– Ethereum transactions worth over $16 million linked to Tornado Cash have fueled speculation about Richard Heart’s involvement or a potential breach

– Heart reportedly shifted more than $600 million in ETH to Tornado Cash after major 2024 acquisitions, according to on-chain data

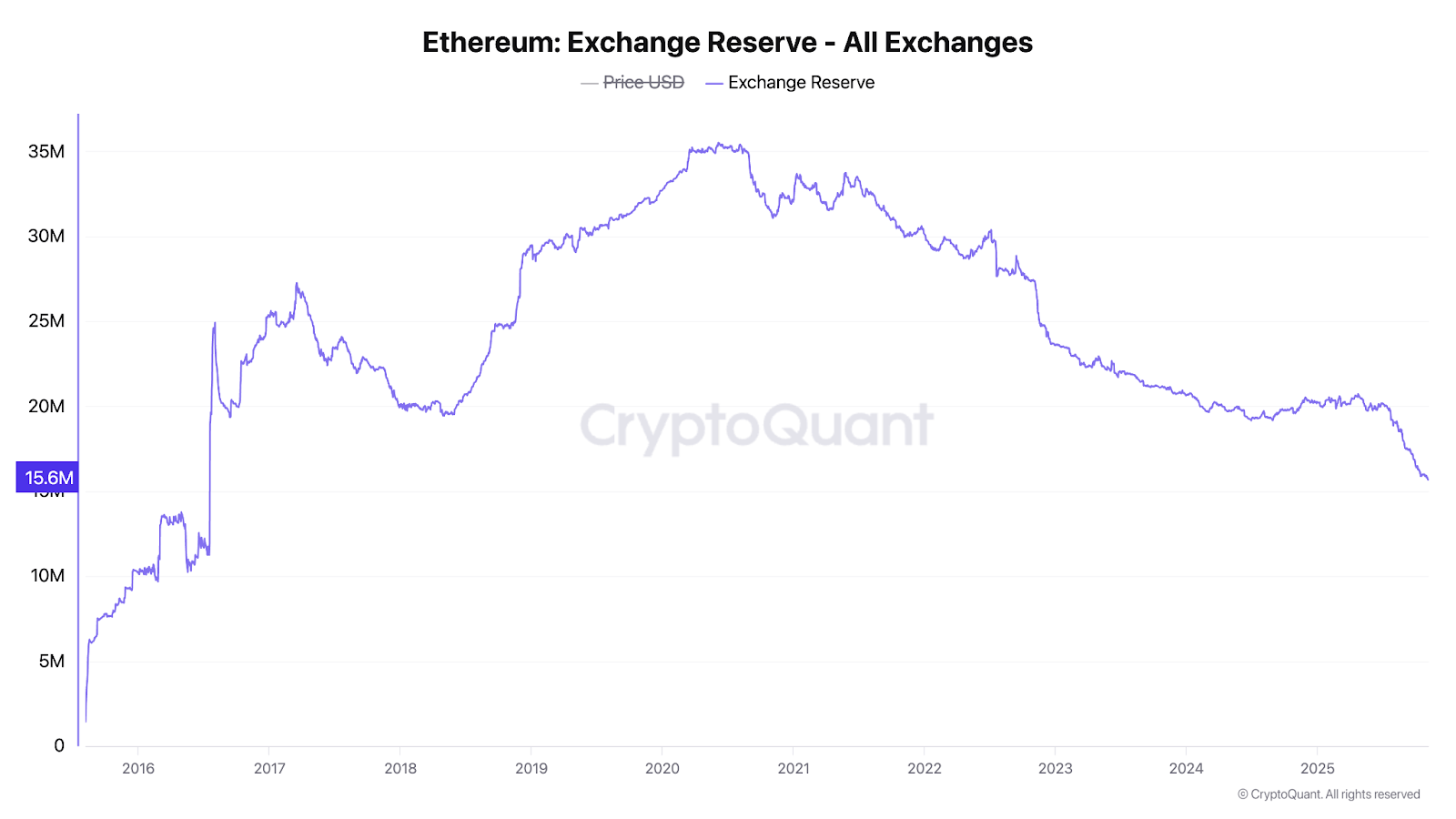

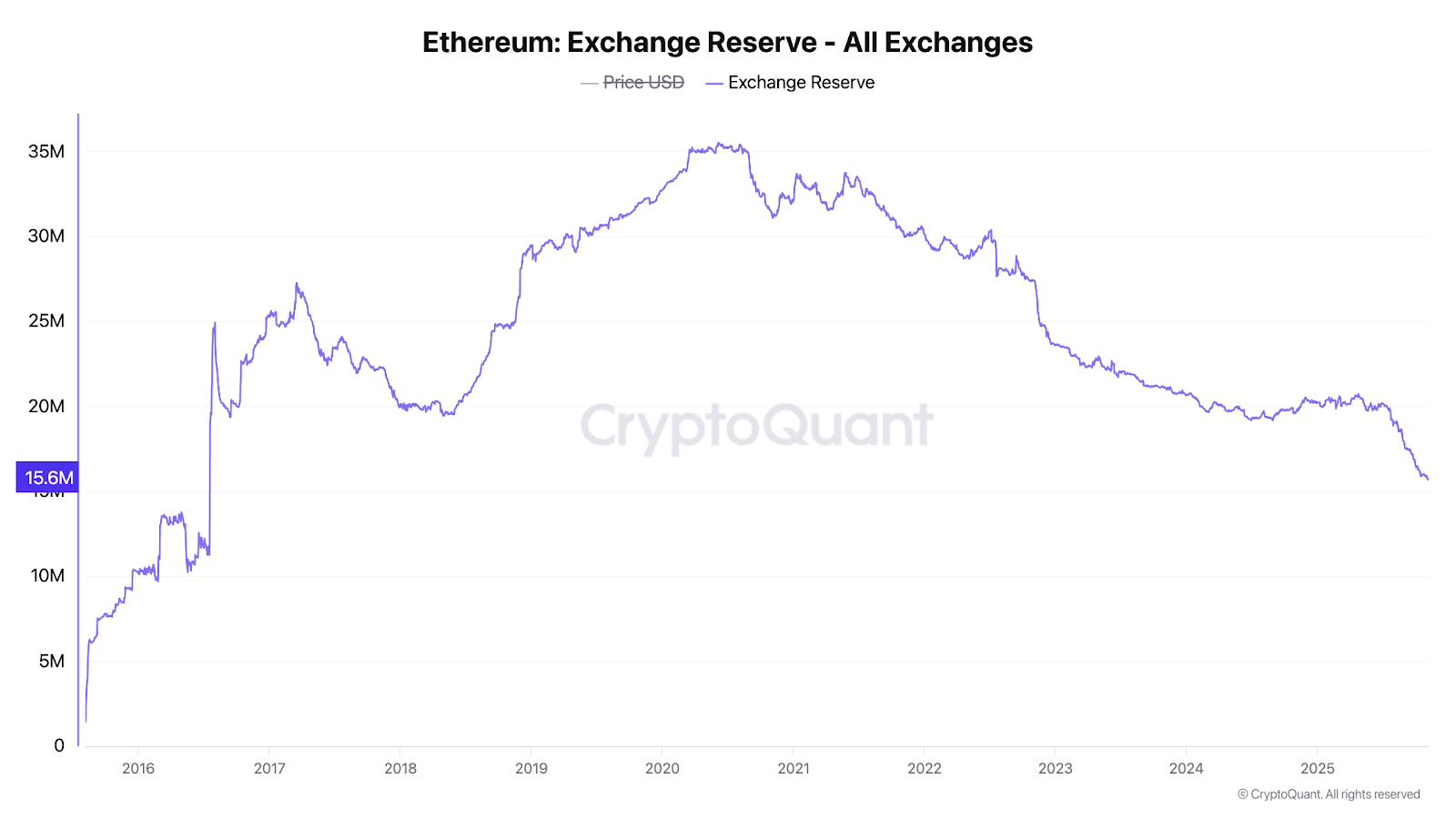

– ETH sentiment improved as exchange reserves hit multi-year lows

Large Ethereum (CRYPTO:$ETH) transfers connected to Tornado Cash have reignited speculation about the identity behind the transactions, with on-chain data linking several movements to wallets previously associated with Richard Heart, the founder of HEX, PulseChain, and PulseX.

Major ETH Outflows Spur Market Debate

According to on-chain tracker Lookonchain, three newly created wallets collectively withdrew 4,920 ETH worth approximately $16.25 million from Tornado Cash before liquidating at around $3,302 per token. The timing of these sales has prompted questions about whether Heart himself or potentially hackers executed the transfers.

Recent blockchain records reveal that Heart had deposited large amounts of Ethereum into Tornado Cash in several waves over recent weeks. On November 5, he moved 112,978 ETH, roughly $366.4 million, to the mixer within just eight hours.

Before that, on October 26, he deposited 25,000 ETH, worth $102 million, following another transfer of 10,990 ETH, valued at $42.6 million, to a new wallet on October 23. Four days earlier, on October 20, he reportedly transferred 153,241 ETH, equivalent to $608 million, across multiple addresses.

