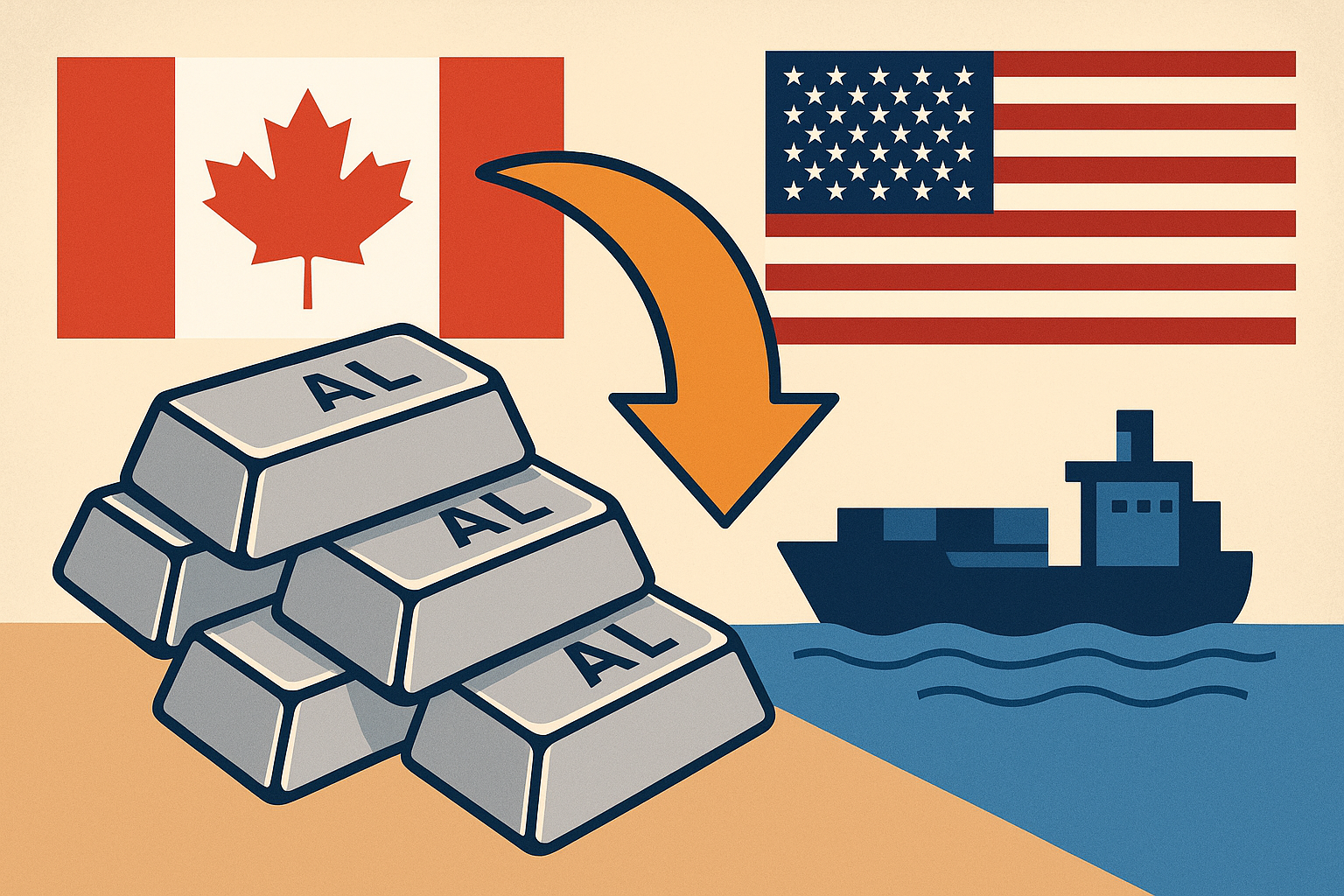

When U.S. aluminium prices hit their highest levels in nearly a decade this week, traders weren’t the only ones watching. Investors across the metals and manufacturing sectors are taking note of a fast-developing dynamic: a sharp surge in U.S. aluminium imports from Canada, driven by record-high Midwest premiums and tightening domestic supply.

