In an exclusive interview with MiningFeeds, Mark Jarvis, CEO of Giga Metals (TSXV:GIGA), shared insights into the company’s ambitious plans to develop the Turnagain Nickel Project in north-central British Columbia. As one of the world’s largest undeveloped sulphide nickel deposits, Turnagain holds immense potential to meet the growing demand for critical minerals driven by the electric vehicle and renewable energy sectors.

“Giga Metals Corporation is a junior mining company focused on developing its Turnagain Nickel Project in north-central British Columbia on the traditional territory of the Tahltan and the Kaska Dena, about 65 kilometres east of the community of Dease Lake and 400 kilometres by highway from the Port of Stewart,” stated Mark Jarvis

The Turnagain Project, held in Hard Creek Nickel, a subsidiary owned 85% by Giga Metals Corporation and 15% by Mitsubishi Corporation, recently released a positive Pre-Feasibility Study (PFS) in October 2023. The company has emphasized the project’s scale, mine life, mineralogy, and product as key factors setting it apart from other nickel cobalt deposits worldwide.

“The Turnagain Project PFS models an annual output of 37,288 t/y Nickel and Cobalt with a projected mine life of 30 years based on 950 million tonnes of reserves,” Jarvis explained. “These reserves are a subset of 1.5 billion tonnes of measured and indicated resources and 1.1 billion tonnes of inferred resources which leaves room for a longer mine life with further development.”

The project’s low strip ratio of 0.4 tonnes waste/1 tonne ore contributes to its positive economics and reduces the amount of waste to be managed. The deposit is much younger and therefore has less alteration products compared to other “similar” nickel deposits, resulting in higher recoveries and a simpler processing flow sheet.

“Ninety nine percent of the recoverable nickel and cobalt are contained in the mineral pentlandite. That, combined with very low levels of alteration products such as talc and clay, means that the recovery flow sheet is shorter and simpler than peer projects,” Jarvis stated. “A shorter, simpler flow sheet equates to lower technical risk and faster project ramp-up.”

Giga Metals has set an ambitious goal to develop the world’s first carbon-neutral nickel mine:

“The current design of the Turnagain Project uses a few strategies to achieve carbon neutrality including the use of a hydroelectric power, and electric equipment such as shovels and drills and an electric trolley-assisted haul fleet that significantly reduces fuel consumption,” said Jarvis. “Not included in the PFS are a fully electrified mine haul fleet and sequestration of carbon dioxide through mineral carbonation. Electric mining fleets are currently in the testing stage, and the company expects that these fleets will be commercially available by the time the Turnagain Project is in production. Carbon mineralization directly from the air into the tailings has been proven through a number of test programs with world-leading experts and the opportunity for carbon sequestration is considered in the tailings management facility design, but it is premature to specify exactly how much carbon will be sequestered in a real-world functioning tailings management facility.”

The company’s partnership with Mitsubishi Corporation will be instrumental in advancing the Turnagain project to the Bankable Feasibility Level. The company has consistently emphasized the importance of this partnership and how it supports Giga Metals’ growth strategy.

“Mitsubishi Corporation is an incredibly supportive partner and Giga Metals values the relationship,” Mark Jarvis stated. “Mitsubishi Corp. is very committed to getting this mine built and is actively connecting us with various potential strategic partners. Mitsubishi Corp. is known for their due diligence and their endorsement in the project has given us a high level of credibility with other companies.”

