Ridgeline Minerals (TSXV:RDG) has provided an update on its ongoing exploration at the Swift gold project in Nevada, a project operated under an exploration earn-in agreement with Nevada Gold Mines (NGM). The announcement, made on October 17, 2024, detailed progress on the drill program, which had faced initial delays.

Chad Peters, Ridgeline’s President, CEO & Director commented in a press release: “We are encouraged by the visual results of the first hole, which continues to show evidence of a strong Carlin-Type gold system at Swift. The 2024 program is building from positive drilling results in 2022, which intersected widespread alteration and low-grade Carlin-Type gold mineralization across multiple framework drill holes. Drilling in 2024 will attempt to vector in on higher grade gold mineralization hosted within proposed structural traps along the projection of the Mill Creek Thrust, a significant structural control and conduit for gold mineralization at Swift.”

The drill program at Swift was originally set to begin in early June, but was postponed until August due to unexpected permitting delays through the Bureau of Land Management (BLM). Despite these setbacks, drilling has since advanced, with the first of up to three deep core holes now completed. Samples from this initial hole, designated SW24-006, have been submitted to ALS Minerals in Elko, Nevada, an independent, certified, and accredited laboratory. The analysis of these samples will provide further insights into the project’s potential.

Under the earn-in agreement, Nevada Gold Mines has the right to acquire a 60% interest in the Swift project. To earn this initial stake, NGM must complete a minimum of $20 million in qualifying work expenditures over five years. As of June 30, 2024, approximately $7.5 million of this commitment had already been met. NGM also retains the option to increase its stake to 70% by investing an additional $10 million in qualifying expenditures before the end of 2029.

Further terms of the earn-in agreement allow NGM to increase its interest by an additional 5%, bringing its total potential stake to 75%. This would be contingent upon NGM deciding to finance Ridgeline’s portion of any necessary debt for mine development or construction. If NGM exercises this option, Ridgeline would retain a 25% interest in the project. Should NGM opt not to increase its interest to 70%, their maximum interest would be 65%.

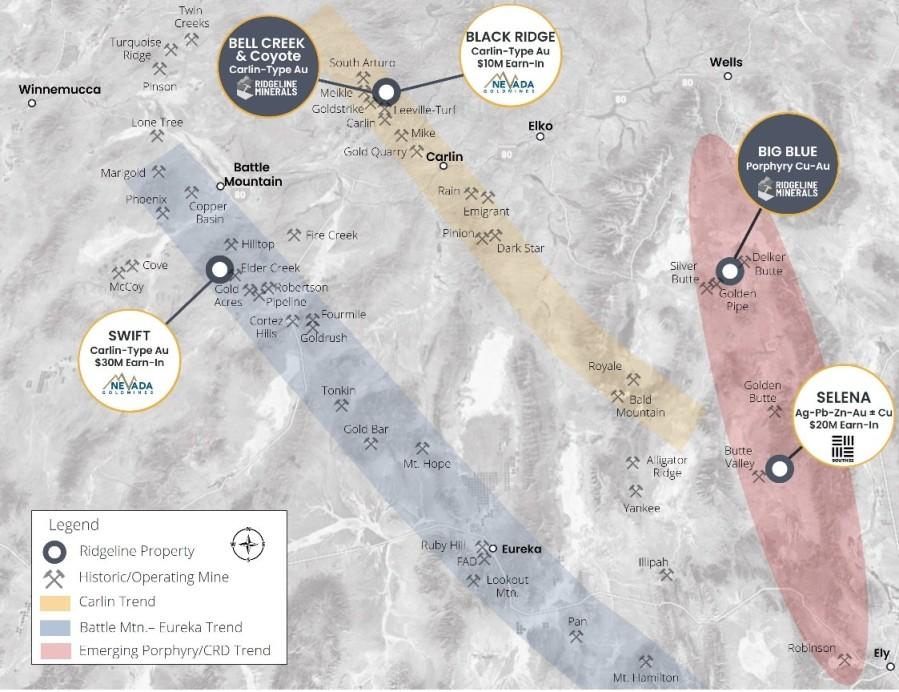

The Swift project, located in Nevada’s Cortez district, is a key asset for Ridgeline, which holds a diversified portfolio of exploration projects across the state. In addition to Swift, Ridgeline operates other Nevada projects such as Big Blue, Bell Creek, and Coyote, all of which are 100% owned. The company also has other earn-in agreements, including one with NGM for the Black Ridge project and another with South32 for the Selena project.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

I specialize in the mining industry, focusing on top global mining stocks. My reporting covers the latest industry news, company/project developments, and profiles of key players. Beyond my professional pursuits, I have a keen interest in global business and a love for travel.

Comments are closed.