These cumulative deposits trace back to Heart’s earlier purchases between March 4 and March 8, 2024, when he acquired 162,937 ETH, worth approximately $619 million, across 25 wallets at an average cost of roughly $3,800 per coin. Over the past six months, he is also believed to have sent 9,500 ETH, equivalent to $37.43 million, into Tornado Cash.

Ethereum Supply on Exchanges Hits Eight-Year Low

Beyond the individual movements, network data highlights a broader market shift. Analytics firm CryptoQuant reported that Ethereum exchange reserves have fallen to their lowest level since 2016.

Historically, such declines indicate that investors are moving assets off exchanges and into private custody or long-term storage. The reduced supply available for trading typically eases selling pressure, supporting potential price stability or upward momentum.

Technical Setup Points to Stabilization

Ethereum is currently trading at $3,357, marking a 2.4% decline in the past 24 hours but showing signs of short-term stabilization. On the daily chart, ETH sits near $3,360.94, up 1.43% intraday, attempting to recover from its sharp retreat between $3,800 and $4,000. Buyers have defended the $3,274.60 level, indicating a temporary floor. However, bulls need to reclaim $3,500–$3,600 to reestablish upward momentum.

Momentum indicators show mixed signals. The Relative Strength Index (RSI) at 34.76 suggests weak momentum but is edging toward oversold conditions, while the MACD histogram is narrowing to –54.26, which implies fading bearish pressure.

A possible bullish crossover could emerge if buying volume strengthens over the coming sessions. Market analyst Michael van de Poppe observed that Ethereum’s price “has dipped slightly below expectations but now sits in a key accumulation zone.”