As AI Integration Accelerates, Telstra’s Workforce Overhaul Signals a Broader Shift in Cost-Efficiency Strategy Across Telecom and Tech Sectors

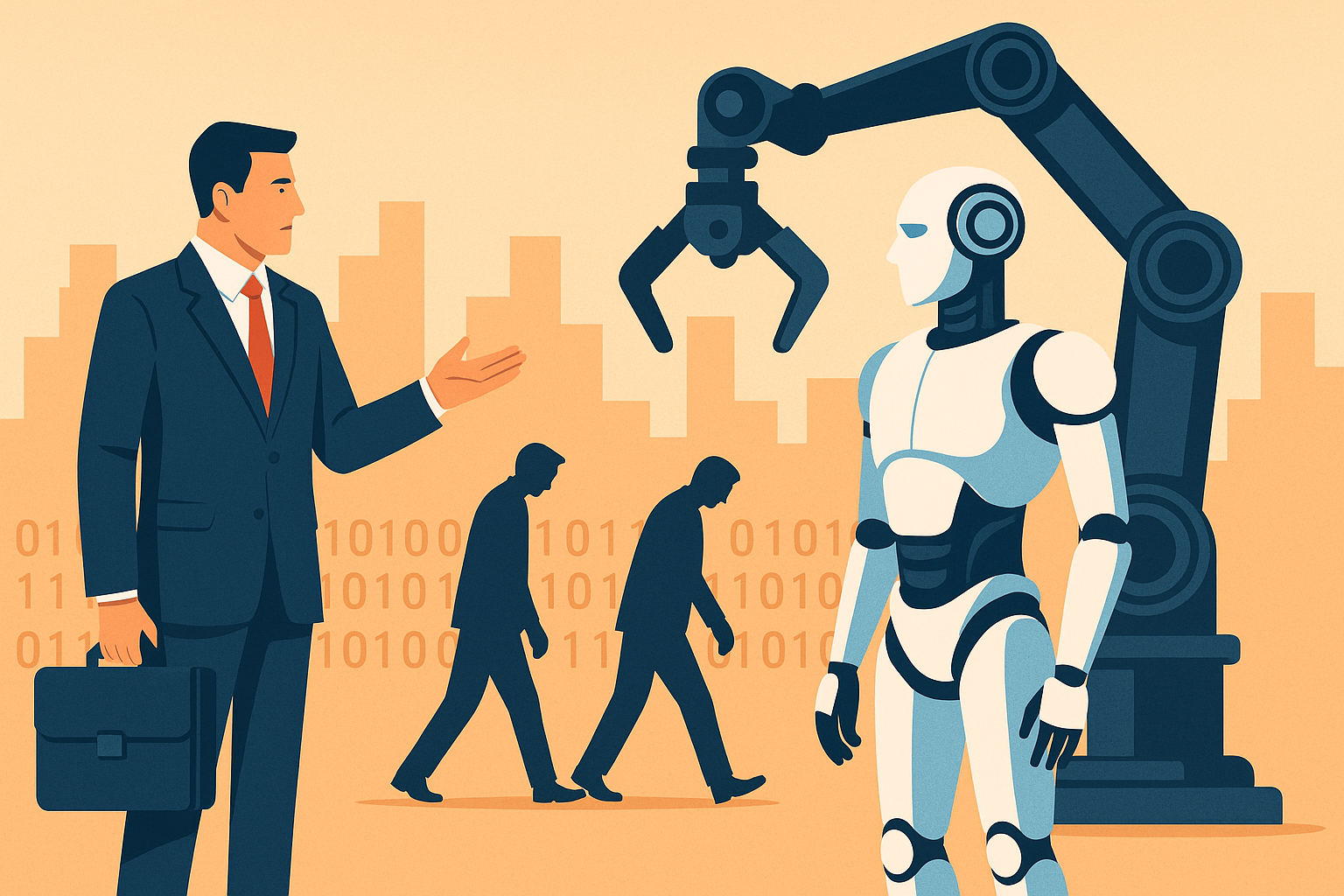

As artificial intelligence (AI) continues to redefine business operations across industries, Australia’s largest telecom operator, Telstra, has announced a sweeping workforce reduction plan driven by AI efficiencies. The company intends to cut thousands of jobs by 2030—signaling a pivotal moment not only for telecom but for the broader investment landscape.

