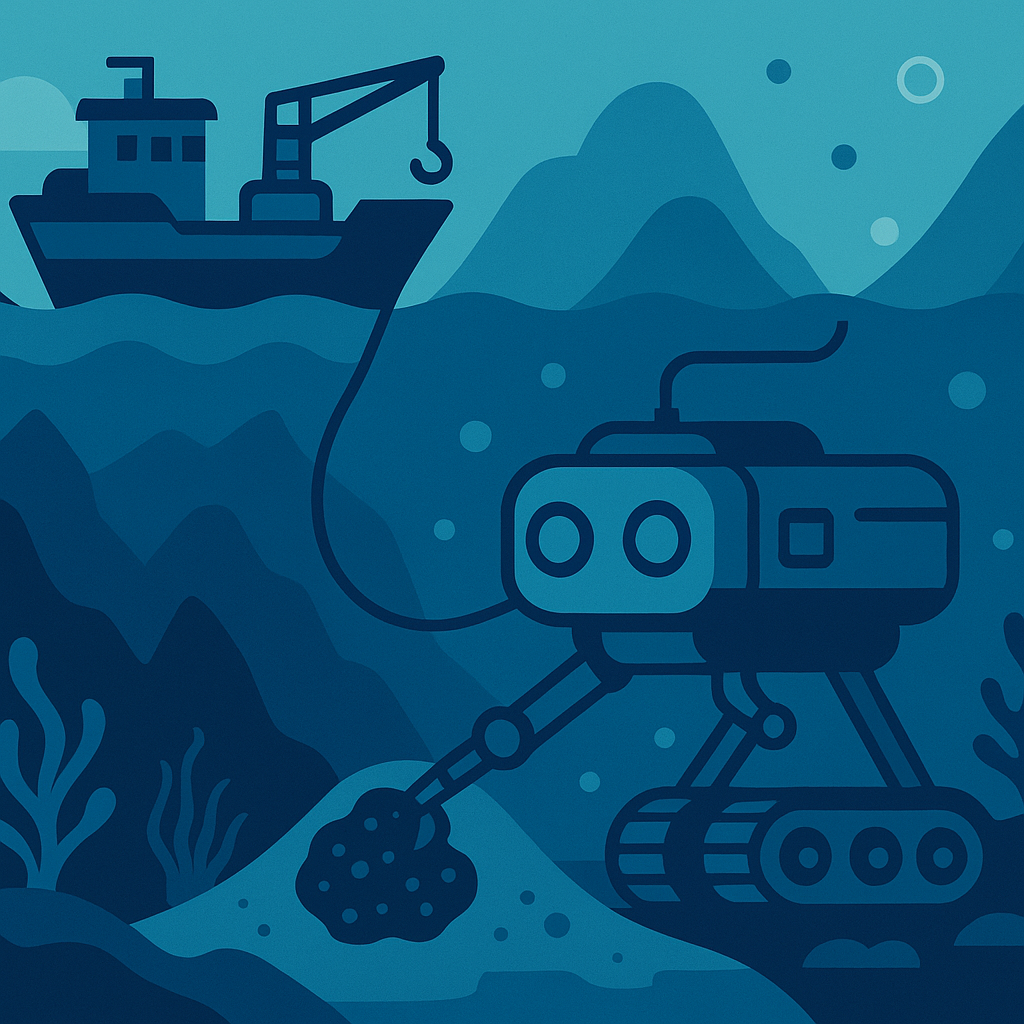

As the global race for critical minerals intensifies, deep beneath the ocean’s surface lies a largely untapped treasure trove of essential resources—and The Metals Company (NASDAQ: TMC) is diving in. The firm has officially applied for a deep-sea mining license from the U.S. government, setting a precedent for what could become one of the most transformative—and controversial—frontiers in the modern resource economy.

This bold move positions TMC at the cutting edge of a growing push to secure critical minerals used in electric vehicles (EVs), renewable energy systems, advanced electronics, and defense technologies, at a time when geopolitical tensions and supply chain fragility have heightened urgency.

Why Deep-Sea Mining Matters Now

For years, the seabed has been viewed as the next frontier in resource extraction—but technological, legal, and environmental hurdles kept it largely theoretical. That’s now changing.

Driven by skyrocketing demand for metals such as cobalt, nickel, copper, and rare earths, governments and corporations alike are scrambling to diversify their sources. According to a 2024 McKinsey report, demand for critical minerals is expected to triple by 2035, and traditional terrestrial mining is struggling to keep pace.

TMC’s application signals a proactive shift in U.S.-linked mining strategies—from land to sea. The company, known for its operations in the Clarion-Clipperton Zone of the Pacific, is now extending its reach to U.S. waters, in line with emerging bipartisan interest in reducing reliance on China for strategic materials.

“We are committed to unlocking new, responsible sources of battery metals,” TMC said in a statement reported by Mongabay. “Deep-sea nodules offer a scalable path forward.”

Why This Matters for Investors

Investors should view TMC’s move through both a strategic and speculative lens. If approved, the license would grant the company first-mover advantage in U.S.-regulated deep-sea mining—a market projected to reach $30 billion by 2030, according to Newsfile.

TMC already holds exploration licenses through the International Seabed Authority (ISA) and has partnered with leading engineering firms to develop harvesting technologies. The company’s stock (TMC) has historically shown volatility, but recent developments may signal an inflection point, especially if U.S. support materializes.

From a broader portfolio perspective, deep-sea mining represents an emerging sector with asymmetric potential—high risk, but potentially high reward. Environmental scrutiny remains intense, but growing mineral scarcity could outweigh resistance, especially as carbon-neutral energy systems hinge on access to these metals.

Key Stat: The IEA estimates that the energy transition will require up to 6x more mineral inputs by 2040 compared to today.

Risks and Trends to Watch

1. Regulatory and Environmental Hurdles

Opposition from environmental NGOs remains strong. Groups like Greenpeace argue that deep-sea mining threatens marine biodiversity and creates long-term ecological unknowns. Any regulatory green light will likely come with heavy conditions—and delays.

2. Geopolitical Advantage

U.S. policymakers increasingly see seabed resources as a strategic alternative to Chinese-controlled mining operations. TMC’s license could benefit from bipartisan political backing, especially under the current national strategy for critical minerals.

3. Technological Validation

TMC’s pilot harvesting systems must prove efficient, scalable, and safe. Investors should watch for upcoming engineering trials and partnership announcements that may signal readiness for commercial-scale operations.

Key Investment Insight

The Metals Company (TMC) is at the vanguard of a potential resource revolution. While the path to commercial deep-sea mining is fraught with challenges—from environmental concerns to technological hurdles—the company’s early positioning and regulatory momentum could unlock outsized returns if the market materializes.

Investors interested in future-facing commodities, energy transition plays, or speculative innovation assets should keep TMC on their radar. Diversifying exposure through ETFs that include critical mineral and mining innovators may offer a balanced risk profile.

Stay Ahead with MoneyNews.Today

As the demand for critical resources redefines the global investment landscape, MoneyNews.Today brings you the edge you need. Subscribe now for timely analysis, market-moving insights, and in-depth coverage of emerging investment themes that shape tomorrow’s portfolios.