Issued on behalf of Ventripoint Diagnostics Ltd.

– Completing the AI Cardiac Trilogy After Circle’s Exit and HeartFlow’s IPO Success

The AI Cardiac Imaging Market Heats Up

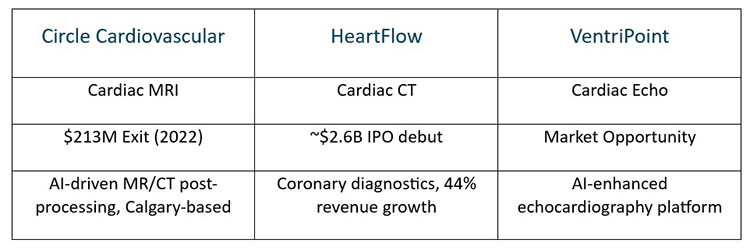

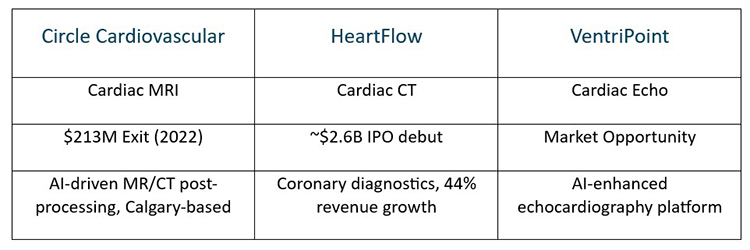

Two major landmarks have validated the massive opportunity in %AI powered %CardiacDiagnostics, establishing clear precedents for investor returns while leaving one critical modality untapped. Circle Cardiovascular Imaging’s $213 million acquisition by Thoma Bravo in 2022 proved the value of AI-enhanced cardiac MRI, while HeartFlow’s spectacular August 2025 IPO – jumping nearly 50% on debut to a $2.3-2.6 billion valuation – demonstrated investor appetite for coronary CT solutions.

These successes have created a clear investment thesis: artificial intelligence is revolutionizing cardiac diagnostics across three primary imaging modalities. With MRI and CT now claimed by proven winners, %Echocardiography represents a final – and potentially, the largest – opportunity in this convergence.

VentriPoint’s Worldwide Partner: Echocardiograms

%VentriPointDiagnostics (TSXV: $VPT) (OTC: $VPTDF) has positioned itself as the definitive AI solution for echocardiography – the most widely deployed cardiac imaging modality globally. While Circle dominated the complex, expensive MRI space and %Heartflow Inc. (NASDAQ: $HTFL) is capturing specialized coronary CT analysis, VentriPoint addresses the massive installed base of echo machines in virtually every clinic and emergency room worldwide.

The company’s VMS+ system transforms standard 2D ultrasound equipment into sophisticated %3DCardiacImaging platforms, delivering MRI-equivalent volumetric analysis without infrastructure investment. This approach eliminates the accessibility barriers that limit CT and MRI adoption while serving the broadest possible market.

While MRI and CT require specialized facilities and significant capital investment, echocardiography represents the most ubiquitous cardiac imaging platform – creating a vastly larger addressable market for AI enhancement.

A Proven Market on the Rise

Heartflow Inc. (NASDAQ: HTFL) Recent Success: $364.2 million IPO raise with sustained trading above $28 demonstrates robust investor confidence in AI cardiac solutions. Revenue growth of 39% in Q1 2025 following 44% expansion in 2024 validates the market opportunity despite ongoing losses.

Circle’s Strategic Value: Thoma Bravo’s acquisition expanded Circle from ~50 to 90+ countries, proving the global scalability of AI cardiac imaging platforms. The private equity giant’s investment serves as a sign of validation of the sector’s long-term growth potential.

Proprietary IP and Ideal Market Positioning

VentriPoint’s competitive advantage extends beyond modality focus. The company’s proprietary Knowledge Based Reconstruction technology enables comprehensive four-chamber cardiac analysis using existing infrastructure – a crucial differentiator for more cost-conscious healthcare systems.

With Health Canada and FDA 510(k) regulatory clearances secured, VentriPoint has already deployed systems at prestigious institutions including Mayo Clinic, Duke University, and Seattle Children’s Hospital. The technology currently addresses critical diagnostic needs across %HeartFailure, pulmonary hypertension, and congenital heart defects – conditions representing billions in annual healthcare spending.

Expanding Borders

VentriPoint’s international strategy demonstrates the technology’s scalability. Their recent entry into the Chinese market through Lishman Global partnership addresses 32,000 hospitals where cardiovascular disease represents 23 percent of admissions – nearly double North America’s rate. Under President & CEO Hugh MacNaught’s leadership, with three decades of med-tech experience from companies such as Philips and Roche, the company continues expanding across U.S., U.K., and EU markets.

Completing the AI Cardiac Trinity

VentriPoint represents a logical conclusion of AI’s penetration into cardiac diagnostics. The company addresses the largest cardiac imaging modality while benefiting from validated investor enthusiasm and proven exit precedents. Circle’s successful exit and Heartflow’s public market performance have established clear valuation benchmarks for AI cardiac solutions.

The convergence of regulatory validation, live clinical deployment, and international expansion positions VentriPoint to capture significant value as AI transforms the final major cardiac imaging modality. With healthcare systems globally demanding cost-effective diagnostic solutions and echo representing the most accessible platform, VentriPoint’s technology addresses both clinical necessity and market opportunity.

As the third pillar in AI cardiac imaging’s proven investment theme, VentriPoint offers investors exposure to a validated sector with established exit pathways while targeting the broadest possible market through ubiquitous echo enhancement.

About VentriPoint

Ventripoint (TSXV: VPT; OTCQB: VPTDF) is an industry leader in the application of AI (Artificial Intelligence) to echocardiography. Ventripoint’s VMS+ products are powered by its proprietary Knowledge Based Reconstruction technology, which is the result of a decade of development and provides accurate volumetric cardiac measurements equivalent to MRI. This affordable, gold-standard alternative allows cardiologists greater confidence in the management of their patients. Providing better care to patients serves as a springboard and basic standard for all of Ventripoint’s products that guide our future developments. In addition, VMS+ is versatile and can be used with all ultrasound systems from any vendor supported by regulatory market approvals in the U.S., Europe, and Canada.

Disclaimer: This article is for informational purposes only and does not constitute a solicitation or offer. The accuracy of the information is not guaranteed. Consult with your financial advisor before making any decisions relating to Ventripoint Diagnostics Ltd. or any other company named herein. Unauthorized use, disclosure or distribution of this article is prohibited. Ventripoint Diagnostics Ltd. is not liable for errors or omissions in this article. This article is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this article should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Castle Rising assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this article and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Yolowire has been compensated eight hundred dollars by Castle Rising for distribution of this Ventripoint Diagnostics Ltd. press release. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this article. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment. Yolowire was not compensated by any public company mentioned herein to disseminate this press release.