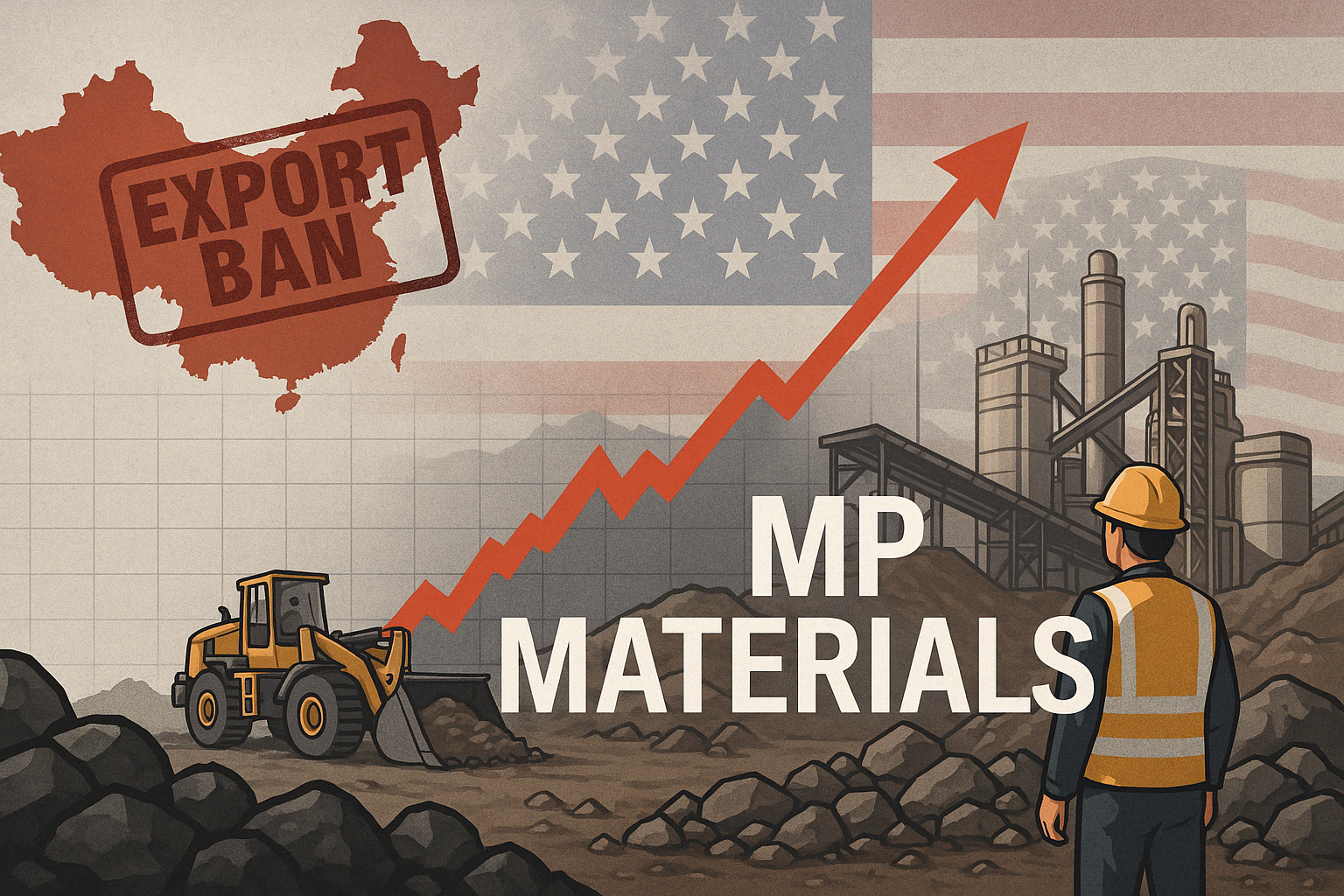

In a move that has shaken global supply chains and reignited geopolitical tensions, China has announced new restrictions on rare earth metal exports, sending shockwaves through the electric vehicle (EV), defense, and consumer electronics industries. As the world’s dominant supplier of these critical minerals, China’s decision has put the spotlight on U.S.-based MP Materials (NYSE: MP), whose stock surged nearly 22% following the news. For investors, this marks a pivotal moment in the global transition toward secure, domestic sources of rare earth elements—a market long vulnerable to external control.

Why This Matters for Investors

Rare earth metals—such as neodymium, praseodymium, and dysprosium—are essential components in EV motors, wind turbines, and advanced defense systems. China currently controls over 70% of global rare earth processing capacity, a dominance that has frequently raised alarms in Washington and other Western capitals.

The latest move by Beijing tightens export licensing requirements for key rare earth products under the guise of protecting national security and environmental standards. However, analysts interpret the policy shift as a strategic response to escalating U.S.-China tech tensions and ongoing trade disputes. As a result, U.S. companies like MP Materials, which owns and operates the Mountain Pass mine in California, stand to benefit from renewed interest in domestic supply chains.

According to Barron’s, the sudden policy change has already triggered a spike in rare earth prices, with neodymium-praseodymium oxide jumping more than 10% in the past week alone. MP Materials, which supplies rare earth materials used in Tesla and General Motors EVs, is now ramping up its refining and magnet production capabilities, aiming to create a vertically integrated supply chain independent of Chinese processors.

Future Trends to Watch

The U.S. government has also shown increasing willingness to fund and incentivize domestic rare earth projects. In 2024, the Department of Defense awarded over $60 million in grants to U.S. firms—including MP Materials—to bolster domestic rare earth production.

“This is not just about economics—it’s a matter of national security,” said Byron Callan, defense analyst at Capital Alpha Partners, in a recent CNBC interview. “The U.S. cannot afford to be reliant on China for critical inputs to its defense systems and advanced technology base.”

Investors should also monitor legislative developments. A bipartisan bill introduced in the U.S. Senate earlier this year aims to establish a strategic rare earth reserve and fast-track environmental approvals for domestic mining operations. If passed, the legislation could act as a significant catalyst for U.S.-based rare earth miners.

Key Investment Insight

MP Materials is uniquely positioned to benefit from the convergence of national policy, technological demand, and geopolitical friction. As global manufacturers look to de-risk their supply chains, the demand for North American rare earth production will likely rise.

While the stock has already seen a sharp uptick, analysts at Morgan Stanley and Jefferies suggest there’s room for further upside, particularly if the company successfully scales its refining operations in Texas, which are expected to go online later this year.

Actionable Takeaways for Investors:

- Monitor domestic rare earth producers like MP Materials, Lynas Rare Earths (via U.S. joint ventures), and Energy Fuels Inc.

- Watch for U.S. legislative moves supporting critical mineral independence.

- Keep an eye on rare earth price movements, which are highly sensitive to policy developments in China.

- Evaluate the long-term potential of rare earth-dependent sectors such as EVs, clean energy, and defense technologies.

As tensions escalate between the world’s two largest economies, the rare earth supply chain is rapidly becoming a strategic focal point for both investors and policymakers. For those seeking exposure to a market poised for long-term structural growth, MP Materials and its peers present compelling opportunities. Stay tuned to MoneyNews.Today for the latest developments in geopolitics, commodities, and investment trends shaping tomorrow’s markets.