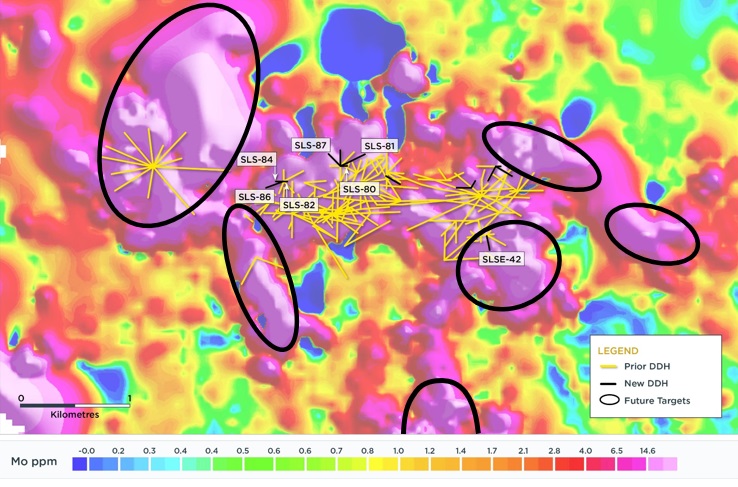

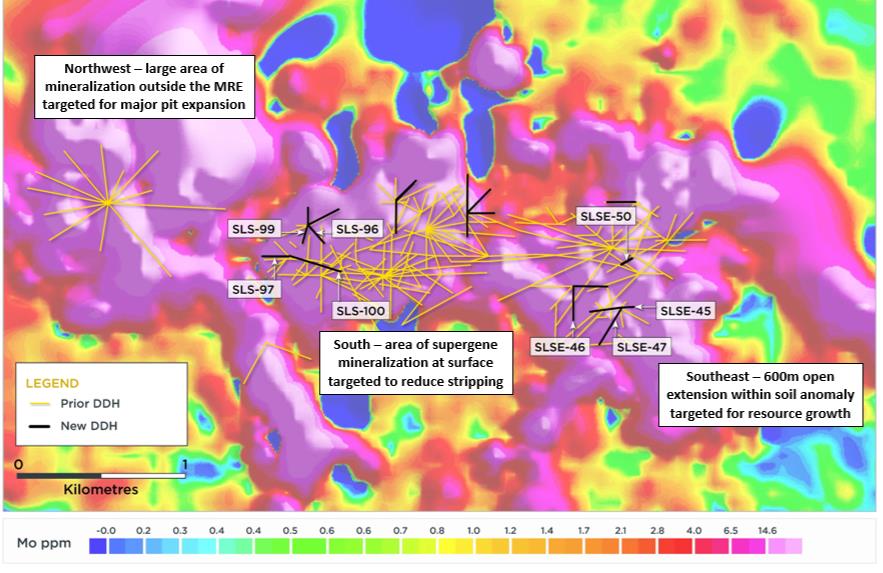

Solaris Resources (TSX:SLS)(NYSEAmerican:SLSR) has released new drill results from its ongoing 60,000-meter, eight-rig drilling program at the Warintza Project in southeastern Ecuador. The company’s recent efforts have extended near-surface, high-grade mineralization in several directions, notably to the north, northwest, and southeast of the existing Mineral Resource Estimate (MRE).

The ongoing drilling campaign primarily focuses on open lateral extensions of mineralization. Infill drilling is also being carried out to upgrade mineral resources and convert areas previously considered waste. The main open vectors for expansion are to the northwest, southwest, and southeast.

A series of drill holes from a step-out platform have shown significant extensions of mineralization to the northwest, revealing high-grade deposits near the surface. This mineralization trend intersects a tabular granodiorite unit, which both separates and underlies the Central deposit from Warintza West. The area to the northwest also includes a large, undrilled molybdenum soil anomaly.

Key drill results from this region include:

SLS-86 (drilled southwest) returned 57 meters of 1.11% Copper Equivalent (CuEq) within 105 meters of 0.88% CuEq from near surface.

SLS-84 (drilled west) showed 69 meters of 0.82% CuEq within 102 meters of 0.64% CuEq from near surface.

SLS-82 (drilled east) recorded 69 meters of 0.77% CuEq within 249 meters of 0.38% CuEq from surface.

In response to these findings, Solaris has constructed additional step-out platforms to further explore the potential of this anomaly and its connection to the Warintza West and Central deposits. Drilling is currently ongoing from the first platform, positioned approximately 1.3 kilometers northwest of SLS-86. Similar efforts are being made with platforms to the southwest, which are expected to contribute to a potential major expansion of the MRE, significantly enlarging the pit.

In addition to the northwest exploration, extensional drilling on the northern edge of the MRE has successfully extended mineralization further north. Infill drilling within this area has also been productive, with hole SLS-83 converting previously undefined waste within the pit.

Significant drill results from this northern region include:

SLS-87 (drilled northwest) recorded 33 meters of 0.81% CuEq within 114 meters of 0.38% CuEq from surface.

SLS-81 (drilled northeast) returned 165 meters of 0.54% CuEq within 327 meters of 0.33% CuEq from surface.

