Power Metals (TSXV:PWM) has reported findings from its recent drilling at the Case Lake Project (CLP) in northeastern Ontario. In the first round of drillhole assays from the summer 2024 program, the company uncovered substantial high-grade cesium deposits. The first three drill holes revealed cesium oxide (Cs2O) mineralization at levels as high as 22.58%. Following these results, Power Metals plans to begin an additional 2,500 meters of drilling to explore the area further once all assay results are in.

Haydn Daxter, Power Metals CEO commented in a press release: “The Phase II drilling program has been very successful for the Company with continued results displaying high-grade cesium in pollucite evident from the first three drill holes. We are also very pleased to commence our planning for Phase III drilling next month on the back of Phase II and the increased level of interest in cesium. Whilst exploration has been ongoing, we look forward to updates on the metallurgical test work later this year from Tomra and SGS, along with continued support from the Ontario Government.”

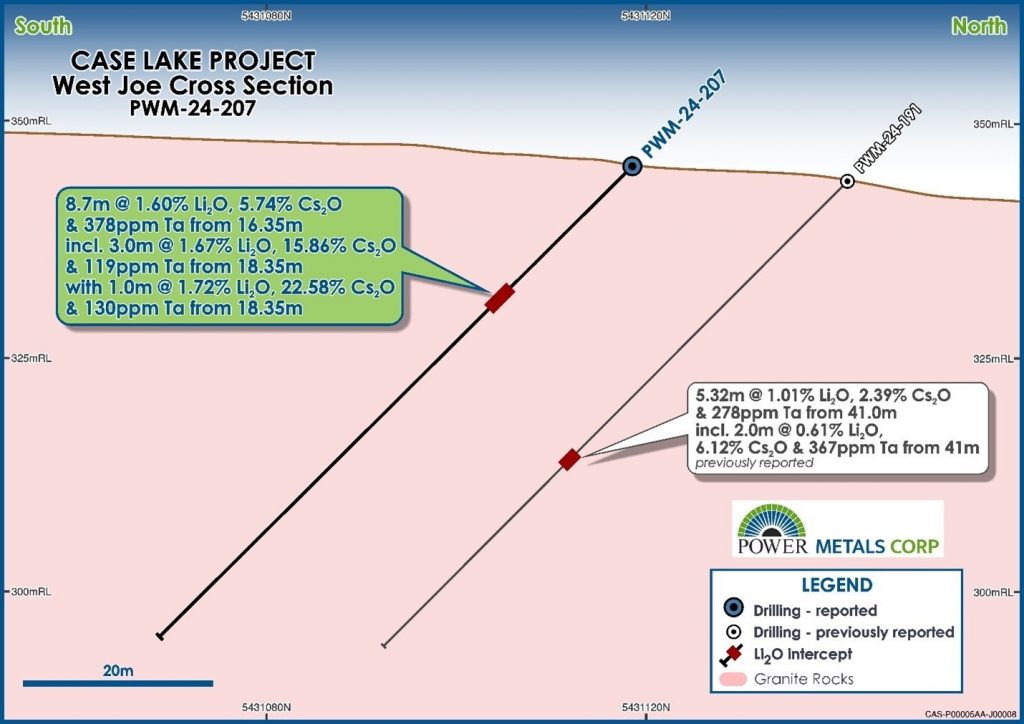

The 2024 Phase II drilling program at the CLP aimed to expand on known cesium deposits, particularly targeting the West Joe and Main Zone areas. The initial findings from drill holes PWM-24-207, PWM-24-208, and PWM-24-209 showed cesium-rich mineralization, with samples from PWM-24-207 reaching individual Cs2O grades of up to 22.58%. The drill core from PWM-24-207 also exhibited high levels of pollucite, a rare cesium mineral, confirming the deposit’s potential. Other samples from these drill holes showed Cs2O grades ranging from 1.35% to 7.51%. In total, Power Metals completed 29 diamond drill holes spanning 2,620 meters during Phase II.

With the Phase II program now complete, Power Metals has announced plans for a Phase III drill program at the CLP. This phase will involve another 2,500 meters of drilling and will start once remaining assay results are available, likely in the coming weeks. The company has cited increased interest from cesium industry specialists as a motivating factor for accelerating the timeline.

In parallel with its exploration activities, Power Metals has applied for additional funding from the Ontario Government. The company already received approval for the Ontario Junior Exploration Program (OJEP) grant and has now applied for the Critical Minerals Innovation Fund (CMIF), which could provide up to $500,000 for projects aimed at strengthening Ontario’s critical mineral sector. The Canadian Government recently updated its Critical Minerals Strategy, with cesium included as one of the prioritized minerals, aligning with Power Metals’ current endeavors at CLP.

