundation for the company to advance to the next stages of development, including detailed engineering and potential partnerships with battery manufacturers or EV companies seeking secure lithium supplies.

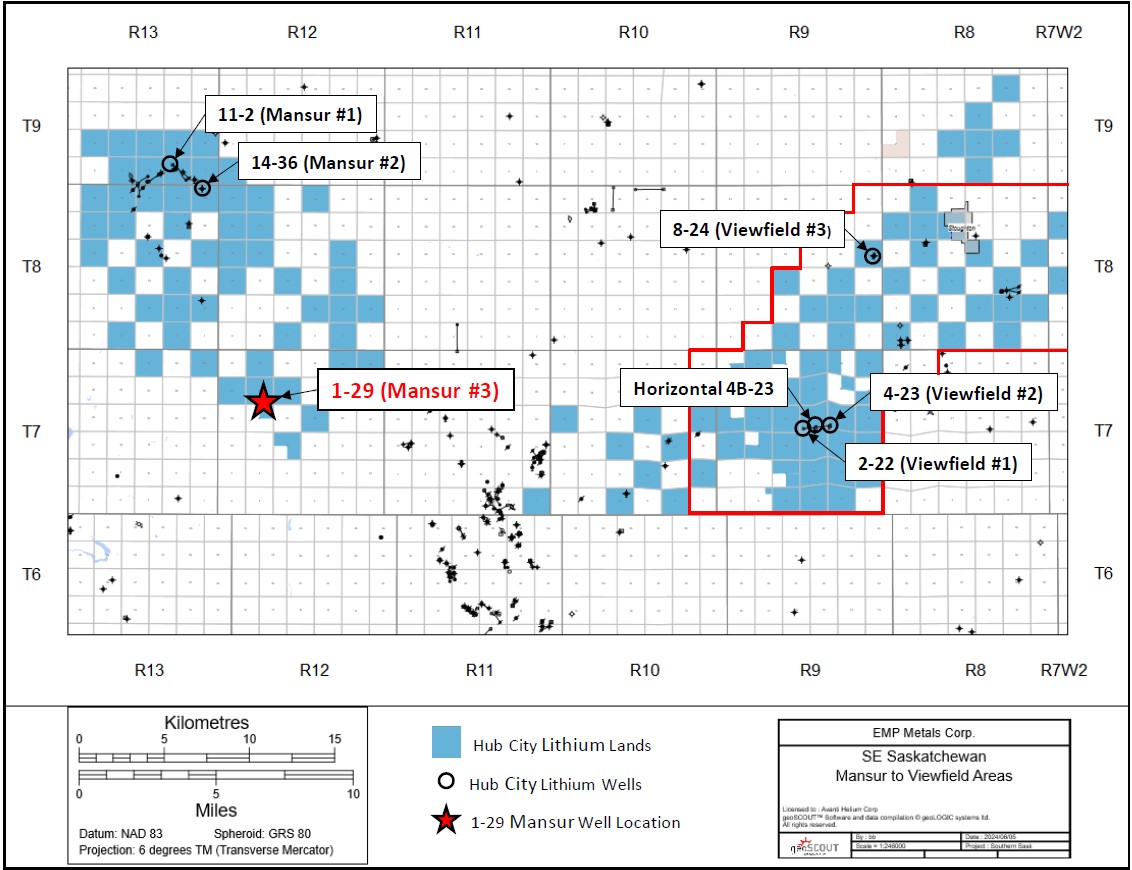

Mansur 3 Test Well Confirms New Project Area

On January 23, 2025, EMP Metals announced another significant breakthrough. The Mansur 3 test well, located within the company’s growing portfolio of assets, returned lithium concentrations of up to 217 mg/L. While slightly lower than the results from the horizontal flow testing program, these findings are no less impactful. The test well has led to the establishment of a new project area, highlighting the potential for further resource expansion.

The Mansur 3 results reaffirm the scalability of EMP Metals’ exploration efforts. With this new project area, the company has effectively extended its operational footprint, positioning itself for future growth. As global demand for lithium continues to rise, having multiple high-quality project areas enhances the company’s ability to attract investment and secure long-term supply agreements.

For investors, the Mansur 3 announcement highlights the importance of diversification within EMP Metals’ portfolio. By identifying and developing multiple resource-rich areas, the company reduces its reliance on any single asset, mitigating risk and enhancing its overall value proposition.

Strategic Implications for the Lithium Market

The lithium market is at a critical juncture, with demand expected to triple over the next decade. The rapid adoption of EVs is driving this surge, the expansion of renewable energy projects, and the development of advanced battery technologies. However, meeting this demand requires significant investment in exploration and production.

EMP Metals is uniquely positioned to capitalize on this opportunity. The company’s recent announcements demonstrate its ability to not only discover high-quality lithium resources but also advance them toward commercial production. By achieving strong flow rates and competitive lithium concentrations, EMP Metals is laying the groundwork to become a reliable supplier in a market characterized by growing supply chain concerns.

Moreover, the company’s emphasis on sustainable production methods aligns with the increasing focus on environmental, social, and governance (ESG) criteria among investors. As regulatory pressures mount and consumer demand for ethically sourced materials grows, EMP Metals’ commitment to responsible exploration and production practices could serve as a competitive advantage.

What Does This Mean for Investors?

For those considering an investment in EMP Metals, the January announcements offer several key takeaways:

- De-risked Projects: The successful horizontal flow testing program and Mansur 3 test well results reduce the geological and technical risks associated with EMP Metals’ projects. These milestones provide investors with greater confidence in the company’s ability to advance its assets.

- Scalability: With the establishment of a new project area and strong results from existing assets, EMP Metals is demonstrating its capacity to scale operations. This is crucial as the company seeks to meet the growing demand for lithium.

- Market Positioning: EMP Metals is emerging as a serious contender in the lithium market. Its ability to deliver competitive results positions it to attract strategic partners and potential acquirers in the future.

- Upside Potential: The lithium market’s rapid growth trajectory presents significant upside potential for companies like EMP Metals. As the company continues to deliver positive results, its valuation could see substantial appreciation.

Next Steps for EMP Metals

With January’s successes in the books, EMP Metals is well-positioned to build on its momentum. The company’s immediate priorities include:

- Advancing Resource Estimates: Building on the results of the horizontal flow testing program and Mansur 3 test well, EMP Metals is expected to update its resource estimates. These updates will provide a clearer picture of the company’s resource base and its economic potential.

- Securing Partnerships: Given the strong results, EMP Metals is likely to attract interest from strategic partners, including battery manufacturers, EV companies, and resource-focused investment funds.

- Exploration and Expansion: With a new project area established, the company will likely ramp up exploration activities to identify additional resources and further expand its portfolio.

A Compelling Investment Opportunity

EMP Metals’ January 2025 announcements mark a turning point for the company. By delivering strong technical results and expanding its project portfolio, EMP Metals is proving its ability to execute on its strategic vision. For investors, this represents a unique opportunity to gain exposure to the rapidly growing lithium market through a company that is poised for long-term success.

As the global energy transition accelerates, companies like EMP Metals will play a crucial role in shaping the future of energy. For those looking to invest in the clean energy revolution, EMP Metals is a story worth watching.

Sources:

Stay tuned to MoneyNews.Today for more updates on EMP Metals and other key players in the lithium market. As always, our goal is to keep investors informed about the trends and developments shaping the future of the global economy.

Disclaimer: This article is for informational and entertainment purposes only and does not constitute financial advice. Please conduct your own research or consult with a financial advisor before making investment decisions.