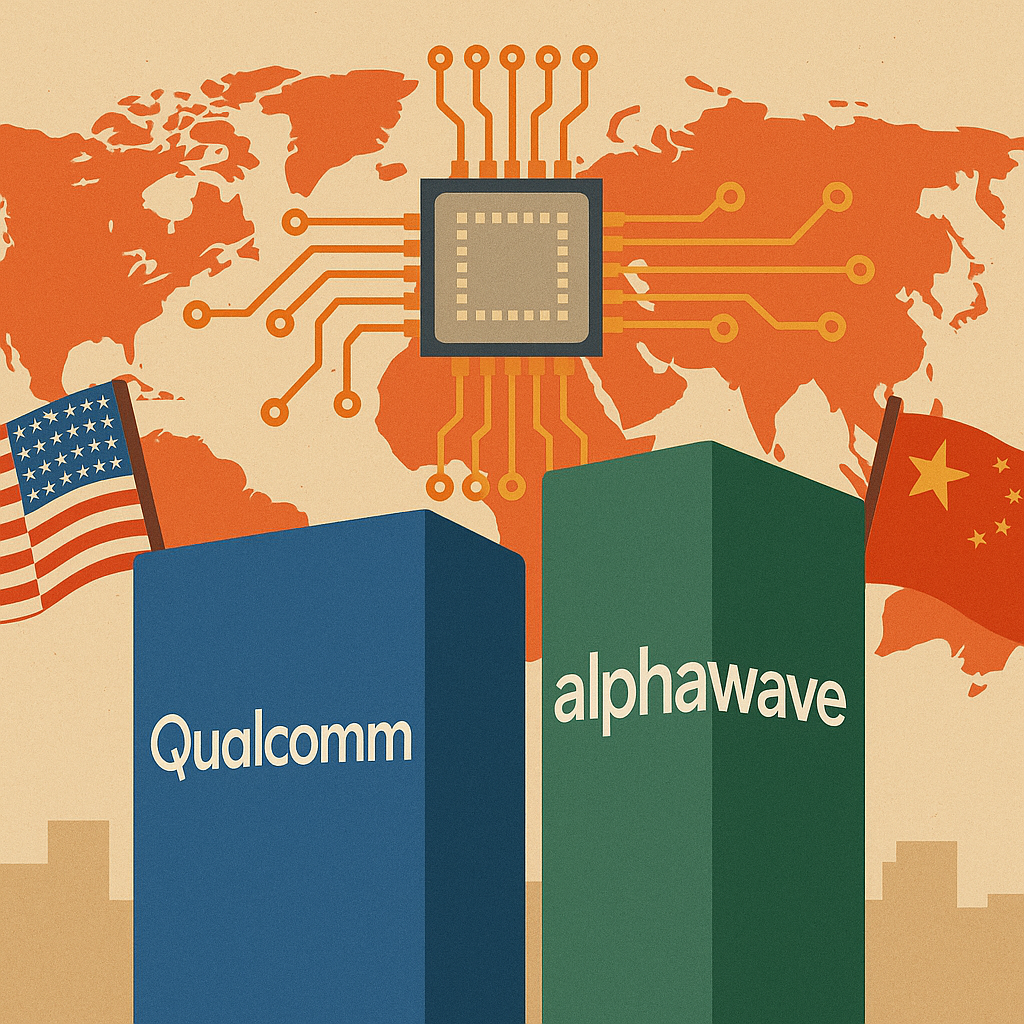

???? LONDON / SAN DIEGO — In a move set to reshape the high-performance semiconductor landscape, Qualcomm Inc. (NASDAQ: QCOM) has finalized its $2.4 billion acquisition of UK-based Alphawave IP, bolstering its position in advanced chip interconnects. The deal comes at a critical moment as US–China trade talks in London signal potential easing of export restrictions—a development that’s injecting optimism into an otherwise cautious global tech sector.

This merger, strategically timed and financially significant, underscores how geopolitical diplomacy and next-gen chip architecture are becoming increasingly intertwined—and why investors should be paying close attention.

???? Why This Deal Matters Now

The semiconductor sector has been a key battleground in US–China relations. With tariffs, export bans, and supply chain uncertainties roiling the markets over the past few years, Qualcomm’s acquisition of Alphawave represents more than just corporate consolidation—it reflects a calculated pivot to future-proof its supply lines and solidify its dominance in chip-to-chip data connectivity.

According to Qualcomm’s official release, the deal “complements and expands [its] data center and AI computing capabilities,” a sentiment echoed by analysts who see Alphawave’s IP and silicon interconnect tech as a vital link in meeting soaring data transmission demands.

“The Alphawave acquisition is a clear response to the AI boom and the massive bandwidth needs across edge, cloud, and data center infrastructure,” said Arjun Malhotra, a semiconductor analyst at Bernstein Research.

(Source: Bloomberg, June 9)

???? Trade Winds Turning?

Just as notable is the timing of the announcement. Ongoing US–China trade talks held in London this week have reportedly shown signs of progress, with negotiators discussing potential relaxation of export licensing requirements for certain semiconductor components.

This softening stance may offer Qualcomm improved flexibility in accessing global fabrication partners—particularly those in Asia—and reduce over-reliance on any single region.

“Investors should read this as a signal of tech detente momentum,” said economist Sarah Liu on InvestingNews.com. “It’s not a full resolution, but it does reduce headline risk for multinational chipmakers.”

???? Strategic Fit: Inside Qualcomm’s Playbook

Alphawave IP, headquartered in London and listed on the LSE, specializes in high-speed connectivity solutions essential for AI accelerators, 5G baseband, and high-bandwidth memory interfaces. These are exactly the technologies Qualcomm is betting on as AI workloads strain traditional infrastructure.

The acquisition boosts Qualcomm’s IP portfolio and grants access to Alphawave’s customer pipeline in Asia and Europe, diversifying revenue and R&D reach.

Notably, the deal may also strengthen Qualcomm’s standing against competitors like Nvidia, AMD, and Broadcom, who are similarly doubling down on data center and AI-optimized silicon ecosystems.

???? Future Trends to Watch

1. Data Center & AI Infrastructure Expansion

The AI hardware arms race is far from over. Demand for energy-efficient, high-throughput interconnects is set to explode, and this deal puts Qualcomm in a stronger position to capitalize on that growth.

2. IP Licensing and Integration Risks

Investors should monitor how efficiently Qualcomm integrates Alphawave’s IP into its existing product lines. Poor integration could impact time-to-market for next-gen chips.

3. Geopolitical Influence on Global Supply Chains

Continued thawing in US–China trade tensions would benefit Qualcomm’s multi-region manufacturing strategy. However, any reversal could rekindle regulatory bottlenecks.

✅ Key Investment Insight

For forward-looking investors, this deal signals Qualcomm’s proactive repositioning in response to both technological and geopolitical shifts. The company is not just playing catch-up; it’s placing strategic bets on where the puck is heading in global chip demand.

Investors might consider this a bullish indicator for Qualcomm’s long-term fundamentals—especially if integration is smooth and trade tailwinds persist. However, it’s crucial to stay alert to regulatory approvals, post-acquisition synergies, and ongoing macro volatility that could temper gains.

???? Stay Ahead with MoneyNews.Today

As the semiconductor sector continues to evolve at breakneck speed, staying informed is not optional—it’s essential. Follow MoneyNews.Today for daily, actionable insights on the world’s most investable trends and stories shaping the global economy.