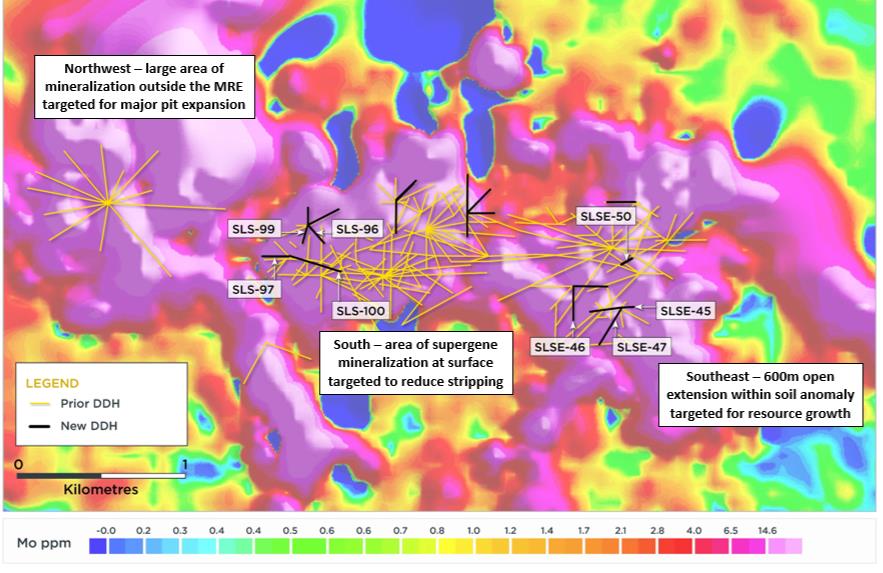

Source: Giga Metals Corporation

Giga Metals is actively exploring additional strategic partnerships to further advance their projects and tap into new opportunities in the nickel and cobalt market.

“The most recent report from Macquarie Commodities Strategy states that there is an 838,000 t/y of increased nickel demand forecasted for battery applications by 2030,” CEO Mark Jarvis noted. “This means that 24 large new nickel projects need to be built in the next six years to meet this demand. Given Turnagain’s modeled supply of 35,000 tons/year of Nickel and 2,000 tons/year of Cobalt and long mine life, the company is well positioned to meet the growing demand of these critical minerals.”

Lyle Davis, the newly appointed Chair of the Giga Metals Board, brings extensive experience in corporate finance and corporate governance of public companies.

Martin Vydra, Giga’s President, is an engineer with extensive experience in managing operating nickel mines and refineries and in marketing nickel and cobalt products to end users. He is leading Giga’s process for engaging new large partners to help develop the project.

Lyle Trytten, the company’s Manager of Development, is a recognized expert in extractive metallurgy and is called upon by governments and international agencies to help them understand technical aspects of the nickel supply chain, from the mine site to the battery cathode.

“We have a small but immensely competent team,” said Mr. Jarvis.

Giga Metals places great importance on investor engagement and transparent communication. Jarvis discussed the company’s participation in virtual investor conferences, bi-annual ‘townhall’ styled Question and Answer sessions, social media posts, monthly email newsletters, and attendance at conferences and roadshows. Additionally, Lyle Trytten participates in panels and events to discuss technical aspects of the nickel market and educate the public.

“We believe transparent communication with our community is important because development takes time, and we hope that our investors’ patience will be richly rewarded,” Jarvis stated.

When asked what sets Giga Metals apart as a compelling investment opportunity, Jarvis emphasized the uniqueness of the Turnagain Project as one of the few 100% nickel sulphide projects of its kind in the world. Despite the current low nickel prices, Giga Metals remains undervalued in the stock market, presenting a unique opportunity for investors.

“Giga Metals represents highly leveraged exposure to the nickel market, particularly right now with prices so low,” Jarvis concluded. “Our goal is to work tirelessly to unlock the inherent value of the project for our shareholders.”

As Giga Metals continues to advance the Turnagain Nickel Project and explore strategic partnerships, the company is well-positioned to contribute to the growing demand for responsibly sourced nickel and cobalt in the rapidly evolving electric vehicle and renewable energy sectors and will be watched closely by investors for news on its flagship project and more in its project portfolio.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

I specialize in the mining industry, focusing on top global mining stocks. My reporting covers the latest industry news, company/project developments, and profiles of key players. With a degree in finance and economics from the University of Toronto, I’ve contributed to a wide range of industry publications. Beyond my professional pursuits, I have a keen interest in global business and a love for travel.

Comments are closed.