The Race to Lithium Supply

With demand for lithium projected to soar in the coming years, companies that can fast-track production will have a competitive edge. EMP Metals (CSE: EMPS, OTCQB: EMPPF) is in a prime position to transition from exploration to production faster than many of its competitors. The company has already completed extensive exploration work and is now focused on building a demonstration plant—a critical step toward commercial lithium production.

Extensive Exploration Work Completed

Unlike many lithium playerss still in early-stage exploration, EMP Metals has already done the hard work. The company’s exploration and development milestones include:

- Multiple test wells drilled, confirming lithium concentrations of up to 259 mg/L.

- Inferred resource estimate of 1.2 million tonnes of lithium carbonate equivalent (LCE) across its Saskatchewan assets.

- Viewfield PEA outlining the estimated production of battery quality LCE over a 23-year period, which represents an estimated pre-tax internal rate of return (IRR) of 55% and a pre-tax net present value (NPV) of US$1.49 billion, at an 8% discount rate.

- Successful pilot testing of Direct Lithium Extraction (DLE) technology, proving its ability to efficiently recover lithium from its high-quality brines.

These milestones help to de-risk the project and provide EMP with a clear path to production, putting it ahead of many other lithium exploration companies.

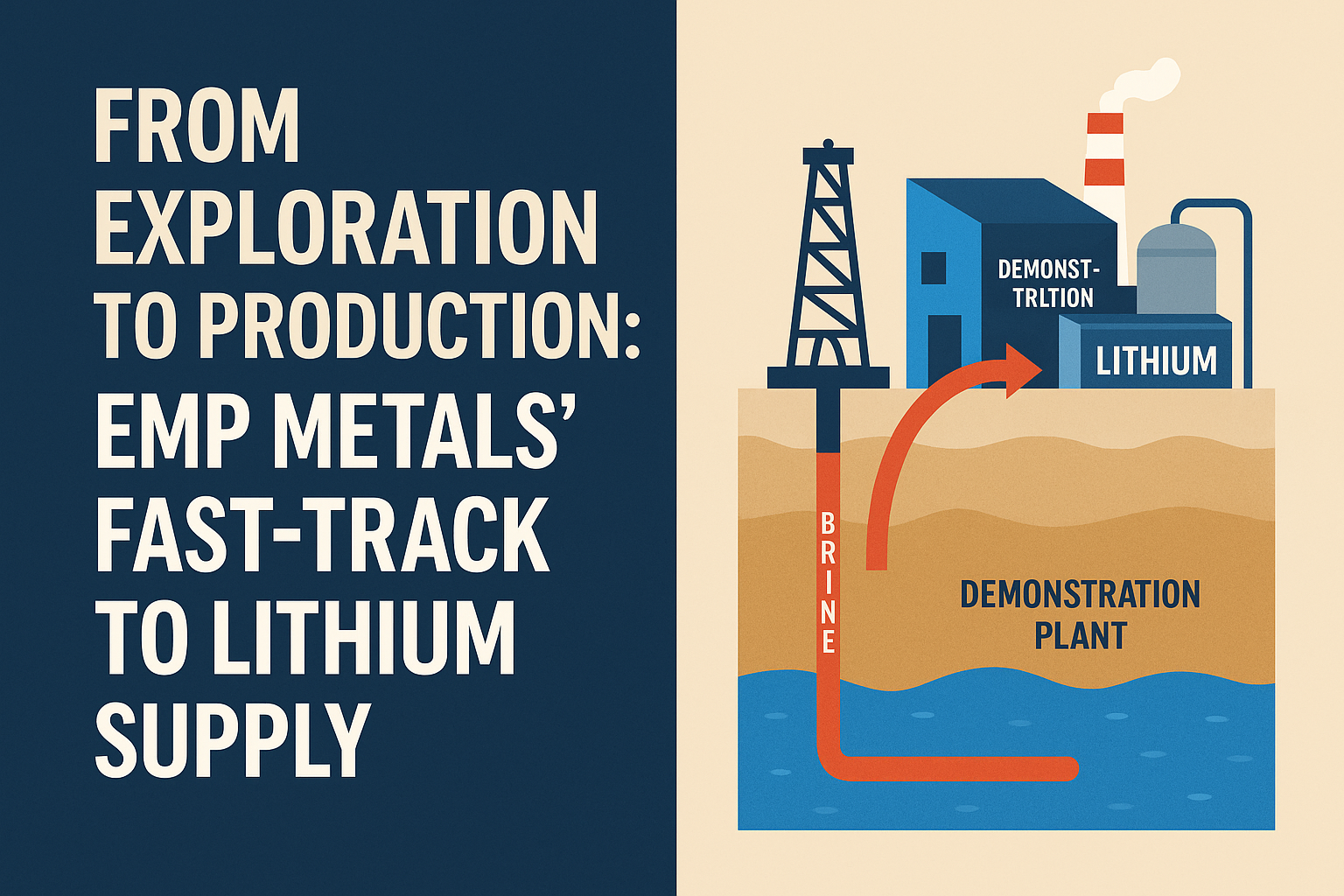

The Approximately US$10M Demonstration Plant: A Pivotal Step

EMP Metals’ next major step is the construction of approximately $10-15 million demonstration plant, aimed at proving the commercial viability of its lithium extraction process. This facility will:

- Process lithium-rich brine using advanced DLE technology.

- Validate operational efficiency before scaling up to full commercial production.

- Help to attract additional strategic investors and industry partners, further strengthening the company’s financial position.

With institutional investors like Tembo Capital already supporting the company, EMP’s ability to fund the demonstration plant is enhanced, paving the way for demonstrating commercial production.Path to Commercial Production

Once the demonstration plant is operational and results confirm economic feasibility, EMP Metals will be in a position to scale up lithium supply. The path to commercialization includes:

- Demonstration Plant Construction (2025-2026): approximately US$10 million investment to validate extraction processes.

- Commercial Plant Planning (2026): Front-end engineering and design (FEED) study to outline full-scale production plans.

- Project Financing and Partnerships (2026): Securing additional investment to fund commercial operations.

- Full-Scale Lithium Production (2027+): Potentially bringing the first commercial lithium brine operation in Saskatchewan online.

What This Means for Investors

For investors looking at near-term lithium producers, EMP Metals presents a compelling case:

- High-grade lithium resource already confirmed.

- Lower production costs thanks to a clean, shallow brine resource.

- Proven DLE technology, enabling fast, efficient lithium extraction.

- Institutional and strategic investor backing, reducing financial risk.

- Clear timeline to potential commercial production, positioning EMP as an emerging lithium leader in North America.

The Takeaway: EMP Metals Is Ready for the Lithium Boom

While many lithium players are still years away from production, EMP Metals is on the fast track. With exploration completed, DLE technology tested, and a demonstration plant in the works, EMP is well-positioned to supply lithium just as global demand surges.For investors seeking exposure to high-grade, low-cost lithium with a clear pathway to production, EMP Metals is a top-tier opportunity in the Canadian lithium sector.

Disclaimer: This article is for informational and entertainment purposes only and does not constitute financial advice. Please conduct your own research or consult with a financial advisor before making investment decisions.