Globally, there are only three high-grade cesium resources—Tanco in Manitoba, Bakita in Zimbabwe, and Sinclair in Western Australia—that have been mined to date. Based on technical reviews of these mines, Power Metals believes the Case Lake Project could become the fourth major cesium deposit. The company plans to continue with resource development for the remainder of the year, once all data from the recent drill programs is processed.

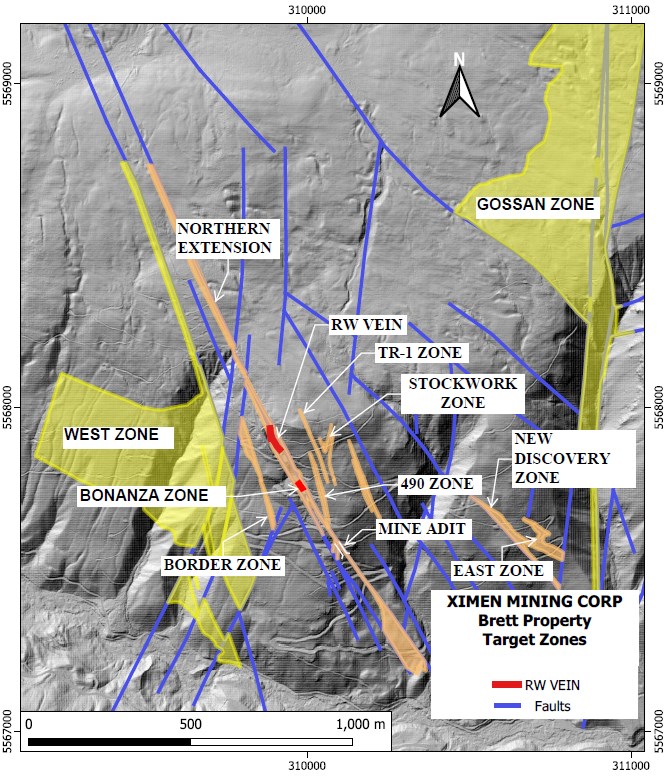

The Case Lake Project is situated 80 kilometers east of Cochrane, near the Ontario-Quebec border. It covers a substantial area, with 585 cell claims across several townships in the Larder Lake Mining Division. The property is known for its pegmatite swarms, which consist of spodumene-bearing lithium-cesium-tantalum (LCT) pegmatites that extend approximately 10 kilometers. Power Metals has undertaken several exploration programs on this site since 2017, drilling over 22,000 meters. A technical report filed in 2017 documents these activities.

In addition to CLP, Power Metals holds interests in other properties with potential LCT pegmatites. The Pelletier Property, located 50 kilometers south of Hearst, northeastern Ontario, comprises 337 mineral claims spanning 7,000 hectares. The property is located within the Porcupine mining division, featuring pegmatitic granites that intrude into metasedimentary and amphibolite rock units near an Archean terrane boundary.

Further east, the Decelles Property covers 669 claims over 38,404 hectares near Val-d’Or and Rouyn-Noranda, about 600 kilometers from Montreal. Power Metals acquired the Decelles Property, along with the nearby Mazerac Property, from Winsome Resources in 2023. This acquisition allowed Winsome Resources to increase its stake in Power Metals to 19.59%. The Decelles Property sits within the Pontiac sub-province and features S-type LCT pegmatites with spodumene and beryl, similar to nearby lithium-rich areas.

Finally, the Mazerac Property, approximately 30 kilometers from Decelles, covers 14,700 hectares of LCT-prospective ground. This property also features S-type pegmatites within the Pontiac Group. Both Decelles and Mazerac are in a region with a strong mining infrastructure, near the established mining centers of Val-d’Or and Rouyn-Noranda.

Highlights from the results are as follows:

PWM-24-207: 8.65 m at 1.60% Li2O, 5.74% Cs₂O and 378 ppm Ta from 16.35m

Including 3.0m @ 1.67 % Li2O, 15.86% Cs₂O and 119 ppm Ta from 18.35m

Including 1.0m @ 1.72 % Li2O, 22.58% Cs₂O and 130 ppm Ta from 18.35m

PWM-24-208: 7.02 m at 1.25% Li2O,1.77% Cs₂O and 355 ppm Ta from 16.38m

Including 3.0m @ 0.77% Li2O, 3.98% Cs₂O and 457 ppm Ta from 19.00m

PWM-24-209: 5.71m at 1.19% Li2O,1.42% Cs₂O and 287 ppm Ta from 20.07m

Including 2.5m @ 1.37 % Li2O, 3.18% Cs₂O and 456 ppm Ta from 22.50m

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

I specialize in the mining industry, focusing on top global mining stocks. My reporting covers the latest industry news, company/project developments, and profiles of key players. Beyond my professional pursuits, I have a keen interest in global business and a love for travel.

Comments are closed.