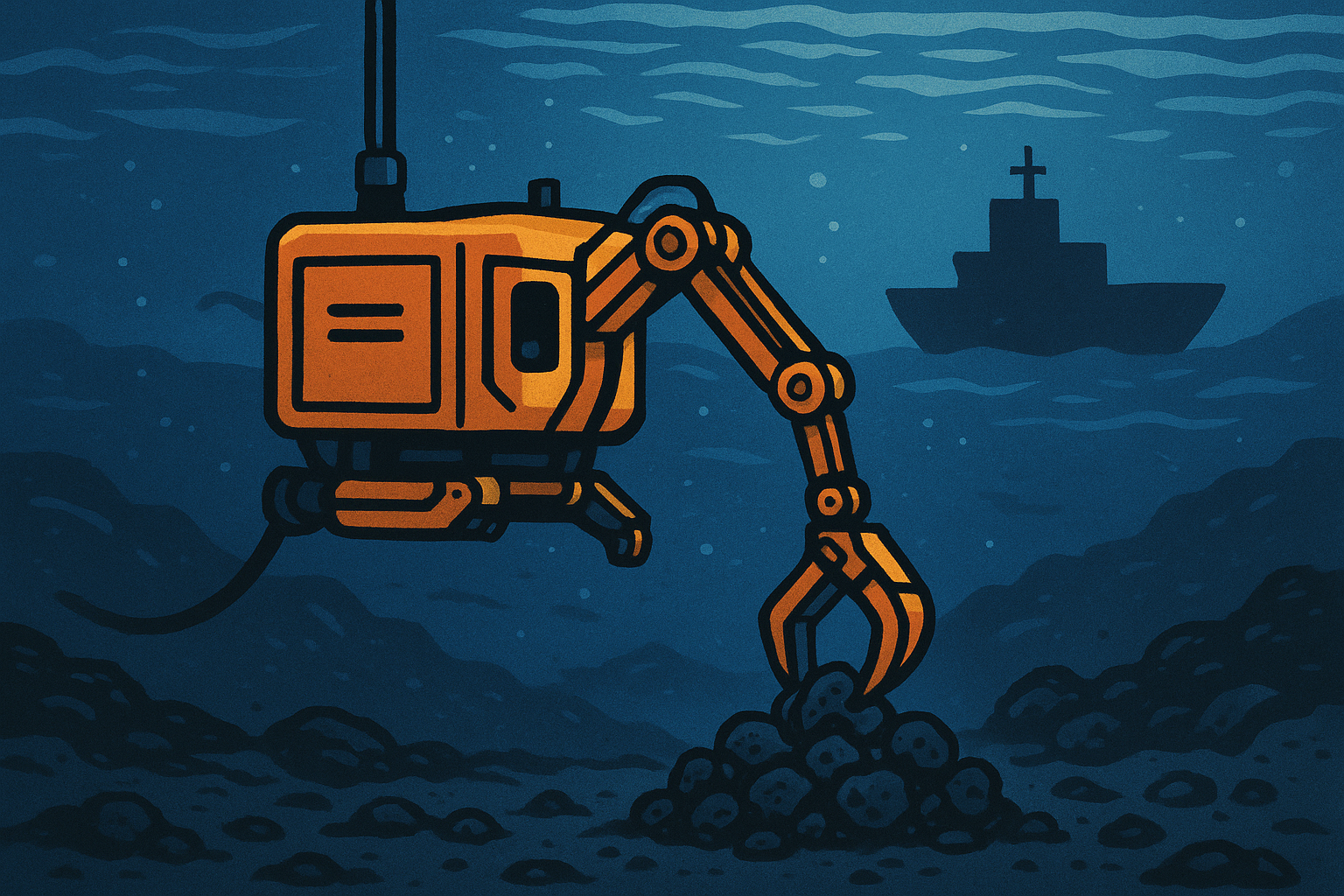

As global demand for critical minerals intensifies, a new executive order from the Trump administration is shifting the tides for one of the world’s most controversial resource frontiers: deep-sea mining. The move, announced last week, fast-tracks permitting for U.S.-based companies pursuing mineral-rich nodules on the ocean floor, potentially unlocking access to cobalt, nickel, manganese, and rare earths essential for electric vehicles (EVs), clean energy technologies, and advanced electronics.

