#Commodities

- Emerging Industries

$1.8 Billion Critical-Minerals Consortium Enters Supply-Chain War...

Global supply chains for critical minerals—lithium, nickel, cobalt, and rare earths—are entering a new battleground as a $1.8 billion consortium led by Orion Resource…

- Metals & Mining

Gold & Silver Pull Back Sharply — Critical-Minerals Fundraising Surges...

After months of speculative fervor, gold and silver markets just delivered a wake-up call. Gold prices saw their sharpest one-day drop in five years,…

- Politics

U.S.–Colombia Trade & Aid Standoff Escalates Under Trump: Markets Weigh...

As investors digest a fresh round of geopolitical tremors, the latest flashpoint between Washington and Bogotá is quickly climbing the risk radar. On October…

- Metals & Mining

Gold Surges to Record as Markets Seek Safe Havens Amid...

Gold has reclaimed the spotlight as investors flee to safety. Futures for the yellow metal surged to an all-time high near US$4,392 per ounce,…

- Metals & Mining

Gold & Silver Break Records as Safe Haven Demand Surges...

Gold’s long-standing reputation as the ultimate refuge asset has rarely looked stronger. On Thursday, spot gold prices soared past $4,200 per ounce, while silver…

- Metals & Mining

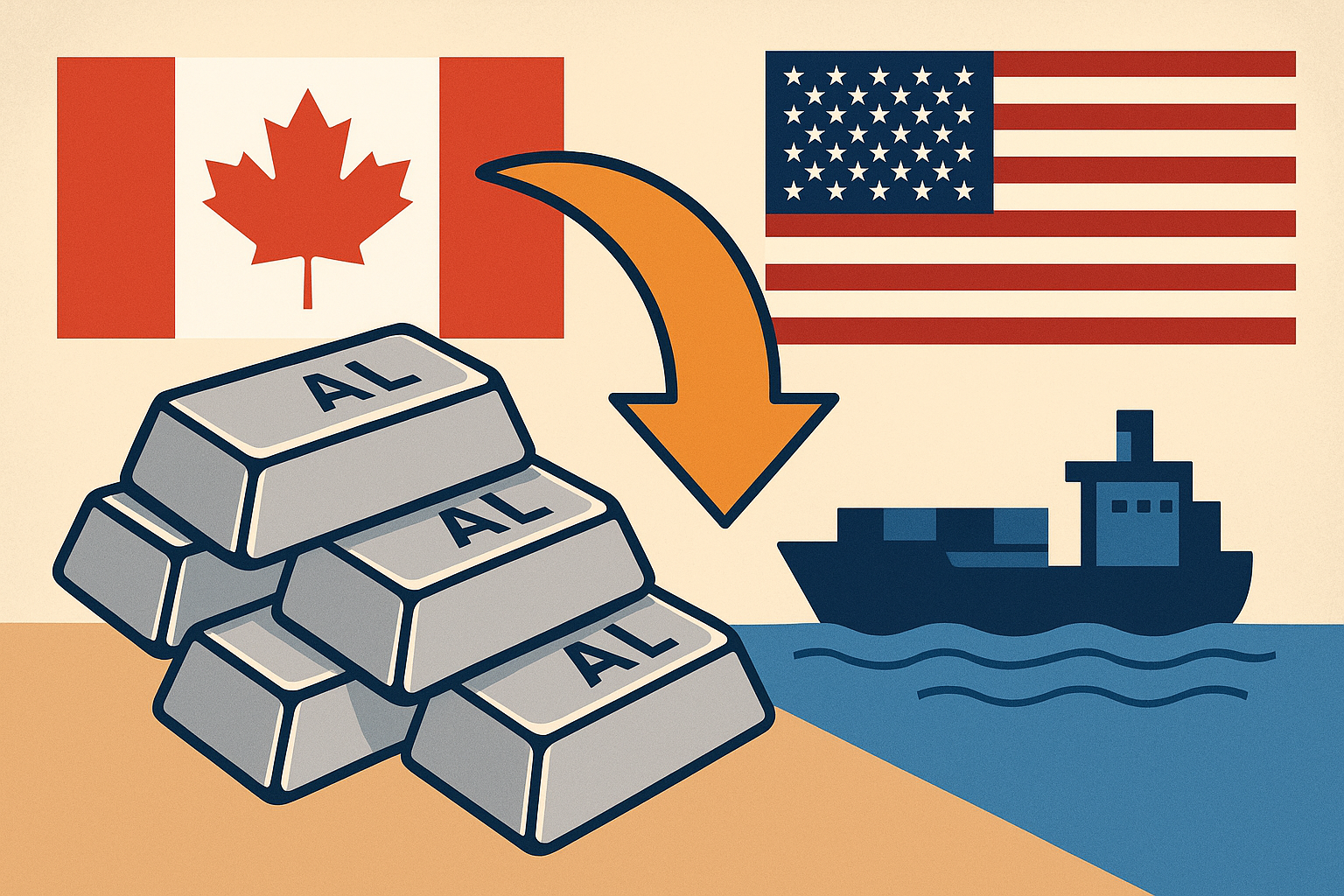

U.S. Aluminium Imports from Canada Surge as Prices Hit Record...

When U.S. aluminium prices hit their highest levels in nearly a decade this week, traders weren’t the only ones watching. Investors across the metals…

- Metals & Mining

Mining Titan Warns of Global Supply Shock Amid Trade &...

Global supply chains are bracing for another jolt as mining billionaire Robert Friedland warns of an impending “breakdown in international order,” citing deepening geopolitical…