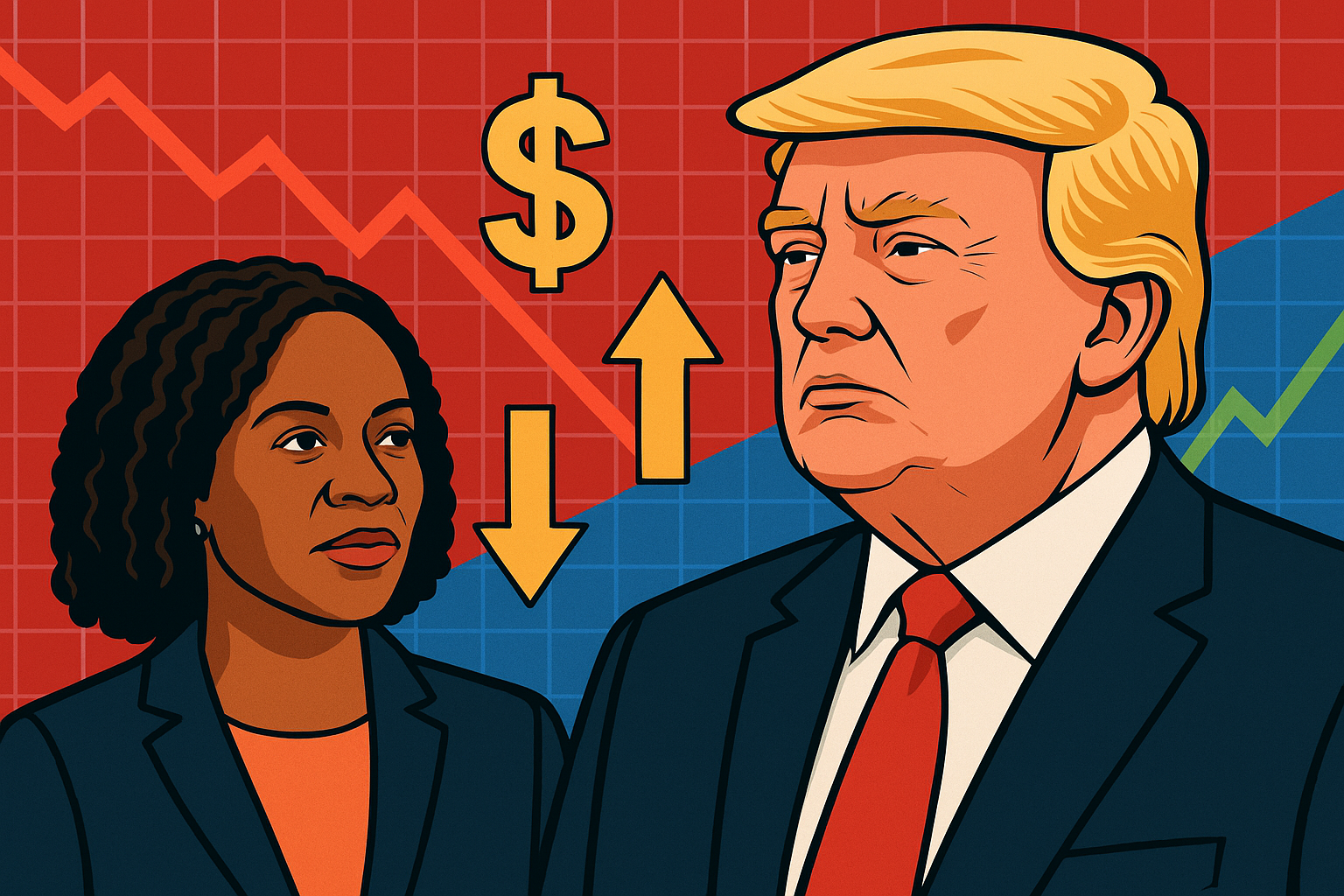

Markets were thrown into turbulence on Tuesday after President Donald Trump unexpectedly dismissed Federal Reserve Governor Lisa Cook, an action that reignited fears over the central bank’s independence and rattled investor confidence ahead of a crucial monetary policy period. The move sent the U.S. dollar lower, pushed long-dated Treasury yields down, lifted gold to a two-week high, and saw futures for major U.S. indices slip into the red.

Political Shockwave Hits Financial Markets

The abrupt firing comes at a sensitive moment for markets already grappling with slowing economic indicators and expectations of potential rate adjustments this fall. According to Reuters, Trump’s decision reflects growing tensions between the White House and the Federal Reserve over monetary policy direction, particularly amid heightened political pressure for lower borrowing costs ahead of the 2026 campaign season.

The Wall Street Journal reported that the dismissal “raises significant concerns over the Fed’s ability to operate free from political influence,” a principle long considered essential for maintaining market stability and investor trust.

Why This Matters for Investors

Investor anxiety is palpable. The S&P 500 and Nasdaq futures both slipped by over 0.5% in early trading, while the Dow Jones Industrial Average fell nearly 200 points at the open. The dollar index declined by 0.4%, and 10-year Treasury yields fell to 3.85% as investors rotated into safe-haven assets. Gold prices climbed to their highest level in two weeks, with spot gold trading above $2,030 per ounce.

“The market is recalibrating not just for policy risk, but for the possibility of a September rate cut becoming more probable,” said Andrew Haldane, chief economist at Lighthouse Capital. “This is a textbook risk-off move: equities lower, dollar softer, and commodities like gold catching a bid.”

Potential Fed Policy Shift on the Horizon

The firing of Lisa Cook—known for her centrist and policy-stabilizing approach—could pave the way for a more dovish Federal Reserve composition. Market participants are increasingly pricing in a rate cut as early as September, with Fed funds futures showing a 62% probability of a 25 basis point reduction, according to CME FedWatch data.

If the administration exerts greater influence over the Fed, we could see an accelerated push toward looser monetary policy, which may provide temporary market support but risks undermining longer-term inflation control.

Key Investment Insight

For investors, this development underscores the importance of managing policy-driven volatility. Bond markets may offer an entry opportunity, especially in the intermediate to long end of the yield curve, as falling yields could support fixed-income returns over the next quarter. Meanwhile, gold and other precious metals are regaining their role as defensive hedges, particularly in light of potential currency fluctuations and safe-haven inflows.

Equities could face a choppier path in the short term, with heightened volatility across financials and rate-sensitive sectors. Investors may consider maintaining a diversified exposure while trimming risk-heavy positions until the policy outlook stabilizes.

Future Trends to Watch

- Federal Reserve Actions: All eyes are on the upcoming Fed meeting in September, where new appointments or guidance could reshape market expectations.

- Inflation vs. Growth Dynamics: A more politically influenced Fed may prioritize short-term growth, raising the risk of inflation persistence.

- Safe-Haven Demand: Gold, Japanese yen, and Swiss franc could continue to benefit from geopolitical and policy uncertainty.

Final Word

As markets navigate this politically charged landscape, the dismissal of a sitting Fed governor serves as a reminder that central bank independence remains a cornerstone of investor confidence—and any threat to it can ripple across global markets.

For daily market-moving insights, sector-specific analysis, and actionable strategies, keep following MoneyNews.Today—your trusted source for timely, investor-focused financial news.