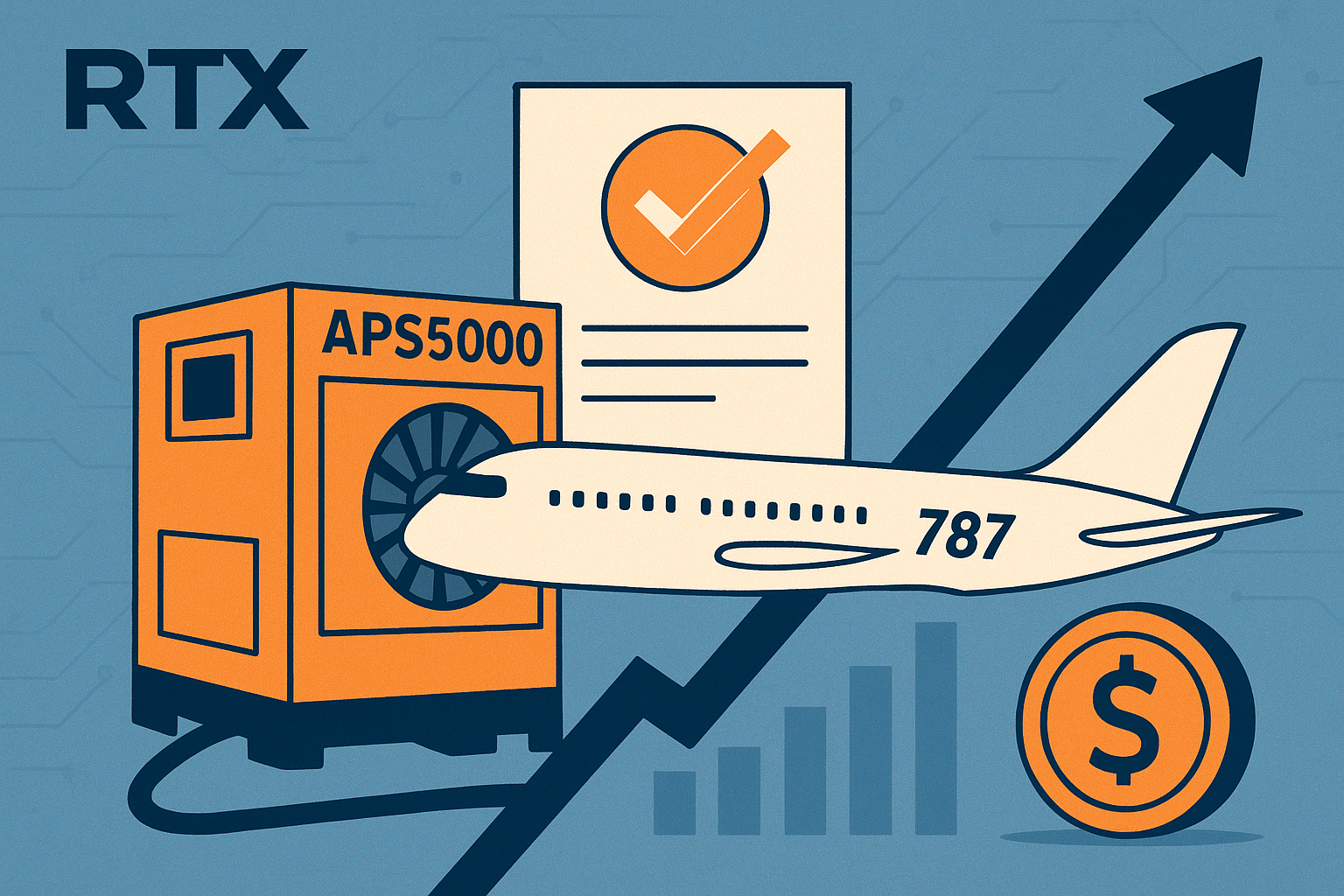

RTX’s Pratt & Whitney Canada has landed a significant long-term maintenance and support contract covering 41 APS5000 auxiliary power units (APUs) on the Boeing 787 fleets operated by Lufthansa and Austrian Airlines. The 14-year agreement, announced October 14, 2025, reinforces the resilience of aerospace industrial services and highlights the steady revenue streams that such contracts provide to established aerospace suppliers.

For investors, this deal underscores the importance of predictable, long-term contracts in a sector often overshadowed by flashy aerospace innovations like space tourism and advanced AI-driven avionics.

Steady Demand in Aerospace Industrial Services

While commercial aerospace headlines often focus on new aircraft deliveries or innovative technologies, aftermarket services remain a critical backbone of profitability for engine and component manufacturers. The APS5000 APUs, which provide essential electrical power and air conditioning to aircraft while on the ground, are a niche yet indispensable part of airline operations.

RTX reported in its 2024 annual review that aftermarket support accounts for nearly 40% of revenue for Pratt & Whitney Canada, highlighting how recurring service contracts act as a stabilizing force against cyclical fluctuations in aircraft sales.

Analyst commentary from Jefferies Aerospace & Defense Research emphasizes that long-term service agreements like this one allow for predictable cash flows and reduce exposure to volatile new aircraft orders. “Investors often underestimate the contribution of industrial components and long-term maintenance contracts. These deals generate steady margins and are less sensitive to market swings than new aircraft deliveries,” notes the report.

Why This Matters for Investors

The contract illustrates several key points for investors:

- Revenue Visibility: Multi-year contracts in aerospace services enhance predictability in earnings and can smooth out cyclical peaks and troughs in aircraft sales.

- Strategic Positioning: Pratt & Whitney Canada continues to cement its market position as a trusted provider for critical aircraft systems. Maintaining long-term contracts with major airlines like Lufthansa and Austrian Airlines strengthens its reputation and competitive moat.

- Resilience Amid Volatility: While aerospace manufacturing can be cyclical, maintenance and service contracts provide insulation against downturns. For RTX, this reduces overall portfolio risk and enhances shareholder value.

Future Trends to Watch

- Aftermarket Expansion: Airlines are increasingly outsourcing component maintenance to reduce operational complexity, which may increase the demand for long-term service contracts.

- Technological Upgrades: As next-generation APUs are developed with higher efficiency and lower emissions, companies like Pratt & Whitney Canada may secure additional contracts for retrofit and upgrade programs.

- Global Fleet Growth: Expanding fleets in North America and Europe provide a growing serviceable market, benefiting OEMs with established service networks.

- Defense and Dual-Use Opportunities: Aerospace service providers with proven commercial capabilities are increasingly being considered for defense contracts, adding another revenue layer.

Key Investment Insight

Investors should view this contract as a signal of stability in aerospace industrial services. While headline aerospace innovation captures attention, the consistent earnings generated from long-term service contracts are often undervalued in market sentiment.

- Look for recurring revenue plays: Companies with robust aftermarket and service divisions often provide a hedge against manufacturing cyclicality.

- Monitor fleet growth: Increasing commercial air traffic and fleet expansions drive demand for APUs and other critical components.

- Evaluate margins: Aftermarket services typically offer higher margins and lower capital intensity than aircraft manufacturing, supporting healthier cash flow.

In sum, RTX’s Pratt & Whitney Canada deal reinforces the notion that steady, long-duration contracts remain a reliable driver of investor confidence and valuation stability in aerospace equities.

Stay Ahead with MoneyNews.Today

As industrial aerospace continues to provide steady revenue amid global market fluctuations, staying informed is crucial for positioning in long-term growth sectors. Follow MoneyNews.Today for timely, data-backed analysis and insights into aerospace, technology, and industrial investments shaping the markets.