According to Reuters, the Midwest aluminium premium — a key benchmark for U.S. buyers — has climbed to multi-year highs, reflecting growing demand from auto manufacturers, construction projects, and defense sectors. Canadian producers, long the United States’ largest suppliers, are rapidly ramping up shipments to meet this appetite, signaling potential opportunities and risks across the North American metals landscape.

Canada’s Aluminium Advantage

Canada holds a unique position in the North American aluminium market. Backed by abundant hydroelectric power, established refining infrastructure, and trade stability under the USMCA framework, it remains a cost-efficient exporter to the U.S. The recent price rally has magnified that advantage.

Industry data shows that over 40% of U.S. aluminium imports originate from Canada, a figure that has ticked higher in recent weeks. Market participants told Reuters that several smelters in Quebec and British Columbia are operating near full capacity, shipping additional tonnage southward to capture premium spreads.

“Canadian producers are enjoying a rare window,” notes Daniel Hynes, senior commodities strategist at ANZ Research. “U.S. premiums are strong, and with lower transport and energy costs, their margins could expand meaningfully through Q4.”

Why This Matters for Investors

For investors, the surge in cross-border shipments offers multiple touchpoints across the metals value chain. On one side, Canadian aluminium producers and downstream fabricators stand to benefit from elevated U.S. price differentials. Publicly listed companies such as Alcoa (NYSE: AA) and Rio Tinto (NYSE: RIO), both with major North American smelting footprints, could experience margin tailwinds if current spreads persist.

At the same time, U.S. manufacturers—particularly in autos and aerospace—face cost pressures that may squeeze profit margins or force price pass-throughs to consumers. The balance between those forces could define sector performance into early 2026.

Meanwhile, analysts at Bloomberg Intelligence warn that the rally could rekindle trade friction if Washington perceives “market distortions” or risks of over-dependence on foreign supply. “Any hint of tariffs or new content rules could swing sentiment fast,” their latest commodities note cautioned.

Market Forces Driving the Rally

Several converging factors are underpinning the aluminium price surge:

- Energy Transition Demand: The global shift toward electric vehicles, solar panels, and lightweight infrastructure has boosted aluminium demand as a critical industrial metal.

- Smelter Constraints: Power costs and environmental regulations have constrained U.S. smelting capacity, pushing buyers to source from imports.

- Trade Policy Uncertainty: With recent U.S.–China trade tensions and renewed discussions on critical minerals policy, supply chains are being re-routed toward allied economies like Canada.

According to CRU Group, aluminium demand in North America is expected to grow 4–5% annually through 2027, while domestic production capacity remains largely flat. This mismatch implies a structurally supportive backdrop for imports and potential expansion opportunities for Canadian refiners.

Future Trends to Watch

Investors should track the Midwest–European premium differential, a key indicator of where arbitrage opportunities might emerge. Sustained high premiums could encourage further cross-border shipments or even lead to the reopening of dormant U.S. smelters, particularly if policy incentives align.

However, risks remain. Logistics congestion, limited freight capacity, and potential tariff revisions could disrupt flows just as quickly. Additionally, if the U.S. economy slows or industrial output softens, aluminium demand could retrace, pressuring prices and squeezing producers who expanded aggressively.

Key Investment Insight

For now, the trend favors Canadian aluminium equities and North American producers with flexible export networks. Exposure to midstream processors—companies converting ingots into sheets, billets, or extrusions—could also deliver upside if pricing remains firm.

Investors should also watch for policy signals from Washington and Ottawa. Any new commitments to “friend-shoring” metals supply chains could reinforce this trend, adding further structural support to Canada’s strategic role in the sector.

In a global environment defined by trade realignment and energy transition demand, aluminium remains one of the most strategically important base metals — and this North American supply dynamic could be one of the more durable stories of 2025.

Stay ahead of the markets with MoneyNews.Today, your trusted source for timely, data-driven insights on global finance, commodities, and macroeconomic trends shaping tomorrow’s investment landscape.