Solaris Resources (TSX:SLS) (NYSEAmerican:SLSR) has announced the termination of a previously proposed minority equity investment aimed at expanding the company’s Warintza Project in Ecuador.

The proposed investment, which would have supported both the growth of existing operations and the potential acquisition of a neighboring property, was initially announced four months ago. However, despite the anticipation of timely approval due to the minority nature of the investment and its focus on critical minerals, the transaction has not yet received the necessary regulatory clearance from Canadian authorities.

Solaris’ share price has also risen by over 35% since the initial announcement, making the terms of the investment, which included a 14% premium at the time, no longer financially advantageous for the company. This price increase, while positive in isolation, has been outpaced by similar companies in the sector due to the ongoing uncertainty surrounding the regulatory process in Canada.

The company has expressed disappointment in the delay, citing the evolved regulatory environment and heightened political sensitivity surrounding Canadian investments in foreign assets. The combination of these factors, coupled with the increasingly unattractive terms of the deal, has led Solaris to conclude that terminating the investment is the most prudent course of action to protect shareholder interests.

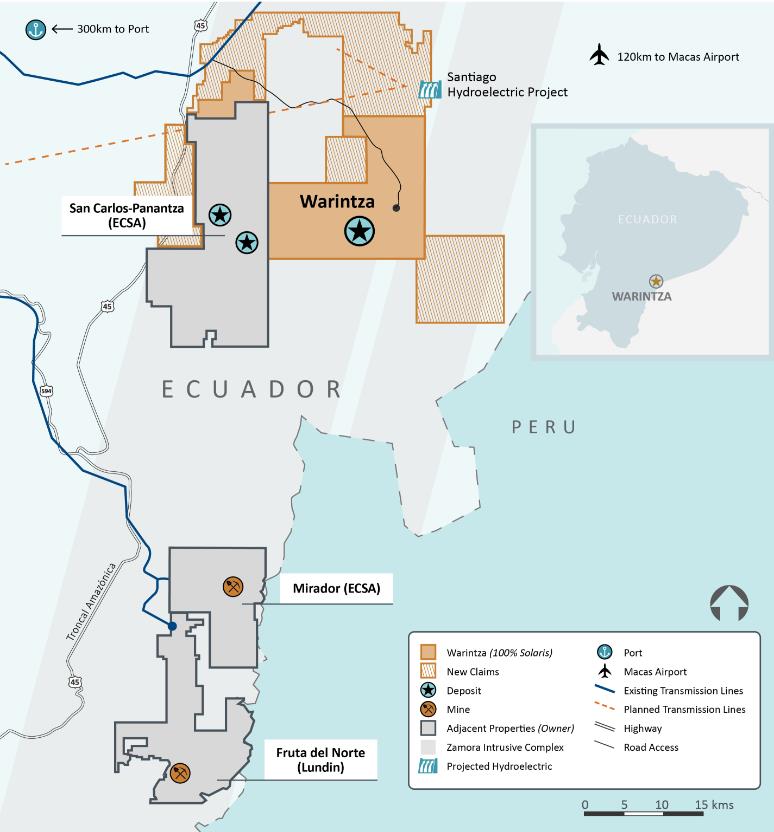

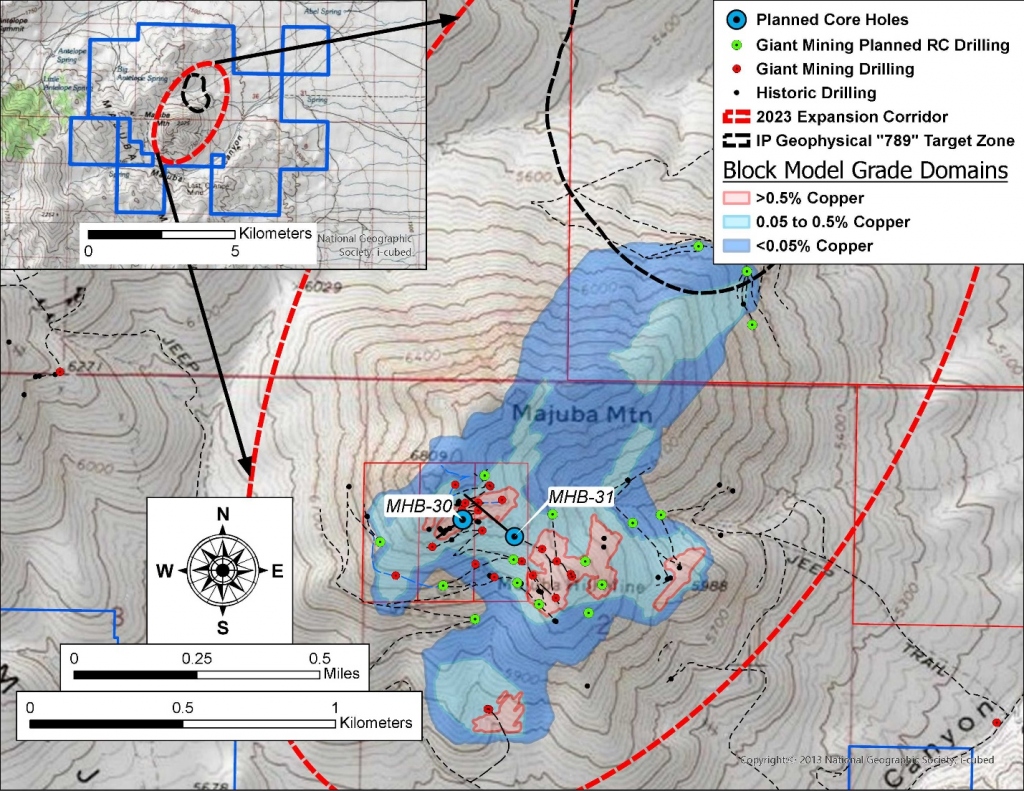

Despite this setback, Solaris remains financially secure, with sufficient funds to support its planned activities at the Warintza Project through 2025. This includes the ongoing exploration of a recently acquired 40,000-hectare area adjacent to the existing project site, which has already shown promising geological and geophysical similarities to the mineral-rich Warintza cluster.

Furthermore, the company has access to an additional US$40 million in funding through an existing offtake financing agreement. With these resources, Solaris intends to focus on maximizing shareholder value through a targeted strategy that prioritizes long-term growth and flexibility.

Solaris has also reiterated its commitment to the Warintza Project timeline, with an Environmental Impact Assessment expected to be delivered in the second half of 2024 and a Pre-Feasibility Study in the second half of 2025. These milestones are crucial steps in the development of the project, and Solaris remains optimistic about the potential of Warintza to become a significant source of critical minerals.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

I specialize in the mining industry, focusing on top global mining stocks. My reporting covers the latest industry news, company/project developments, and profiles of key players. With a degree in finance and economics from the University of Toronto, I’ve contributed to a wide range of industry publications. Beyond my professional pursuits, I have a keen interest in global business and a love for travel.

Comments are closed.