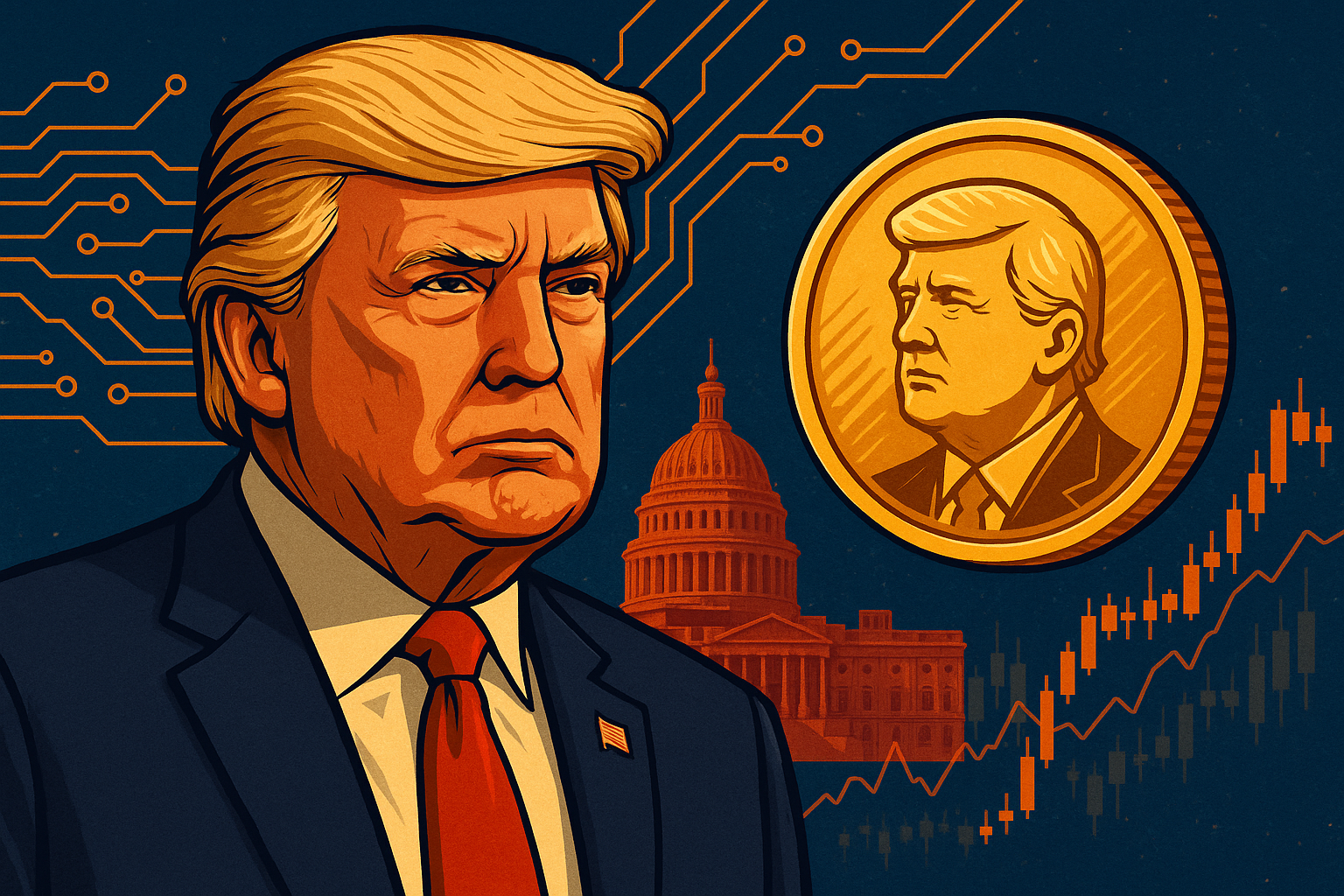

Political Drama Meets Digital Finance

In a political twist with serious implications for investors in the cryptocurrency space, a top House Democrat has launched an investigation into a private dinner hosted by former President Donald Trump, allegedly attended by prominent investors in his meme coin venture. The probe is raising concerns over ethics, regulatory boundaries, and the increasingly blurred lines between political influence and digital finance.

According to The Washington Post and Yahoo Finance, the dinner reportedly served as an exclusive meeting between Trump and backers of a meme-based cryptocurrency associated with his campaign. With cryptocurrency regulation still in a gray area, the event has triggered a flurry of legal and political scrutiny—especially regarding potential financial conflicts of interest and campaign finance violations.

Why This Matters for Investors

This story is more than political theater—it signals a growing convergence between cryptocurrency and mainstream politics. The scrutiny around Trump’s meme coin dinner may serve as a bellwether for broader regulatory attention toward digital assets, particularly those endorsed or promoted by public figures.

The U.S. Securities and Exchange Commission (SEC) and other regulatory bodies have already stepped up enforcement actions in the crypto sector. However, the intertwining of political figures and meme coins introduces new legal complexities. As a result, investors should anticipate potential policy shifts, especially around crypto-related political fundraising, transparency, and investor protections.

A Look at the Regulatory Landscape

While crypto regulations in the U.S. remain largely fragmented, the increased involvement of politicians may accelerate legislative clarity. Lawmakers on both sides of the aisle have introduced various bills concerning the classification of cryptocurrencies, consumer protections, and tax guidelines.

According to The Motley Fool, regulatory momentum could significantly impact market valuations, especially for smaller, speculative tokens. Meme coins—often driven by social media buzz rather than fundamentals—are particularly vulnerable to changes in sentiment and legality.

The House probe could reignite debates around disclosure laws, financial ethics for public officials, and how meme coins are promoted to the public. For investors, this represents a cautionary moment: regulatory tightening could mean substantial volatility for politically associated digital assets.

What’s Driving Meme Coin Popularity?

Despite the risks, meme coins continue to captivate retail investors, especially Gen Z and Millennial traders. The allure lies in their low entry price, viral appeal, and the hope of achieving Dogecoin-like returns. Trump’s coin—riding on his public persona and political momentum—capitalizes on this dynamic.

However, as Bloomberg notes, these assets often lack intrinsic value and are heavily influenced by market hype and celebrity backing. In such an environment, any sign of government action or reputational risk can cause dramatic price swings.

Key Investment Insight

Investors should monitor developments in crypto regulation—especially those stemming from high-profile investigations like this one. While meme coins offer high-risk/high-reward potential, the fallout from political or legal scrutiny can be swift and severe. Diversification, due diligence, and awareness of regulatory risk are essential.

Consider exposure to more established cryptocurrencies or regulated crypto ETFs, and stay attuned to the evolving policy landscape, particularly during election cycles when digital assets are increasingly politicized.

Stay Ahead with MoneyNews.Today

As crypto, politics, and regulation continue to intertwine, smart investors will need to separate market noise from actionable insight. Follow MoneyNews.Today for in-depth analysis, verified news, and daily updates on the financial forces shaping tomorrow’s markets.