A Game-Changing Merger That Could Redefine AI’s Role in Hardware

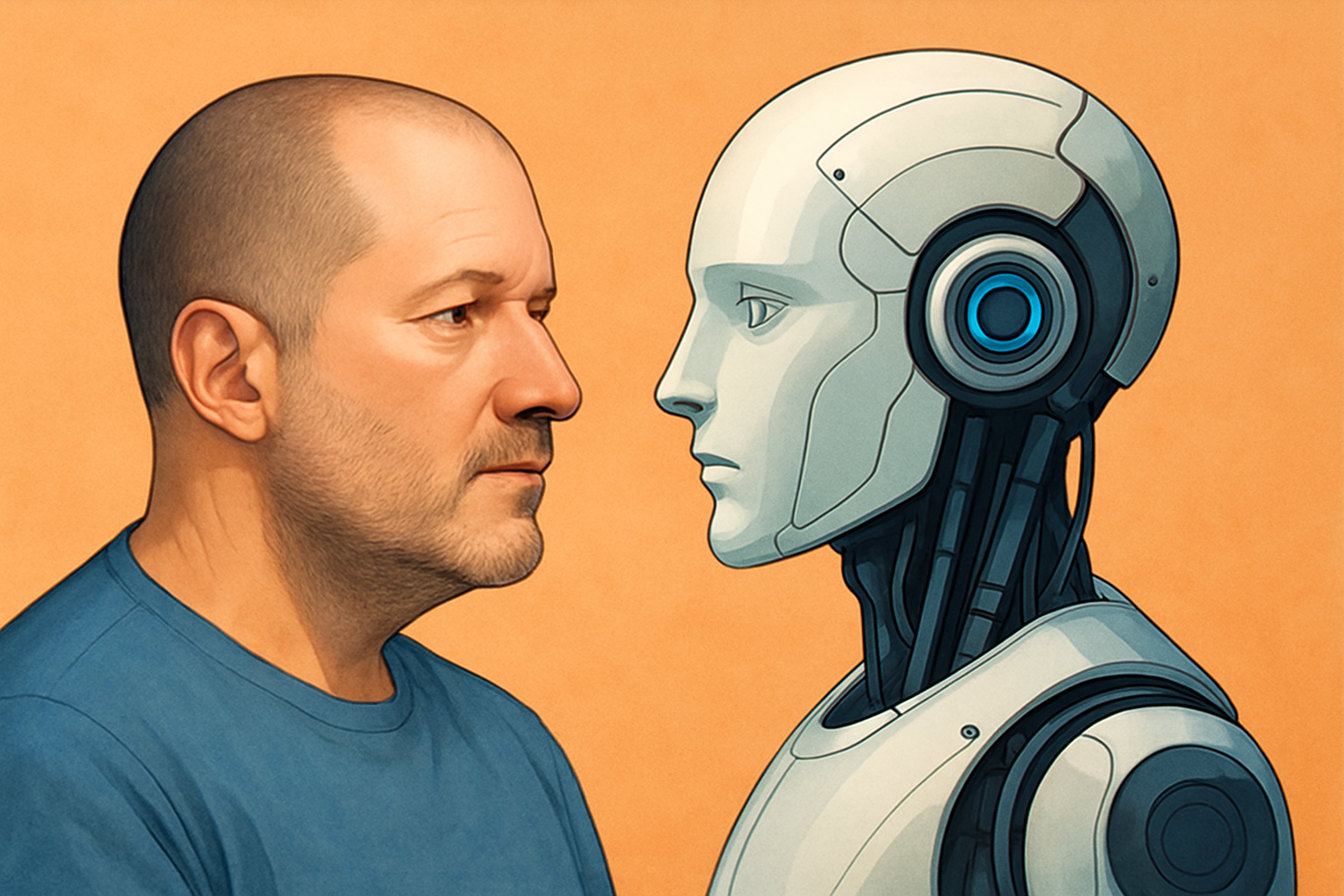

In a bold move that signals the next chapter of artificial intelligence innovation, OpenAI has acquired the AI hardware startup launched by legendary Apple designer Jony Ive for a staggering $6.5 billion. This deal marks OpenAI’s largest acquisition to date and serves as a powerful signal of its ambition to expand far beyond the digital confines of software and APIs into the tangible, interactive world of consumer and enterprise hardware.