For investors, this development signals both opportunity and risk. While the order provides regulatory tailwinds for early-stage ventures, questions around environmental impact, international compliance, and long-term feasibility remain unresolved.

Why This Matters for Investors

Critical minerals are the backbone of the energy transition, powering everything from EV batteries to wind turbines. According to the International Energy Agency (IEA), demand for key battery minerals like cobalt and nickel could increase by more than 60% by 2040 if global decarbonization goals remain on track. Yet, supply constraints and geopolitical dependencies—particularly on China for rare earths—continue to raise alarm across Western markets.

By accelerating permitting processes, the Trump administration is attempting to position U.S. companies as first movers in deep-sea exploration. Unlike terrestrial mines, which are constrained by land access and local opposition, the seabed—particularly in the Clarion-Clipperton Zone (CCZ) of the Pacific—is estimated to hold billions of tons of untapped polymetallic nodules. For context, MIT research estimates the CCZ alone may contain more cobalt and nickel than all known terrestrial reserves combined.

This policy push arrives at a moment when investors are increasingly seeking exposure to critical minerals. The S&P Global Metals & Mining Index has climbed over 15% year-to-date, largely fueled by optimism around battery supply chains.

Navigating the Regulatory and Environmental Landscape

Despite the promise of accelerated timelines, deep-sea mining remains a flashpoint of environmental debate. The International Seabed Authority (ISA), the UN-backed body overseeing international seabed resources, has yet to finalize a comprehensive mining code. Marine scientists warn that large-scale disturbance of seabed ecosystems could trigger irreversible biodiversity loss.

Bloomberg reports that over 20 countries, including France and Canada, have called for a moratorium on deep-sea mining until further studies clarify the risks. Meanwhile, environmental NGOs have pushed back against the Trump order, citing potential conflicts with international treaties.

For companies, this creates a regulatory paradox: while U.S. firms may now have a clearer domestic path forward, international acceptance—and the ability to trade extracted minerals in global markets—remains uncertain.

Companies and Future Trends to Watch

Several early-stage companies are already positioning themselves to benefit. The Metals Company (NASDAQ: TMC), headquartered in Canada but active in U.S. policy discussions, is one of the most prominent names in the space. Its shares have been volatile but tend to react sharply to news tied to deep-sea mining regulation.

Meanwhile, technology partnerships are emerging as a potential differentiator. Firms investing in low-impact collection methods or digital monitoring of ecosystems may be better positioned to navigate regulatory scrutiny.

Longer term, deep-sea mining could reshape global mineral supply chains. If proven economically and environmentally viable, it could reduce reliance on politically sensitive terrestrial mines in regions such as the Democratic Republic of Congo, which supplies over 70% of the world’s cobalt.

Key Investment Insight

Investors should approach deep-sea mining as a speculative, high-risk, high-reward frontier. The Trump administration’s executive order provides short-term momentum for U.S.-linked players, but long-term viability hinges on international alignment and environmental safeguards. For now, consider monitoring:

- Early-stage companies like TMC and their capital-raising activities.

- Policy developments from the ISA and global climate summits.

- Clean energy and EV sector trends, which directly impact demand for deep-sea resources.

Diversification remains key—deep-sea mining may evolve into a transformative industry, but regulatory uncertainty makes it unsuitable as a standalone investment.

Investor Perspective & Next Steps

The Trump administration’s decision to fast-track deep-sea mining permits underscores Washington’s urgency in securing critical mineral supply chains. While the order may catalyze U.S. exploration efforts, unresolved global regulations and mounting environmental pushback temper its long-term prospects.

For investors, this is a story of timing and risk management. Those with an appetite for speculative frontier industries may see opportunity in early-stage mining ventures, while risk-averse investors should view the sector as a longer-term theme rather than an immediate play.

Stay ahead of the shifting tides of global markets with MoneyNews.Today—your trusted source for timely, actionable insights on the trends shaping tomorrow’s investments.