SLS-80 (drilled east) showed 191 meters of 0.43% CuEq from near surface.

Further south, extensional drilling in the southeast sector of the project has extended mineralization, with potential for further exploration up to 600 meters within a large 0.8km x 0.8km undrilled molybdenum soil anomaly. Notably, hole SLSE-42 returned 300 meters of 0.57% CuEq within 359 meters of 0.53% CuEq from surface, reinforcing the growth potential in this area.

At Warintza East, located to the northeast, additional drilling has encountered lower-grade mineralization in several holes (SLSE-37 to SLSE-43). These results, however, are still important as they serve to convert previously undefined waste within the MRE pit shell. Further drilling is planned in this direction and to the east to better delineate the resource.

Meanwhile, Solaris continues complementary district exploration efforts. Geotechnical drilling in the Caya-Mateo target area has encountered epithermal clay alteration in sandstone and high-temperature alteration in the underlying volcanic rocks. This information is expected to assist in refining future exploration targets in the area. Additionally, fieldwork in the Celestina epithermal gold/silver area is ongoing, with the company anticipating the release of the next batch of results soon.

Table 1 – Assay Results

Hole ID

Date Reported

From (m)

To (m)

Interval (m)

Cu (%)

Mo (%)

Au (g/t)

CuEq² (%)

SLS-87

Aug 15, 2024

0

114

114

0.23

0.02

0.05

0.38

Including

81

114

33

0.64

0.02

0.06

0.81

SLS-86

54

159

105

0.58

0.04

0.11

0.88

Including

60

117

57

0.77

0.05

0.13

1.11

SLS-85

0

123

123

0.12

0.02

0.04

0.23

Including

102

123

21

0.41

0.01

0.03

0.51

SLS-84

54

156

102

0.38

0.04

0.07

0.64

Including

54

123

69

0.52

0.04

0.10

0.82

SLS-83

15

265

250

0.15

0.00

0.14

0.25

SLS-82

0

249

249

0.17

0.03

0.04

0.38

Including

48

117

69

0.47

0.04

0.12

0.77

SLS-81

0

327

327

0.20

0.02

0.04

0.33

Including

84

249

165

0.35

0.03

0.04

0.54

SLS-80

69

260

191

0.34

0.01

0.04

0.43

SLSE-43

0

295

295

0.13

0.01

0.02

0.18

SLSE-42

0

359

359

0.38

0.02

0.06

0.53

Including

21

321

300

0.42

0.02

0.06

0.57

SLSE-41

0

258

258

0.07

0.00

0.02

0.09

SLSE-40

6

39

33

0.13

0.00

0.02

0.16

SLSE-39

60

318

258

0.19

0.01

0.04

0.26

Including

60

102

42

0.30

0.01

0.04

0.38

SLSE-38

93

152

59

0.19

0.00

0.03

0.23

Including

108

132

24

0.26

0.00

0.05

0.31

SLSE-37

153

258

105

0.12

0.02

0.02

0.23

Including

360

419

59

0.11

0.02

0.01

0.21

Notes to Table 1: True widths are interpreted to be very close to drilled widths due to the bulk-porphyry style mineralized zones at Warintza.

Table 2 – Collar Locations

Hole ID

Easting

Northing

Elevation

(m)

Depth

(m)

Azimuth (degrees)

Dip (degrees)

SLS-87

800198

9648473

1338

295

315

-60

SLS-86

799685

9648332

1374

251

250

-50

SLS-85

800199

9648475

1336

274

0

-60

SLS-84

799684

9648330

1374

200

270

-69

SLS-83

800621

9648398

1332

265

120

-58

SLS-82

799682

9648329

1373

302

90

-85

SLS-81

800198

9648471

1339

400

65

-52

SLS-80

800200

9648473

1338

260

90

-77

SLSE-43

801615

9648467

1104

296

210

-60

SLSE-42

801528

9647849

1154

360

170

-70

SLSE-41

801612

9648466

1105

259

120

-50

SLSE-40

801616

9648469

1104

141

90

-75

SLSE-39

801385

9648268

1244

318

270

-67

SLSE-38

801615

9648469

1104

152

0

-90

SLSE-37

801388

9648263

1243

419

30

-80

Notes to table: The coordinates are in WGS84 17S Datum.

Endnotes

Refer to press release dated July 22, 2024. NI 43-101 Technical Report to be released within 45 days of the July 22, 2024 news release and available on the Company’s website and Sedar+.

Copper-equivalence grade calculation for reporting assumes metal prices of US$4.00/lb Cu, US$20.00/lb Mo, and US$1,850/oz Au, and recoveries of 90% Cu, 85% Mo, and 70% Au based on preliminary metallurgical testwork. CuEq formula: CuEq (%) = Cu (%) + 5.604 × Mo (%) + 0.623 × Au (g/t).

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

I specialize in the mining industry, focusing on top global mining stocks. My reporting covers the latest industry news, company/project developments, and profiles of key players. With a degree in finance and economics from the University of Toronto, I’ve contributed to a wide range of industry publications. Beyond my professional pursuits, I have a keen interest in global business and a love for travel.

Comments are closed.