As AI’s capabilities grow exponentially, the demand for more intuitive, human-centric interfaces is surging. By bringing Ive’s design vision under its umbrella, OpenAI is betting on a future where hardware becomes the new frontier for AI deployment—blending function, form, and intelligence.

Why This Matters for Investors

The AI sector has witnessed meteoric growth over the past 24 months, with OpenAI standing at the epicenter. From powering enterprise solutions to integrating with tools like Microsoft’s Copilot and ChatGPT Enterprise, OpenAI has dominated the AI-as-a-service space. However, this latest move suggests a strategic pivot—from service to ecosystem.

By acquiring Ive’s firm, OpenAI positions itself to compete directly with Apple, Google, and Amazon in the realm of AI-integrated hardware—potentially developing everything from smart devices and wearables to AI-native computing systems.

In a saturated software market, where APIs are commoditizing, hardware may offer OpenAI new defensible moats. Think Apple’s ecosystem logic—but with AI-first tools built from the ground up.

“This is not just about owning the stack—it’s about redefining the stack,” noted Daniel Ives, Managing Director at Wedbush Securities. “OpenAI is moving toward creating its own universe of intelligent tools, starting with the physical interface.”

What We Know About the Deal

According to Wikipedia, which cited multiple verified sources, the $6.5 billion acquisition includes all IP, design teams, and pending patents from Ive’s AI startup. While still in stealth mode, the startup is believed to have been developing an AI-integrated personal device that could redefine how users interact with intelligent systems—freeing them from screen-bound experiences.

The merger comes at a time when AI-human interface design is considered one of the hottest frontiers in tech. It follows recent announcements from companies like Humane (AI Pin) and Rabbit, which have also explored new ways to bring AI into real-world interactions.

Future Trends to Watch

- AI Hardware Race: Expect increased activity from tech giants like Apple, Google, and Meta, who may respond with hardware-embedded AI initiatives. Investors should track patents, R&D spending, and hiring trends in AI + design labs.

- Vertical Integration: Similar to Tesla’s approach in automotive AI, OpenAI is moving toward vertical integration—controlling both the software and hardware stack. This could lead to stronger unit economics and deeper customer loyalty.

- Design-Driven Disruption: With Jony Ive’s team onboard, expect design-led differentiation—where devices not only perform better but feel intuitive and aspirational. This approach could disrupt incumbents relying on legacy hardware aesthetics.

- AI Ecosystem Wars: OpenAI’s hardware could serve as a central hub for its entire ecosystem—from voice interfaces to cloud compute. Investors should look for signals of OpenAI launching a proprietary operating system or chip architecture.

Key Investment Insight

This acquisition signals a strategic shift that could unlock multi-billion-dollar opportunities in AI-native hardware. Investors should monitor companies positioned at the intersection of AI and device design—including suppliers of edge computing chips, AI sensors, and interface technology.

Public market exposure is limited since OpenAI remains private, but stakeholders in its ecosystem—like Microsoft (MSFT) and chipmakers such as Nvidia (NVDA) and AMD (AMD)—stand to benefit. Private equity and venture investors should pay attention to emerging players in AI-interface hardware.

Is This AI’s “iPhone Moment”?

With Jony Ive’s track record of creating cultural-defining products and OpenAI’s dominance in AI capabilities, this acquisition could pave the way for a groundbreaking device that finally makes AI “invisible”—seamlessly integrated into our lives.

As the AI landscape shifts from digital to physical, investors should view this as a critical inflection point—one that could usher in a new generation of hardware-centric AI innovation.

Stay informed with MoneyNews.Today—your trusted source for daily market-moving stories, emerging tech insights, and actionable investment news.