This move comes amid an accelerating global trend: companies leveraging AI to streamline operations, cut costs, and boost margins. Investors watching the AI transformation unfold now have clear evidence of how automation is moving from hype to high-impact reality.

AI Cuts Deep: Telstra’s Strategic Workforce Reduction

Telstra CEO Vicki Brady confirmed that the company plans to significantly reduce its headcount as it integrates AI across core functions—especially in customer service, software development, and operational support. The announcement follows an internal review highlighting how AI-powered tools and autonomous agents can deliver the same (or improved) service levels at a fraction of the cost.

“We’re not just digitizing old systems. We’re building entirely new ways of working,” Brady stated, emphasizing the shift from traditional support models to AI-driven platforms.

According to The Guardian, the strategy aligns with Telstra’s broader digital transformation roadmap aimed at boosting long-term competitiveness and profitability. It mirrors similar shifts occurring in U.S. tech and telecom sectors, where AI adoption is increasingly tied to cost-cutting measures and margin expansion.

Why This Matters for Investors

AI is no longer a futuristic investment narrative—it’s a disruptive force being actively implemented by industry leaders to reshape cost structures and performance metrics. Telstra’s decision to downsize its workforce signals that AI is moving into mature deployment across critical business functions.

For investors, this marks an inflection point:

- Operational Efficiency: Companies investing in AI-driven solutions are showing improved EBITDA margins by cutting labor-intensive processes and replacing them with autonomous systems.

- Cost Optimization: Telstra’s headcount reduction could lower opex significantly, freeing capital for reinvestment in digital infrastructure or returning value to shareholders.

- Competitive Positioning: Firms that integrate AI effectively will likely outpace peers in customer acquisition, service delivery, and product innovation.

AI Labor Disruption: A Broader Trend

Telstra’s move isn’t isolated. Across sectors, companies are acknowledging that AI not only augments human capabilities but, in many cases, replaces them. A 2025 report by the Information Technology & Innovation Foundation (ITIF) highlighted that over 43% of Fortune 500 companies have deployed AI solutions that resulted in headcount reductions or reskilling initiatives.

This reinforces forecasts by McKinsey & Company, which predict that by 2030, up to 800 million global workers could be displaced due to AI and automation—while productivity and profitability metrics rise sharply for early adopters.

Future Trends to Watch

- AI-Powered Customer Service: The global market for AI in customer service is projected to grow at 21.3% CAGR, reaching $11.3 billion by 2030 (Statista).

- Telecom Sector Automation: Telecoms are rapidly automating network management, billing systems, and helpdesk support using AI, leading to lower churn and enhanced ARPU (Average Revenue Per User).

- AI as a Cost Center Replacer: Companies across healthcare, financial services, and manufacturing are evaluating AI to replace repetitive, rules-based jobs.

Key Investment Insight

Investors should monitor companies in the telecom, banking, logistics, and SaaS sectors for signs of workforce automation. Those that can maintain service quality while significantly reducing labor costs will likely see margin expansion and increased enterprise value.

Publicly listed firms embracing AI—from Telstra (ASX: TLS) to U.S. telecom giants—may become outperformers in the next market cycle. Additionally, firms providing the enabling AI infrastructure (e.g., NVIDIA, Palantir, ServiceNow) stand to benefit from increased enterprise demand.

Stay Ahead of the Curve

Telstra’s AI-led transformation is more than a company story—it’s a clear signal that AI is becoming foundational to operational strategy. For investors, this underscores the need to actively seek exposure to businesses that are not just adopting AI—but are redesigning themselves around it.

Stay tuned with MoneyNews.Today for the latest investor-focused analysis on AI, automation, and the emerging leaders of tomorrow’s economy.